Ripple Price Analysis: XRP targets $0.76 after a fake breakdown from descending triangle

- Ripple's cryptocurrency may benefit from the IBM-Expertus deal.

- XRP breaks above the upper line of a triangle pattern.

Ripple (XRP) resumed the recovery after the devastating sell-off below $0.5 at the beginning of the week. At the time of writing, XRP is changing hands at $0.56. The third-largest digital asset has gained over 23% on a day-to-day basis amid strong bullish sentiments on the cryptocurrency market.

Ripple's market capitalization increased to $25 billion, while its average daily trading volume is registered at $17 billion.

Ripple may benefit from IBM-Expertus deal

IBM, the hi-tech giant, announced the acquisition of Canadian fintech startup Expertus Technologies, a partner of Ripple in the payments division. The company will provide a technology that will help to process over $50 billion in transactions per day. IBM hopes to improve its electronic-payments capabilities and meet banking clients' needs while controlling expenses and complying with regulatory requirements.

Commenting on the news, Shanker Ramamurthy, Global Managing Partner for Banking at IBM Services, said:

Payments represent a very profitable part of their franchise, and they want to continue to ensure they hold onto and not see erosion in that business in this new digital-banking environment.

Expertus Technologies is Ripple's partner since 2016. The company has been testing blockchain-based payments for banks and integrated the new technology into the existing payments infrastructure.

The solution created by Ripple in partnership with Expertus was meant to improve liquidity management and reduce the costs of financial operations for banks.

XRP looks bullish again

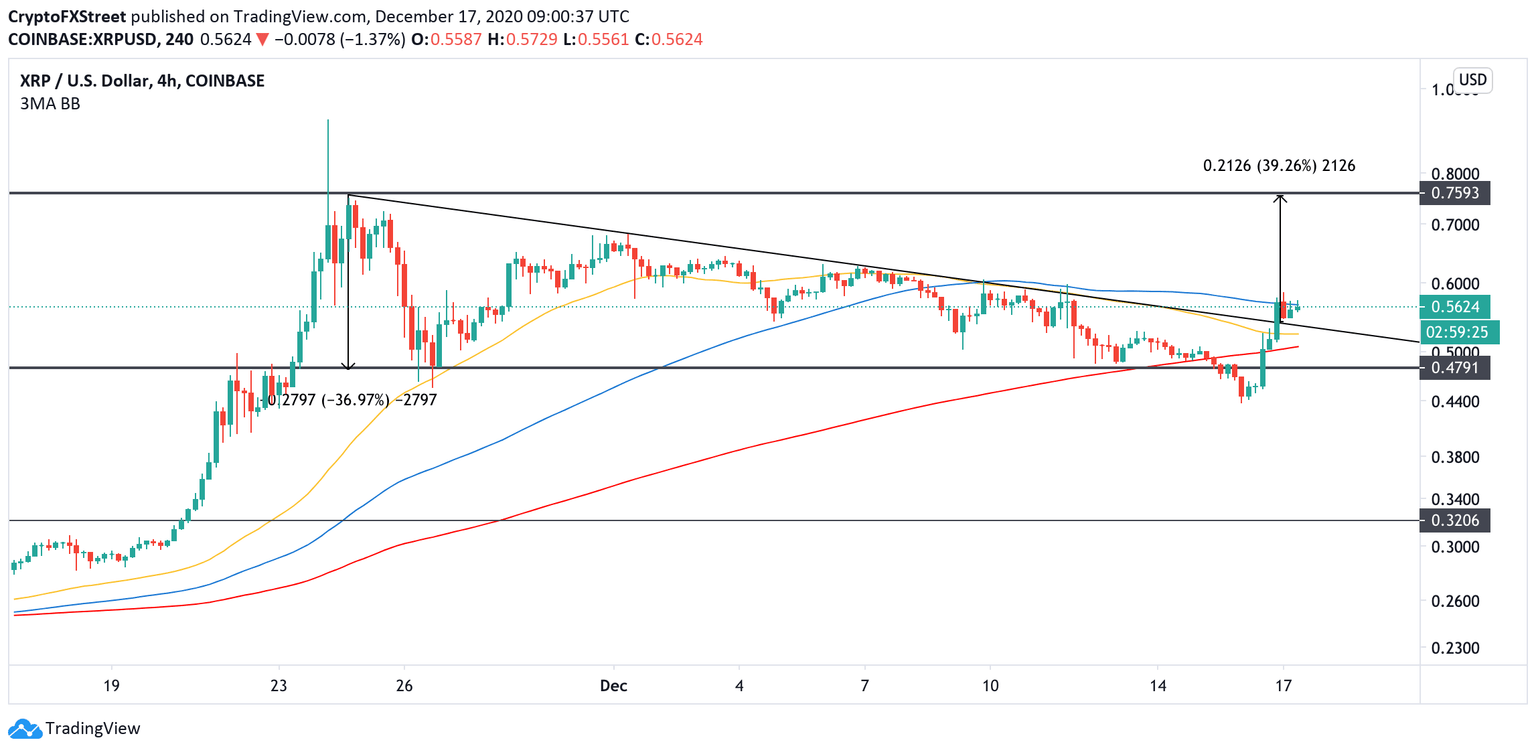

From the technical point of view, XRP returned above the x-axis of a descending triangle at $0.48 and extended the recovery. A robust bullish momentum allowed the price to clear the hypothenuse at $0.54 and continue the upside quest. If the breakup from the triangle pattern is confirmed, XRP may head to the estimated target of $0.76, which is a 39% price increase from the breakout point.

XRP. 4-hour chart

On the downside, the local support is created by the psychological $0.5 reinforced by 4-hour 200 EMA. Once it is broken, the price may retest the above-mentioned descending triangle x-axis at $0.48, followed by a local bottom at $0.43. If it gives way, the sell-off may be extended towards the ultimate bearish target at $0.33.

Author

Tanya Abrosimova

Independent Analyst