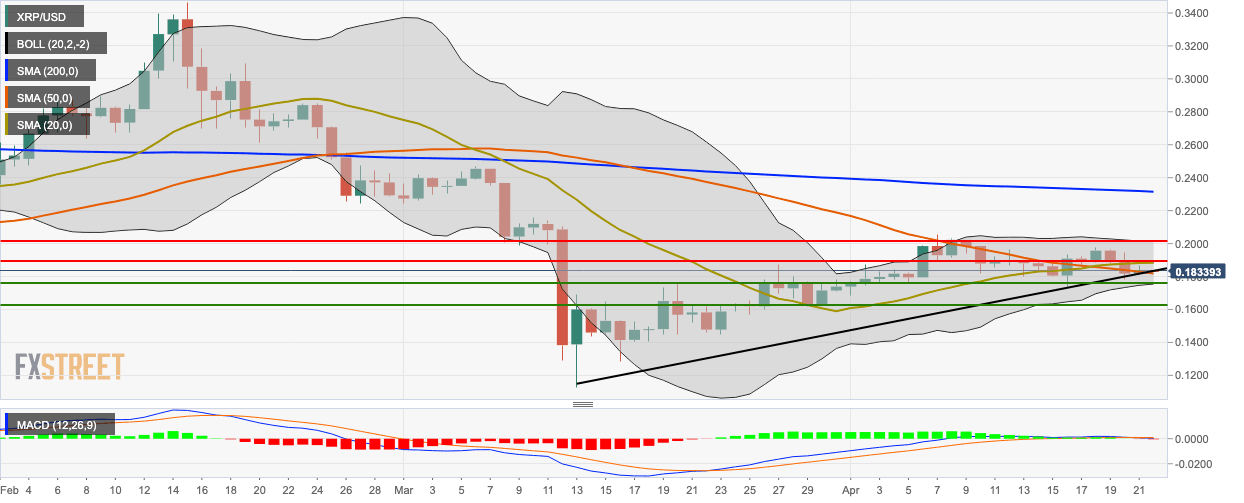

Ripple Price Analysis: XRP/USD bulls stay in control as upward trending line holds strong

- XRP/USD broke above the SMA 50.

- The 20-day Bollinger jaw has narrowed, showing decreasing price volatility.

XRP/USD daily chart

XRP/USD went up from $0.1834 to $0.1847, as the bulls remained in control of the market. The price bounced off the support provided by the upward trending line and broke above the SMA 50 curve. The 20-day Bollinger jaw has narrowed, showing decreasing price volatility. The buyers will aim to take the price above the $0.19-level and break past the SMA 20. The MACD indicates that despite the bullish price action, the overall market momentum is slightly bearish.

Key levels

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.