US-China trade talks could ignite XRP price rally as risk-on sentiment improves

- XRP price solidly maintains $2.10 support, bolstered by increasing risk-on sentiment among large-volume holders.

- Markets, including crypto, shift focus to the Fed interest rate meeting ahead of US-China trade talks.

- The RSI’s indicator's pivotal movement around the midline signals XRP price consolidation and trader indecision.

Ripple (XRP) price is mum, holding firmly to support at $2.10, as consolidation extends on Wednesday, ahead of the Federal Reserve's (Fed) decision on interest rates and trade talks between the United States and China. If risk-on sentiment among whales improves, demand could keep XRP elevated above key support areas, and possibly ignite a rally toward $3.00 in the coming weeks.

The CME Group FedWatch Tool shows that market participants expect the Federal Open Market Committee (FOMC) to leave interest rates unchanged at 4.25%-4.5%. According to the K33 Research weekly report, "the Fed's cautious stance stems from continued uncertainty driven by tariff policies and broader macroeconomic risks."

US-China trade talks set for this weekend

Tariff shocks between the US and China destabilized global markets in April as investors panicked. Tensions between the two economic giants accelerated beyond tariffs, with the US banning NVIDIA from exporting its specialized H20 computing chip to China. Similarly, Beijing halted the export of rare earth minerals to the US, as the government vowed to fight till the end.

However, experts have warned that the thawing trade tensions could have wider implications on global trade, prompting talks between the US and China's top officials.

"The current tariffs and trade barriers are unsustainable, but we don't want to decouple," US Treasury Secretary Scott Bessent said on Tuesday as he disclosed plans to meet China's top economic official, He Lifeng, in Switzerland this weekend.

Global markets, including crypto, will monitor the trade talks, hoping the two sides will agree to de-escalate tensions.

Bitcoin's uptrend has failed to make significant headway above $97,000 despite Exchange Traded Funds (ETFs) inflows exceeding 50,000 BTC between April 21 and May 2, highlighting caution among traders ahead of the FOMC meeting on Wednesday.

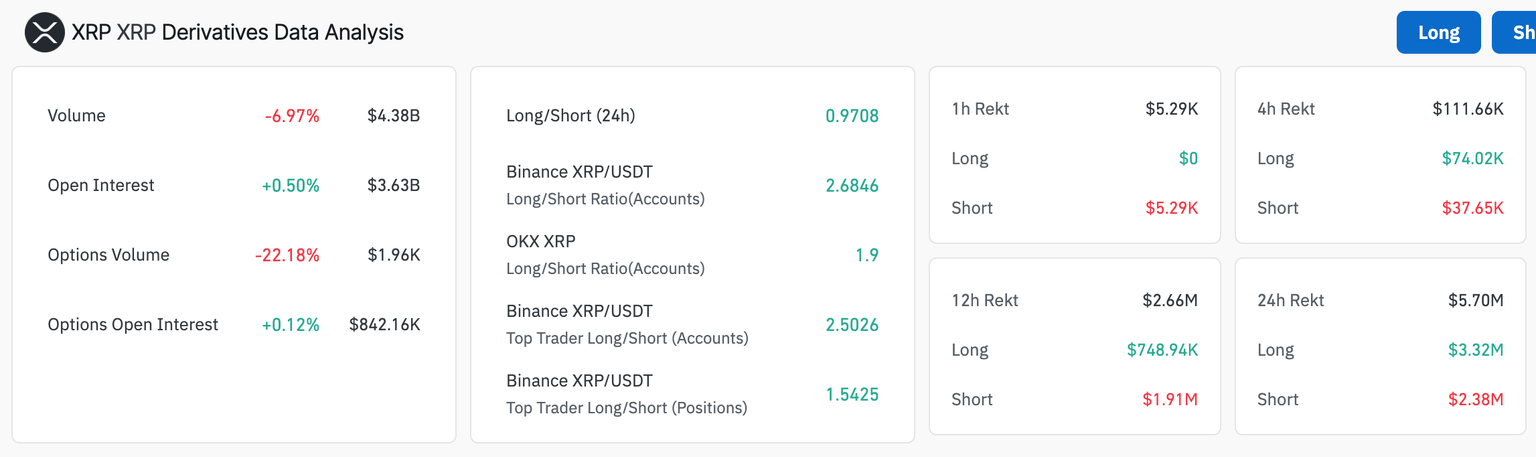

XRP's uptrend has been weighed down by trader indecision, underperforming major assets such as Bitcoin. The modest rise in Open Interest (OI) by 0.5% to $3.63 billion, per Coinglass data, signals a slight uptick in market participation.

However, the drop in trading volume by 6.97% to $4.38 billion caps the bullish outlook, suggesting low conviction, as few traders are buying or selling XRP.

XRP derivatives data | Source: CoinGlass

On-chain data on holder activity reveals that risk-on sentiment is improving. Santiment's Supply Distribution metric, shown below, reveals a steady rise in whale holdings for addresses with 1 million to 10 million XRP. This group now owns 9.44% of the total supply, a 1.2% increase from January 1's 8.24%.

The growing whale activity reflects strong investor confidence in XRP amid prolonged consolidation.

%20%5B07-1746597847072.38.23%2C%2007%20May%2C%202025%5D.png&w=1536&q=95)

XRP Supply Distribution metric : Source: Santiment

Can XRP price stage a recovery amid consolidation challenges?

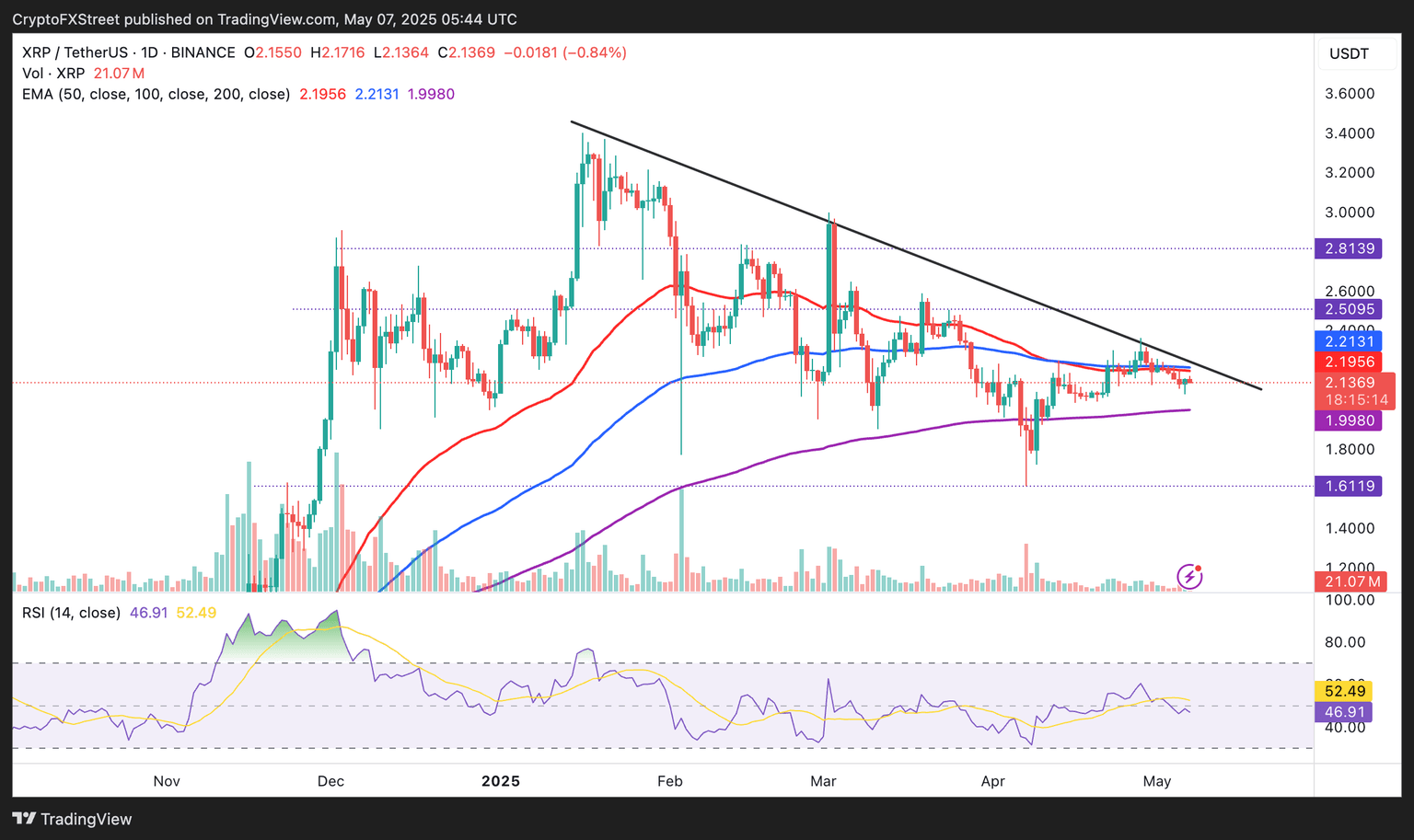

XRP price moves broadly sideways between the 200-day Exponential Moving Average (EMA) at $1.99 and a confluence resistance created by the 50-day EMA and the 100-day EMA around $2.20.

A long-term descending trendline from January adds to the bulls' challenges to influence a rally toward $3.00.

The Relative Strength Index (RSI) indicator's gradual drop below the midline of 50 points to a strong bearish momentum with the potential to ignite losses below the short-term support at $2.10.

XRP/USD daily chart

Beyond the 200-day EMA support at $1.99, instability is expected to grip XRP, possibly resulting in larger-than-expected losses. Traders would focus on finding support at $1.80 and the April 7 low at $1.61 to collect liquidity before attempting another reversal.

Cryptocurrency prices FAQs

Token launches influence demand and adoption among market participants. Listings on crypto exchanges deepen the liquidity for an asset and add new participants to an asset’s network. This is typically bullish for a digital asset.

A hack is an event in which an attacker captures a large volume of the asset from a DeFi bridge or hot wallet of an exchange or any other crypto platform via exploits, bugs or other methods. The exploiter then transfers these tokens out of the exchange platforms to ultimately sell or swap the assets for other cryptocurrencies or stablecoins. Such events often involve an en masse panic triggering a sell-off in the affected assets.

Macroeconomic events like the US Federal Reserve’s decision on interest rates influence crypto assets mainly through the direct impact they have on the US Dollar. An increase in interest rate typically negatively influences Bitcoin and altcoin prices, and vice versa. If the US Dollar index declines, risk assets and associated leverage for trading gets cheaper, in turn driving crypto prices higher.

Halvings are typically considered bullish events as they slash the block reward in half for miners, constricting the supply of the asset. At consistent demand if the supply reduces, the asset’s price climbs.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren