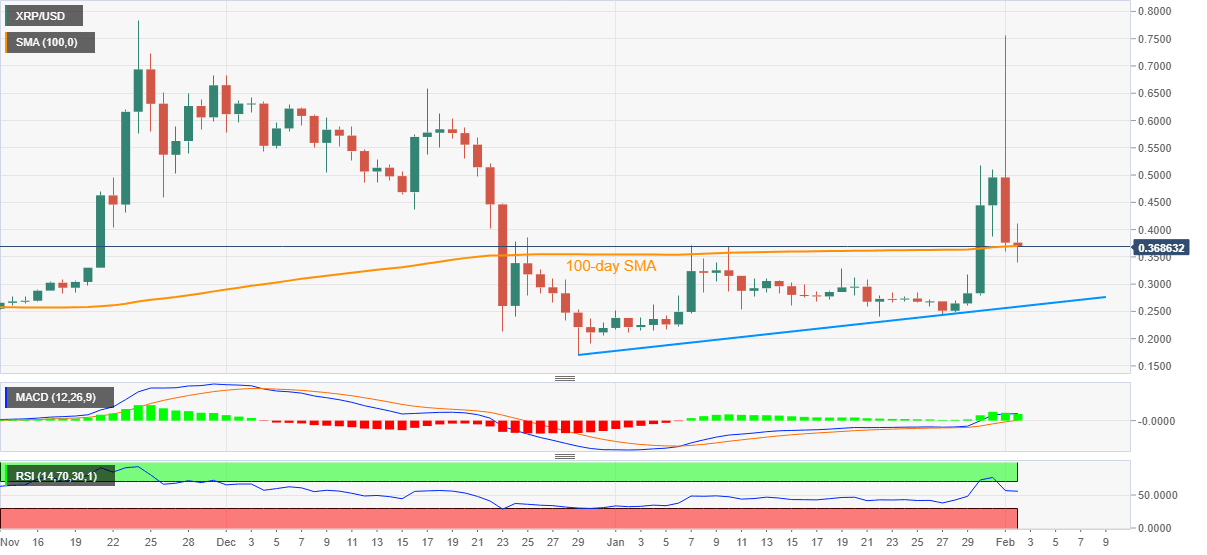

Ripple Price Analysis: XRP bears battle 100-day SMA on the way to yearly support line

- XRP/USD remains heavy after Monday’s pump-and-dump performance.

- Bullish MACD probes bears targeting five-week-old support line, January top offers key upside hurdle.

XRP/USD stays depressed near 0.3700 by the end of Tuesday’s trading session. The ripple bears are cheering the consolidation of Monday’s heavy jump but 100-day SMA restricts immediate downside amid bullish MACD.

Hence, a sustained trading below 0.3700 becomes necessary for the XRP/USD sellers to extend the latest south-run.

In doing so, an upward sloping trend line from December 29, at 0.2586, should be their ultimate target. However, the 0.3000 round-figure can offer an intermediate halt during the fall.

Meanwhile, the corrective pullback may aim for the 0.4000 threshold, 0.4400 and the 0.5000 round-figure resistance levels but can’t convince XRP/USD buyers before crossing January’s top of 0.5167.

In a case where the quote regains upside momentum beyond January high, December 2020 peak surrounding 0.6580 and the latest top of 0.7565 can probe bulls eyeing the all-time high of 0.7842

XRP/USD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.