Ripple Price Analysis: XRP bulls require a ride through 0.5500 to mark dominance

- XRP/USD stays firm around the month-start top, rises for the third consecutive day.

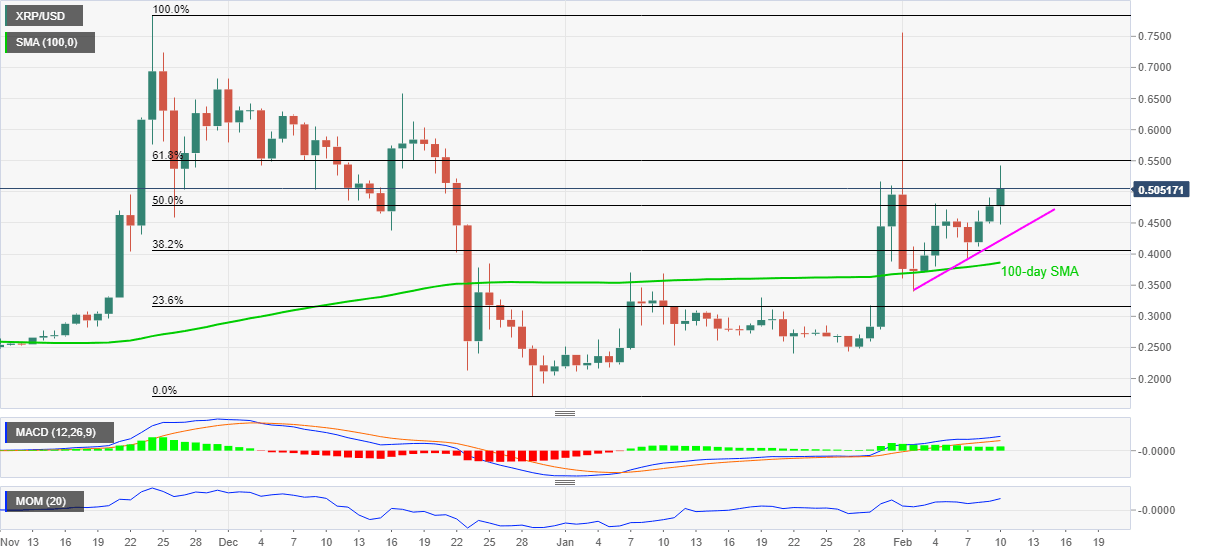

- Successful recovery from 100-day SMA joins upbeat oscillators while targeting the key Fibonacci retracement hurdle.

- One-week-old rising trend line adds to the downside filters, late-December high offers extra resistance.

XRP/USD picks up bids to 0.5070 as crypto traders prepare to close Wednesday’s books. The ripple pair rose to the highest since February 01 during the early hours of the day before stepping back from 0.5422. Though, the pullback couldn’t drag the quote below 50% Fibonacci retracement of November-December 2020 downside, needless to mention breaking the immediate support line and 100-day SMA.

Also favoring the XRP/USD bulls could be the MOM and MACD signals that back the gradual upward trajectory towards the key 61.8% Fibonacci retracement level near 0.5500.

During the quote’s ability to cross the 0.5500 hurdles, the 0.6000 threshold can act as an intermediate halt during the run-up targeting the December 17 peak near 0.6580.

However, the ultimate target for the uptrend could be the monthly peak surrounding 0.7570 and the year 2020 top, also the record high, close to 0.7845.

Meanwhile, a downside break of 50% Fibonacci retracement level of 0.4780 will highlight an ascending trend line from February 02, at 0.4220 now, on the short-term seller’s radar.

Also acting as the key support is the 100-day SMA and the monthly low, respectively around 0.3865 and 0.3400.

XRP/USD daily chart

Trend: Bullish

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.