Ripple Price Analysis: XRP staring at the abyss as exchanges continue delisting token

- Ripple's XRP is under pressure, losing ground even as other coins are recovering.

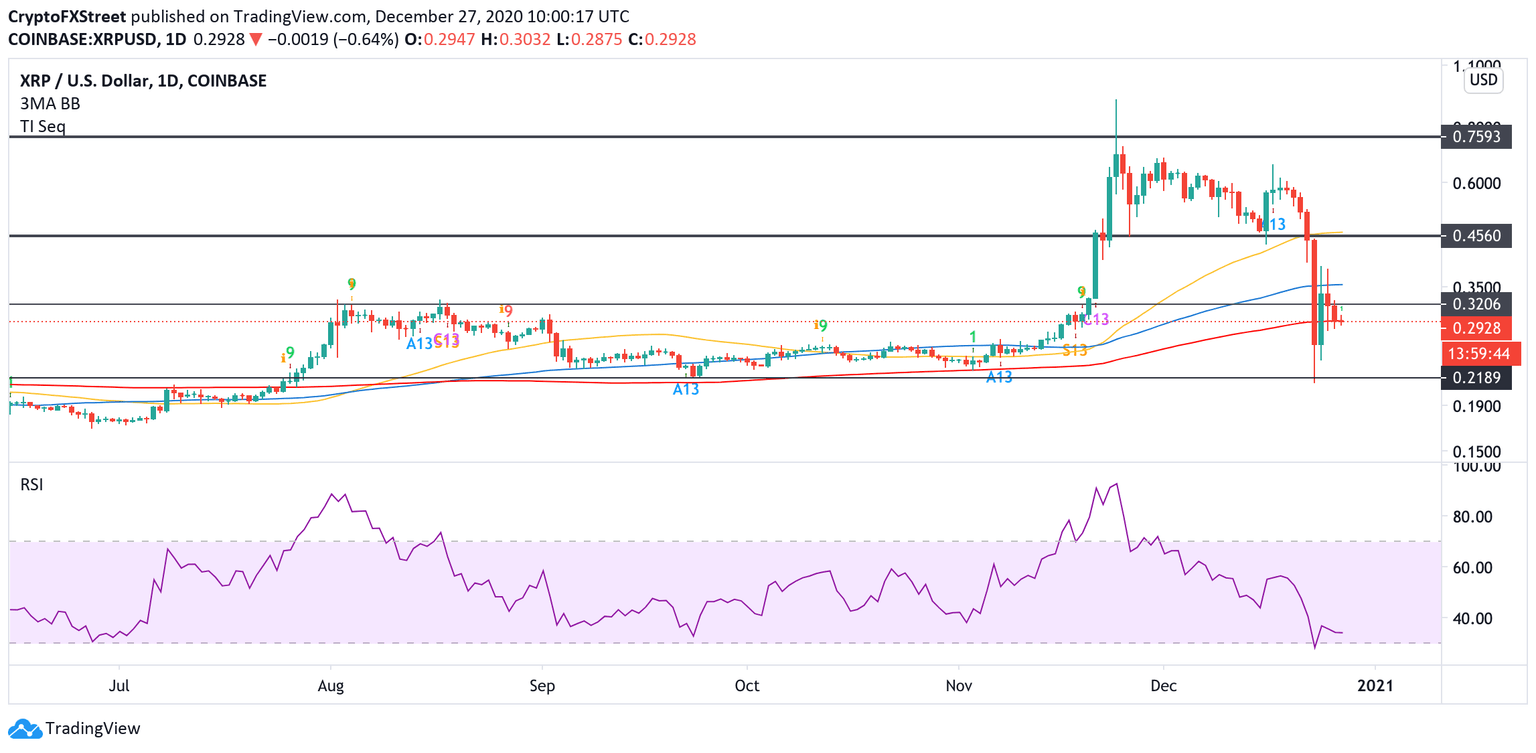

- The price is hovering at a critical level created by the daily EMA200.

Ripple's XRP is a whipping boy of the cryptocurrency industry. The digital asset lost nearly half of its value in less than a week amid panic caused by SEC's lawsuit against the San-Francisco-based fintech startup.

At the time of writing, XR is changing hands at $0.29, down over 6% on a day-to-day basis. The asset slipped to fourth place in the global cryptocurrency market rating with the current market capitalization of $13.2 billion and an average daily trading volume of $9.5 billion.

Cryptocurrency exchanges continue delisting XRP

As FXStreet previously reported, several cryptocurrency exchanges delisted or suspended XRP trading, citing concerns about Ripple's legal issues. If the court decides that XRP is a security, the trading platforms may be accused of making it available for retail investors.

Bistamp is the latest exchange that introduced limitations on XRP trading. The US-based customers will not be allowed to trade or deposit XRP as of January 2021, the company announced on Twitter.

In light of the SEC's recent filing alleging XRP is a security, we are going to halt XRP trading and deposits for all US customers on January 8, 2021. Other countries are not affected. Read more: https://t.co/RUGtkAjr08

— Bitstamp (@Bitstamp) December 25, 2020

The Bistamp's decision halted XRP's upside correction and threw the price back below $0.30.

XRP is bearish as on as it stays below $0.45

From the technical point of view, XRP has settled at the daily EMA200. This critical barrier has been limiting XRP's sell-off since June 2020. If it is broken, the sell-off may gain traction with the next focus on the former channel support at $0.21. The price touched this area on December 23 but managed to recover amid strong profit-taking activity.

XRP, daily chart

Meanwhile, on the upside, the local recovery is created by a psychological $0.30. However, a sustainable move above $0.32 is needed to mitigate the initial bearish pressure and allow for a rally towards $0.035 (daily EMA100) and $0.45. The latter is created by the broken channel support and the daily EMA50. A move above this barrier will invalidate the bearish scenario and bring XRP in line with the cryptocurrency market recovery.

Author

Tanya Abrosimova

Independent Analyst