Ripple Price Forecast: XRP consolidates in anticipation of a 30% move

- XRP price is moving inside an ascending parallel channel pattern lacking a clear path for where it is heading next.

- A 4-hour close above or below the channel will confirm a 30% move in that direction.

- On the upside, this cryptocurrency may target $0.75, but if sell orders pile up, it may take aim at the $0.46 support level.

XRP price has been consolidating within a narrow range over the past two weeks. Although this altcoin seems in an uptrend making a series of higher highs and higher lows, there are two critical levels that will determine where it is heading next.

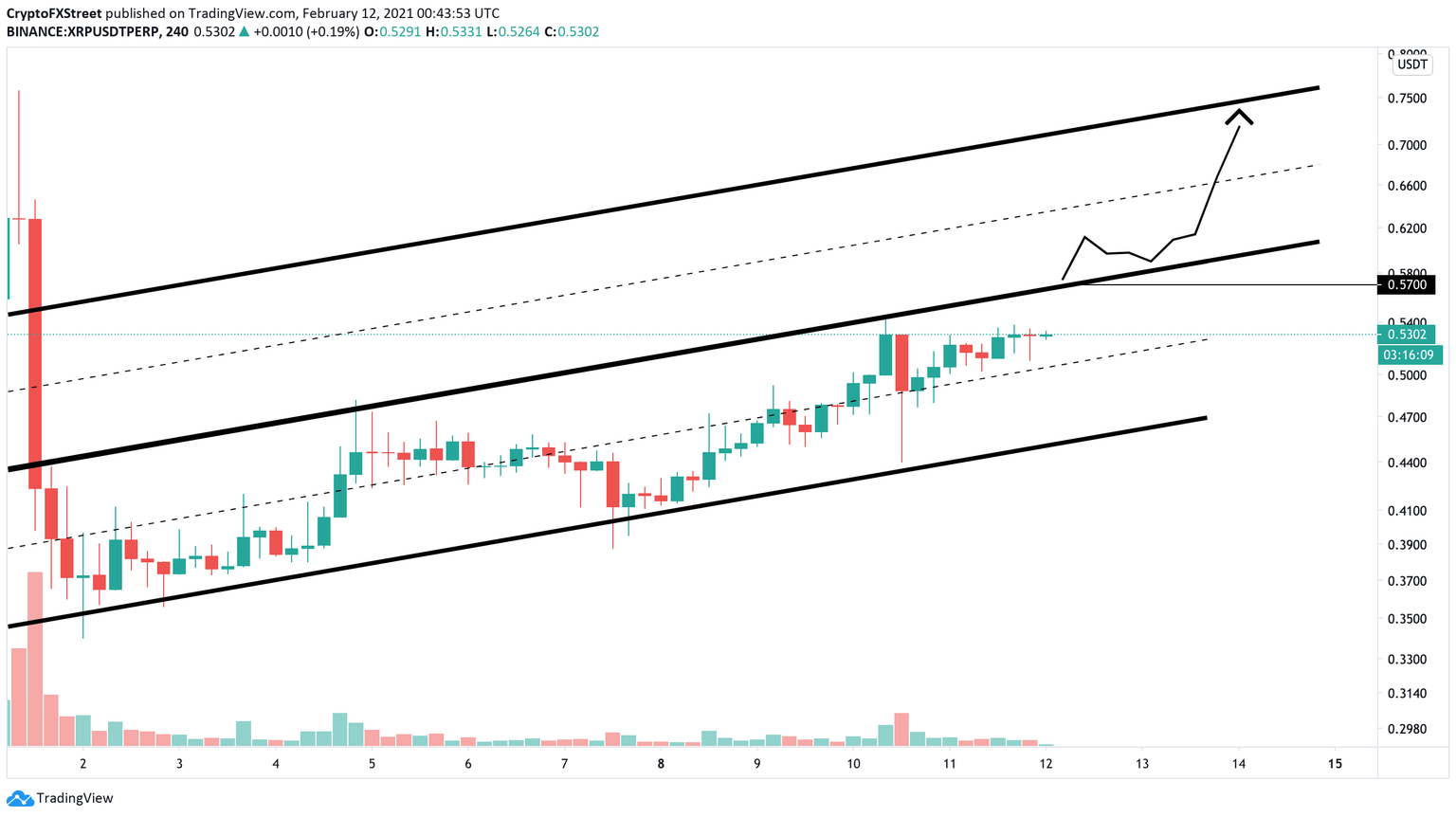

Ripple price prepares for a 30% breakout

XRP price dumped all the way down to $0.35 on February 2 after rising to a yearly high of $0.76. Following the massive downswing, this cryptocurrency formed an ascending channel where it has been contained over the past two weeks.

At the time of writing, XRP price is trading around the channel’s upper trendline at $0.55, waiting to establish a clear trend.

The last time Ripple’s native cryptocurrency tested this resistance barrier it was rejected, which led to a 20% correction. Therefore, it is critical that XRP price slices through the overhead barrier and closes above $0.57. This would establish a new bullish uptrend that may push XRP’s market value 30% to hit a target of $0.75.

XRP/USDT 4-hour chart

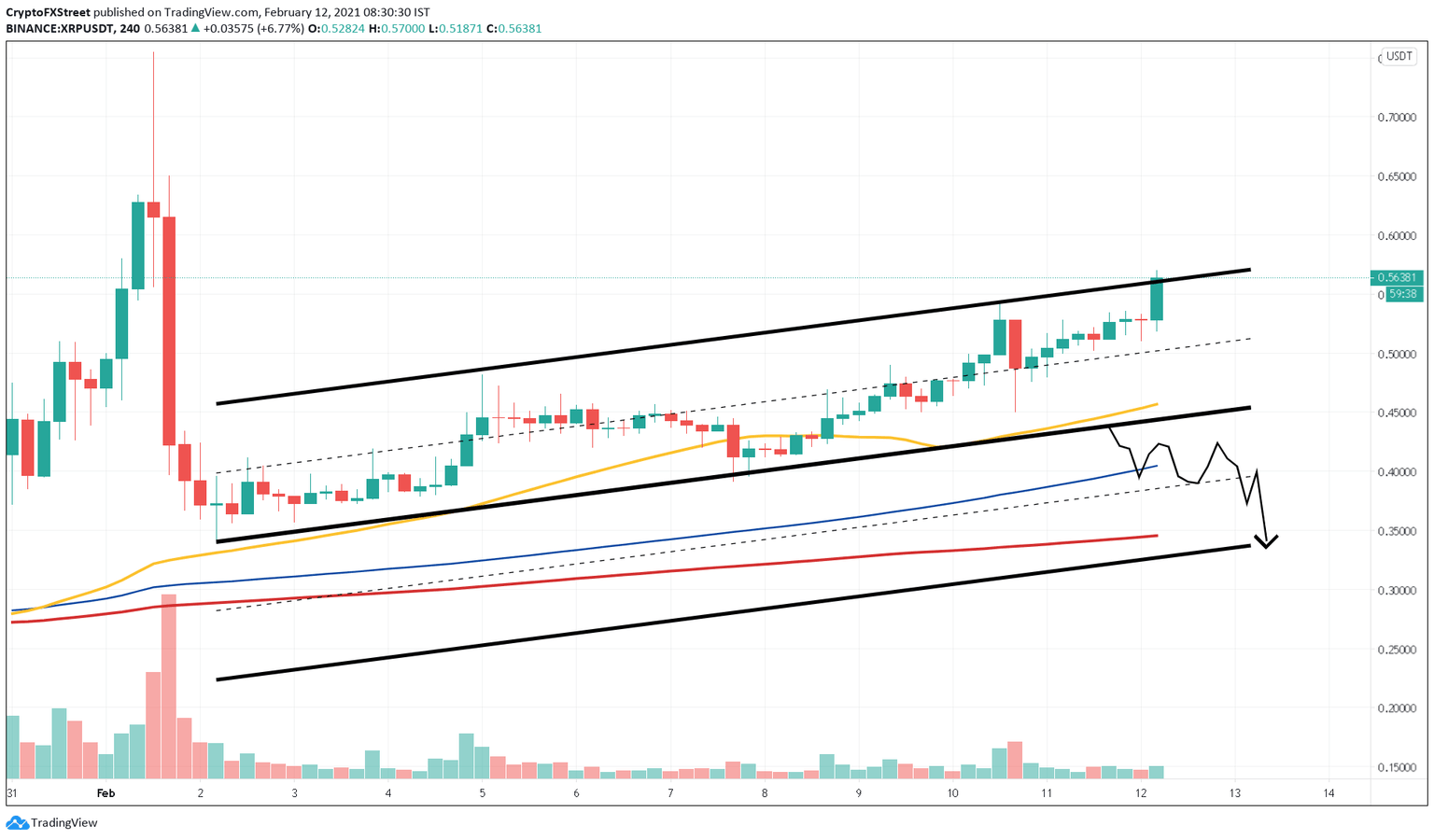

Nonetheless, a spike in selling pressure around the current levels could trigger another rejection from the channel's upper trendline. This may result in a slow correction towards the 50 four-hour moving average at $0.46.

XRP/USDT 4-hour chart

If the number of sell orders behind XRP is significant enough the 50 four-hour moving average may fail to keep falling price at bay. Under such pessimistic circumstances, Ripple price could dive towards the 100 or 200 four-hour moving average.

These support levels sit at $0.40 and $0.35, respectively.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.