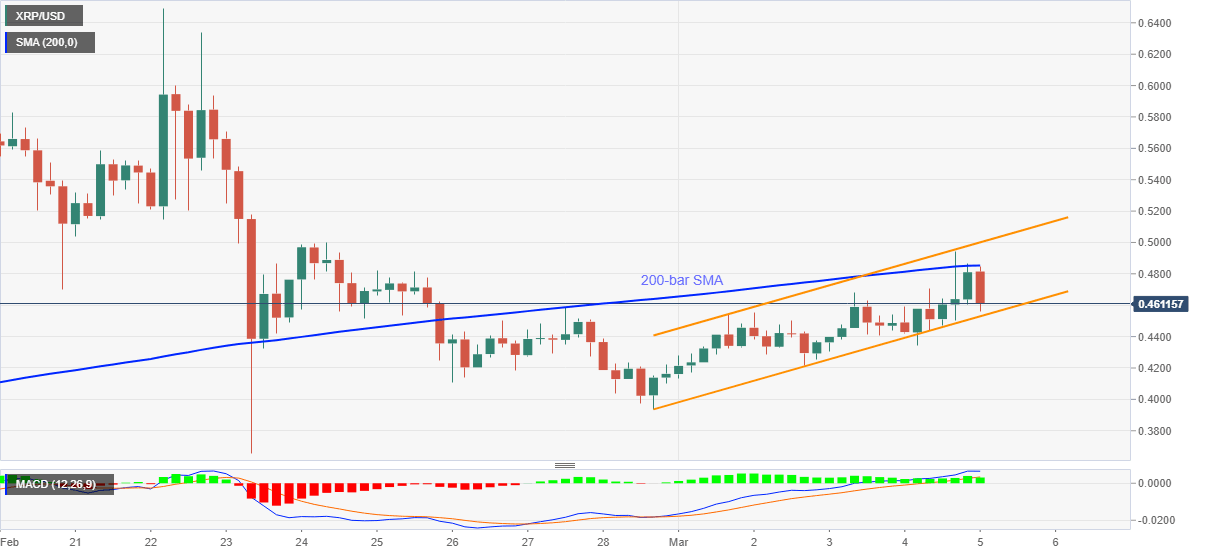

Ripple Price Analysis: XRP bulls need to defend $0.4500

- XRP/USD snaps two-day winning streak, takes a U-turn from 200-bar SMA.

- Failures to cross key SMA battles bullish MACD.

- Sellers will look to defy the bullish chart pattern for entry.

Ripple joins the fresh drop in headline cryptocurrencies while revisiting $0.4600, down 4.62% intraday, during early Friday. The altcoin recently took a U-turn from 200-bar SMA but stays inside a weekly rising trend channel to keep the buyers hopeful.

Given the bullish MACD testing the XRP/USD failure to cross the key SMA, sellers will wait for a clear downside break of the stated channel’s support, at $0.4500 now, for fresh entries.

Following that, the last week’s low around $0.3650 can offer an intermediate halt during the quote’s slump towards February’s low near $0.3400.

Meanwhile, a clear break above the 200-bar SMA level of $0.4850 needs to cross the stated channel’s upper line, at the 0.5000 threshold.

During the quote’s sustained trading above 0.5000, 0.5200 and the 0.6000 can entertain XRP/USD bulls ahead of late February top near 0.6500.

XRP/USD four-hour chart

Trend: Pullback expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.