XRP price remains choppy as futures open interest declines

- XRP remains above the 100-day EMA support, but choppy market trends keep it confined below the multi-month trendline.

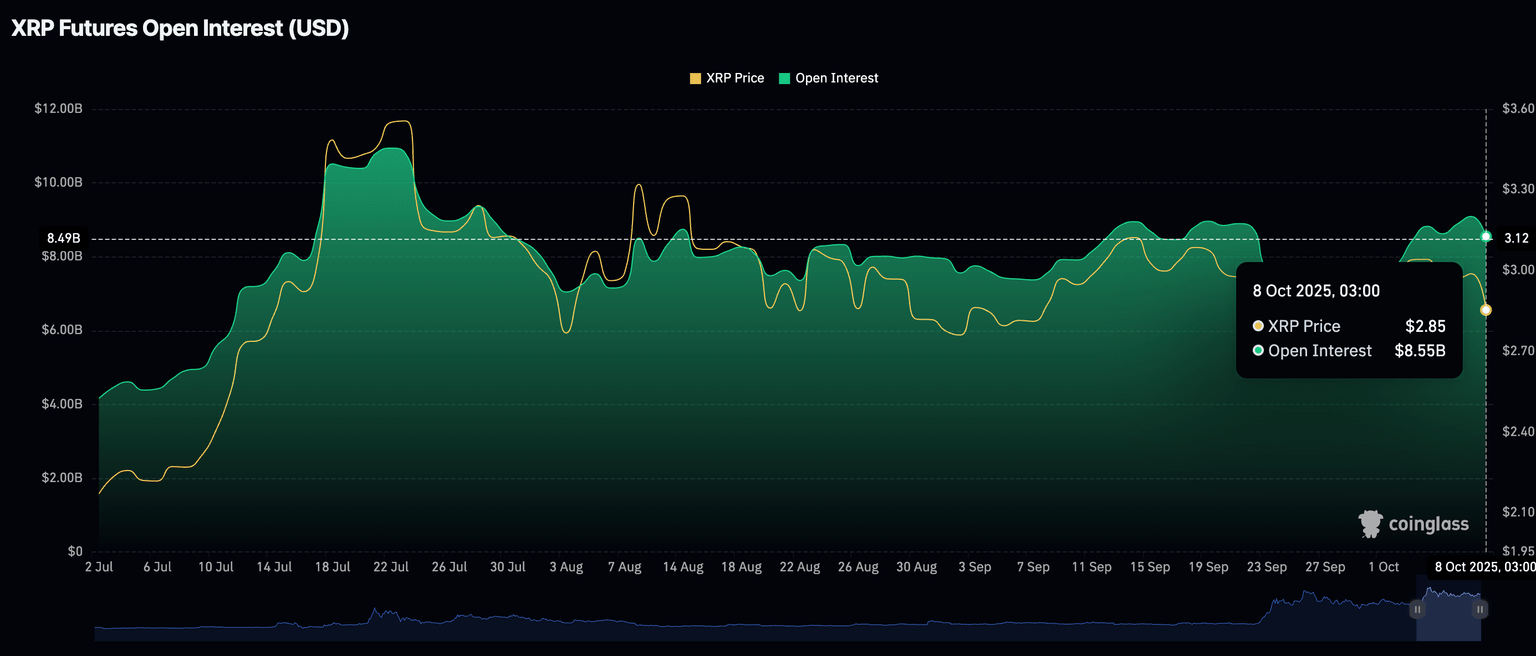

- The futures Open Interest declines to $8.85 billion as retail investors lean toward risk-off sentiment.

- Short-term consolidation between support at $2.70 and resistance at $3.00 is likely to persist.

Ripple (XRP) is struggling to hold above a short-term support at $2.85 on Wednesday, reflecting a relatively calm cryptocurrency market after a sharp decline the previous day.

Attempts by the bulls to sustain gains above the $3.00 level late last week failed to gain momentum, leaving the XRP price susceptible to headwinds. Early profit booking alongside changing market dynamics triggered losses to $2.82. If the short-term $2.85 support holds, the chances of a breakout above the $3.00 psychological level could increase significantly.

XRP struggles amid a weak derivatives market

Retail interest remains shaky as evidenced by the futures Open Interest (OI) averaging at $8.85 billion after crossing the $9 billion mark on Tuesday.

OI is the notional value of outstanding futures contracts. Therefore, a correction implies that traders could be losing confidence in the uptrend and closing their long positions. A steady decline in the OI often signals the potential for an extended price correction.

XRP Futures Open Interest | Source: CoinGlass

CoinGlass data indicates that many traders, particularly those holding long positions, are experiencing losses as liquidations persist. At least $21.17 million were wiped out in long positions compared to $2.17 million in shorts on Tuesday.

Although the pullback has taken a breather, at the time of writing on Wednesday, long position liquidations average $3.35 million. In contrast, short positions have incurred losses of approximately $447,000, indicating that highly leveraged retail traders were anticipating a sustained breakout above the $3.00 level.

XRP Futures Liquidations | Source: CoinGlass

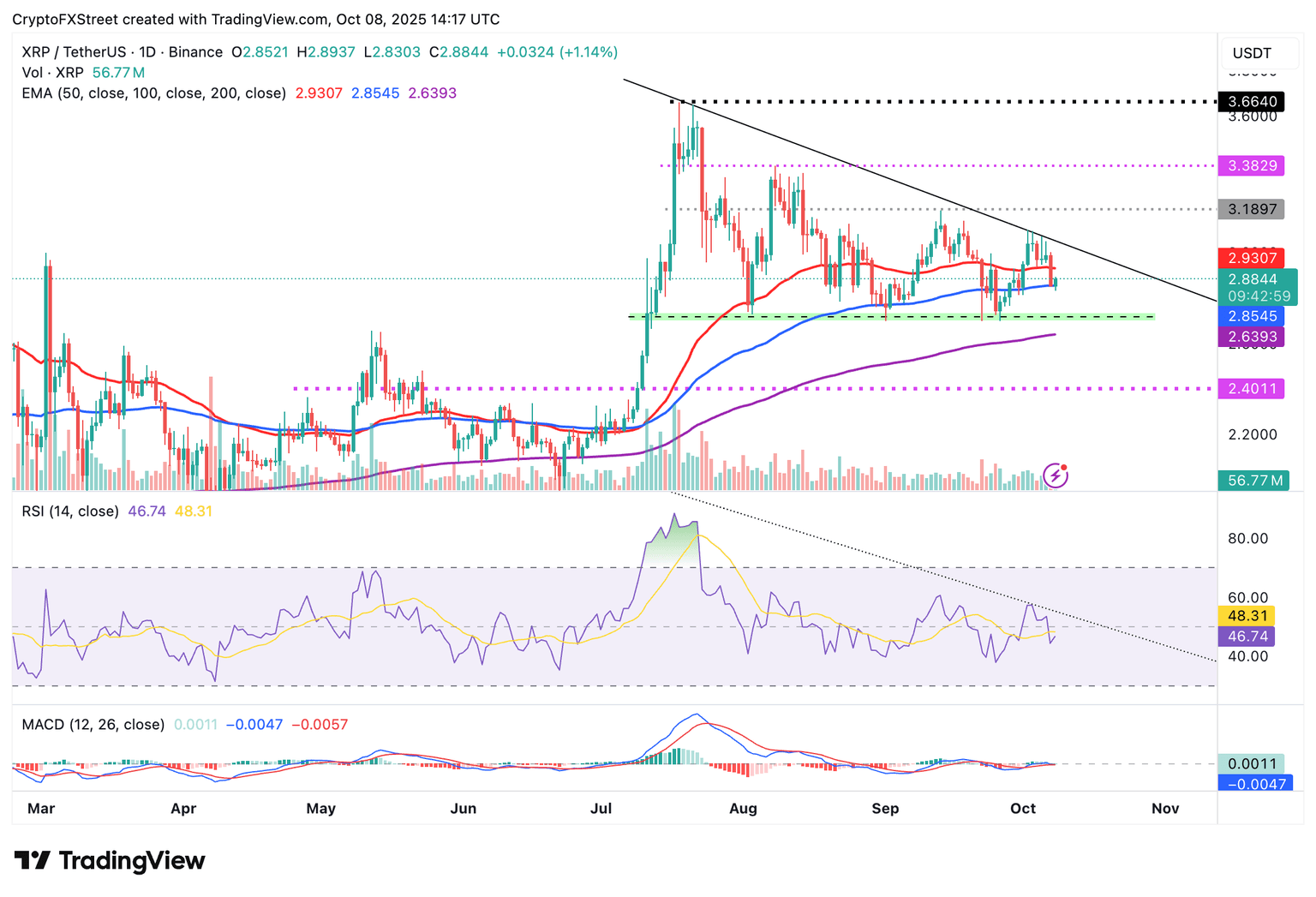

Technical outlook: Assessing XRP’s short-term technical outlook

Ripple holds marginally above the 100-day Exponential Moving Average (EMA) at $2.85 as bulls strive to push for gains above the critical $3.00 level. The upward-facing Relative Strength Index (RSI) holds at 45, highlighting a subtle bullish momentum.

A breakout in the RSI into the bullish region above the midline would mean a stronger bullish grip, increasing the chances of a breakout past the descending multi-month trendline on the daily chart.

XRP has, since its record high of $3.66 in mid-July, formed a lower high pattern, emphasising the downtrend.

XRP/UDSDT daily chart

Still, the 50-day EMA resistance at $2.92 could delay the recovery. Traders should temper their bullish expectations, as a correction to the next key support at $2.70, which was previously tested in late September, cannot be ruled out yet. The 200-day EMA at $2.63 is in line to provide additional support if headwinds intensify.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren