Regulatory tailwinds push Bitcoin to new highs, boosting crypto market momentum

The cryptocurrency market kicked off Friday’s session on a strong note, buoyed by pivotal legislative developments out of Washington that propelled Bitcoin back above the $120,000 mark and fueled a broad-based rally in altcoins. This momentum comes amid growing efforts by U.S. lawmakers to reshape the regulatory framework for digital assets following a decisive vote in the House of Representatives.

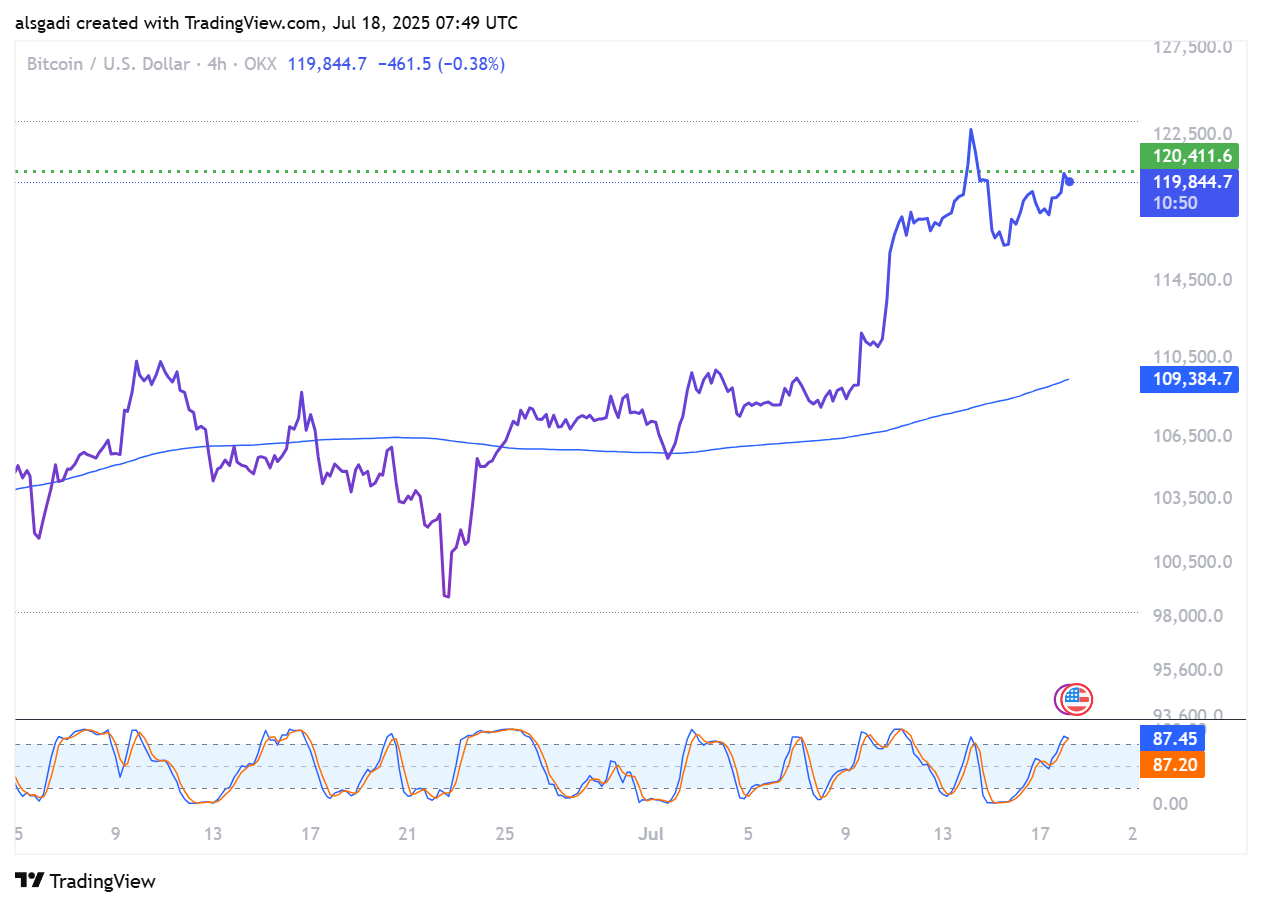

Bitcoin, which had earlier this week touched a historic high above $123,000, was last seen trading at $120,552 in Asian hours—up 1.7% on the day. The bullish sentiment marks a fourth consecutive week of gains, although upward momentum is being moderated by profit-taking at record levels and lingering uncertainty around the final passage of key legislative measures.

Unlike previous technical-led rallies, the latest surge was largely driven by a strong regulatory catalyst. The U.S. House passed three major crypto-related bills aimed at establishing a comprehensive legal framework for the digital asset industry—marking the most aggressive legislative push to date.

At the heart of the package is the GENIUS Act, which outlines clear requirements for issuing stablecoins, including fully collateralized reserves in U.S. dollars, subject to regular audits and oversight from both federal and state regulators. The bill passed with bipartisan support—308 to 122—after clearing the Senate last month, and is now awaiting President Trump’s signature to become law.

Additionally, the House approved the CLARITY Act, designed to delineate regulatory jurisdiction between the SEC and CFTC—a long-standing demand from crypto firms and institutional investors. A third bill, the Anti-CBDC Surveillance Act, restricts the Federal Reserve from issuing a central bank digital currency (CBDC) without express Congressional approval, addressing growing concerns over financial privacy and state surveillance.

Despite the progress, parts of the legislative package still require Senate approval, keeping markets cautiously optimistic while digesting the rapid pace of developments.

Meanwhile, altcoins saw sharp upside across the board. Ethereum surged over 8% to trade at $3,674, its highest level in more than six months. XRP jumped 15.4% to reach $3.63, staging one of its strongest rallies of the year.

Solana and Cardano added 7% and 14%, respectively, while Polygon gained 10% in market capitalization. Among meme coins, Dogecoin soared by 15.1%, with the $TRUMP token also advancing 8%.

The market appears to be interpreting this week’s events as a significant shift in how the U.S. intends to approach crypto regulation—a move that could ultimately bring greater legal clarity and institutional confidence. While these legislative changes are not yet law, the direction of travel signals a structural pivot: from regulatory ambiguity to a more mature and transparent framework.

Ultimately, Bitcoin’s price action now reflects more than just speculative appetite—it is becoming a parallel indicator of policy evolution and technological adaptation in the world’s largest economy.

Author

Ahmed Alsajadi

Independent Analyst

Ahmed Al-Sajjady is a professional economic and market analyst with over five years of experience in macroeconomic forecasting and institutional trading methods (SMC/ICT).