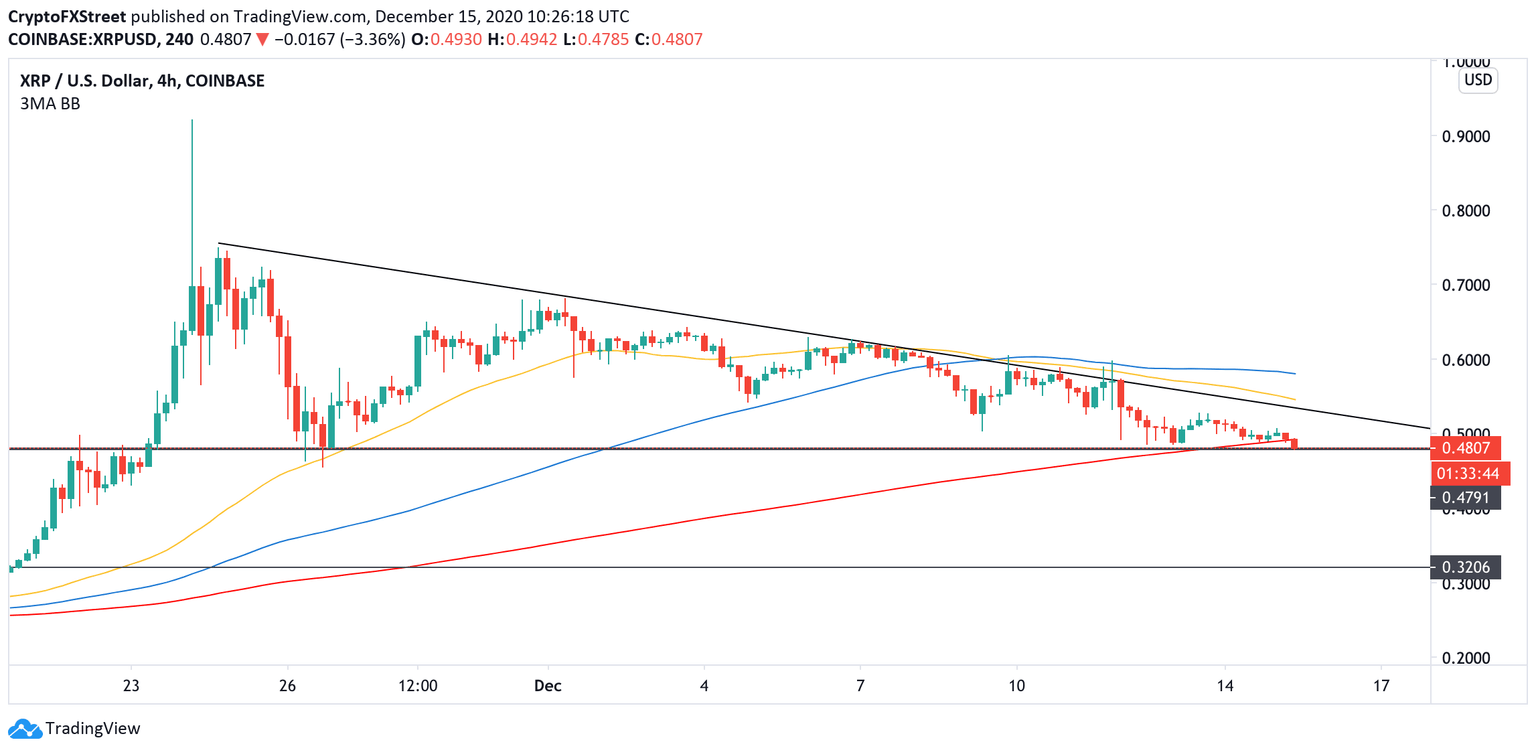

XRP slices through critical support barrier, $0.33 in sight

- XRP recovery failed to materialize as the price dropped below 4-hour 200 EMA.

- A break below the lower line of a symmetrical triangle will bring $0.33 into focus.

Ripple's XRP is losing ground rapidly. The third-largest coin lost over $6 billion of its value in the past 24 hours as the selling pressure has been building since the past weekend.

At the time of writing, XRP is changing hands at $0.48, down over 4% in the past 24 hours and 18% on a week-to-week basis. Ripple's average daily trading volume dropped to $8.6 billion, while its market cap retreated to $21 billion.

XRP recovery in danger

Bullish signals on XRP's short-term charts failed to materialize as the token continued moving down and the price slipped below the local support created by the 4-hour 200 EMA and came close to $0.48. This barrier coincides with the x-axis of the descending triangle.

Based on this technical formation, XRP could still rebound from the x-axis to the hypothenuse at $0.53. However, further recovery may be limited as this barrier is reinforced by 4-hour 50 EMA. Only a sustainable move above this area will invalidate the bearish scenario and bring the recovery back on track.

XRP, 4-hour chart

Meanwhile, if the price breaks below the triangle's x-axis at $0.48, the sell-off will continue towards the estimated target of $0.33 or lower. The next strong support comes at $0.32, as this area served as a significant resistance during the recovery attempt in August. Verifying it now as support would confirm the upside momentum is resumed.

Author

Tanya Abrosimova

Independent Analyst