Renowned trading veteran condemns Ripple a security while XRP/BTC sinks

- XRP price has been weaker than the top coins like Bitcoin and Ethereum for the past year.

- Peter Brandt, a veteran trader, has recently stated that XRP price could be poised for further losses in the near future.

- The renowned trader also said XRP would have been considered a security if the "SEC understood cryptos".

Peter Brandt, a legendary 45-years trading veteran has recently discussed the situation of the XRP/BTC pair and the potential of a dead cat bounce now that it’s seeing some action. Brandt believed it’s better to short XRP despite the current price action.

Was Peter Brandt correct about XRP?

Peter Brandt tweeted about the XRP/BTC dead cat bounce on November 6 and so far, it seems that his prediction was more or less accurate as XRP got no follow-through after the initial 7% jump.

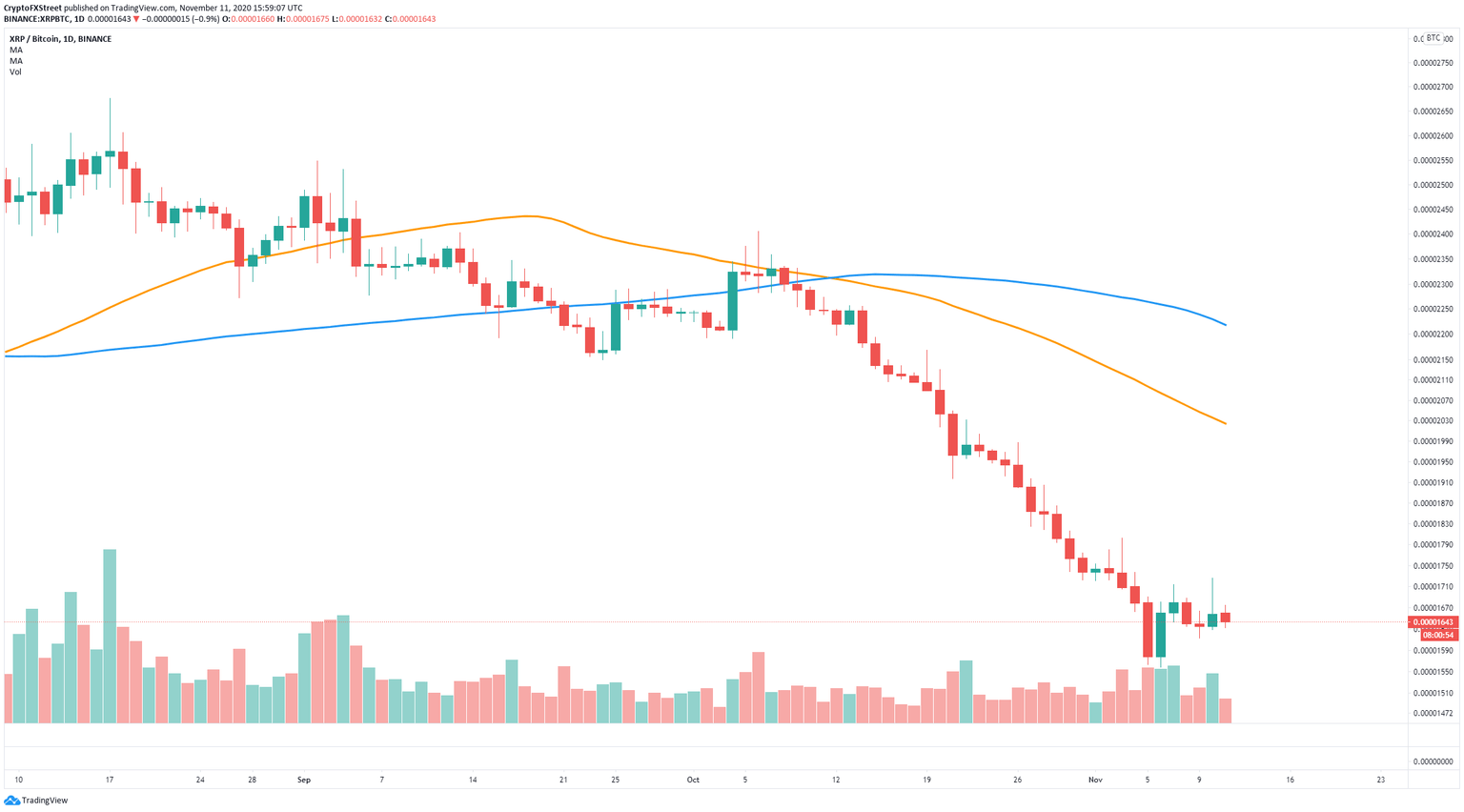

XRP/BTC chart

XRP/BTC is in a massive daily downtrend and would take bulls a lot more than a 7% price spike to change it. It seems that a lower high at 0.00001726 could have formed on November 10 while bears wait for the next lower low.

XRP would have been declared as a security if the SEC understood cryptos. This is a classic case of a market being manipulated by a bag-holder.

— Peter Brandt (@PeterLBrandt) November 10, 2020

Peter Brandt also added that XRP would have been considered a security if the "SEC understood cryptos", calling the latest move a ‘classic case of market being manipulated by a bag-holder’.

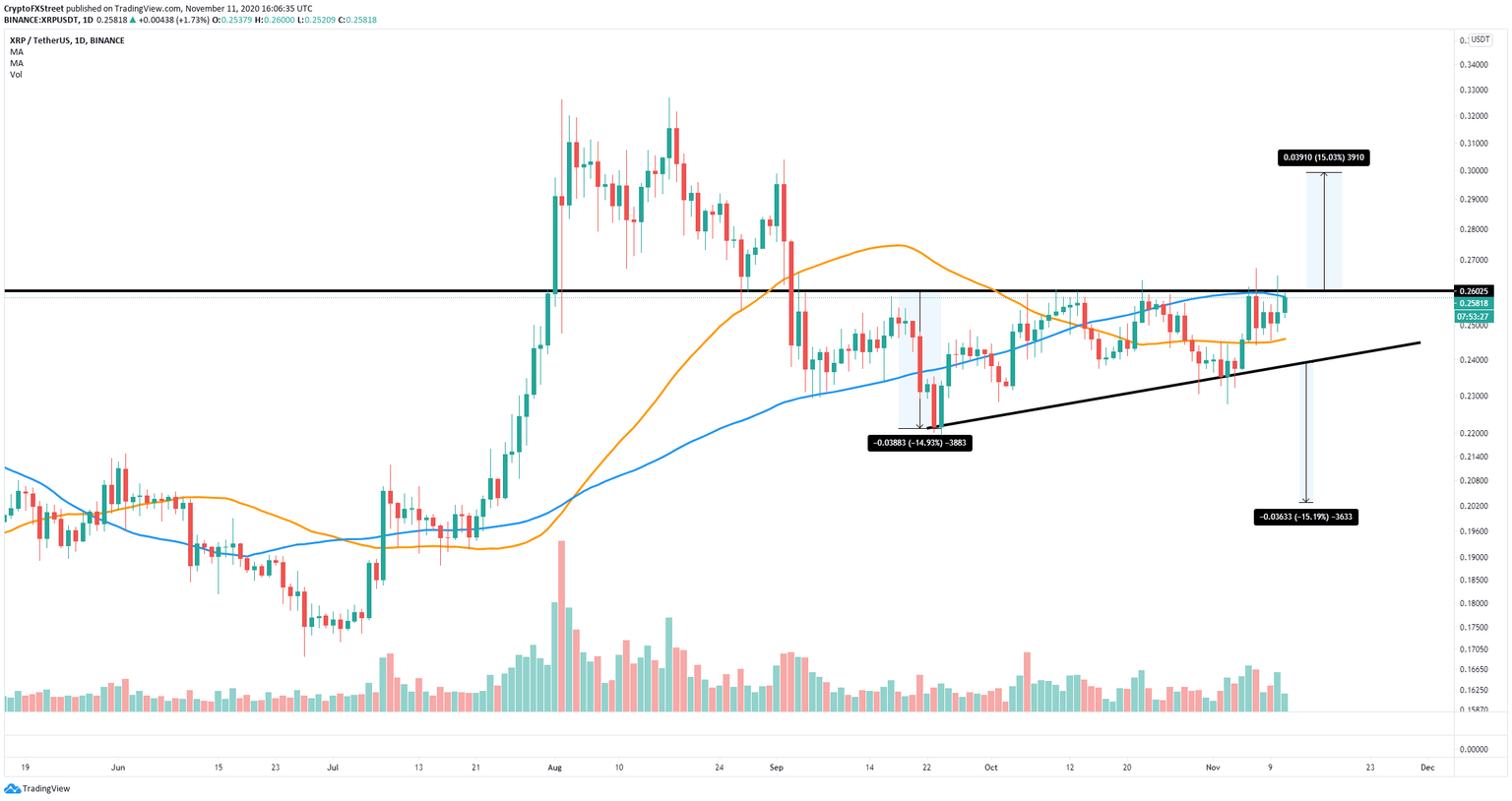

Despite the bearishness that XRP shows against Bitcoin, it presents an ambiguous outlook against the US dollar. The cross-border remittances token faces a major barrier at $0.26 which coincides with the 100-SMA on the daily chart. This significant resistance level has been tested and re-tested almost a dozen times in the past two months.

XRP/USD daily chart

Another rejection from this point can easily drive XRP price towards the 50-SMA at $0.246 and towards the lower boundary of the ascending triangle at $0.238. A breakdown below this point can push XRP price to $0.20

On the other hand, a clear breakout above $0.26 into a candlestick close would be notable and likely to drive XRP price towards $0.30 using the height of the ascending triangle pattern as a reference point.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.