Proper regulation will protect ETC from future 51% attacks – ETC Labs

- Ethereum Classic has suffered from many 51% attacks in recent times.

- ETC Labs said that some attacks were carried out by renting hash power through NiceHash.

- ETC Labs plans to pursue regulators to provide “accountability” for hash rentals.

Ethereum Classic (ETC) blockchain has suffered numerous 51% attacks on its network in recent times. In response to this, ETC Labs noted that it is time to regulate hashpower rental marketplaces as the attackers carried out at least two of these attacks by renting hash power through NiceHash. According to Terry Culver, the CEO of ETC Labs, CipherTrace data shows that the perpetrators used proceeds from the first attack to rent hashpower for the second one. ETC Labs is planning to bring in law enforcement and engage global regulators in providing "accountability" and "transparency" for hash rentals.

Andrej Skraba, the chief marketing officer at NiceHash, said that their cryptocurrency exchange is a regulated entity and follows all KYC and Anti-Money Laundering procedures (AML). However, he added that its hash rental business is not regulated and its users are not required to disclose their identity, as per a Cointelegraph report. Skraba also said that NiceHash can be compared to an Internet Service Provider (ISP) that simply delivers data packets.

NiceHash can deliver packets of data to mining pools and these packets of data can be described as hash power. <...> So if we really want to be built a truly decentralized world, we cannot impose limitations on this traffic.

Skraba mentioned that it is difficult for platforms like NiceHash to identify or prevent such attacks from taking place. Although he admitted that instituting proper KYC and AML would reduce the risks, it would not solve the issue, in his opinion.

You can always use fake KYC. So it would help, but it would not stop. It would not stop at all.

Skraba added that NiceHash has introduced ETC Labs to its platform. ETC Labs now plans to use the platform’s services for defensive mining.

We have introduced them to our service because before they were not aware of how NiceHash works. And they have also publicly stated that they will use defensive mining.

Defensive mining will include ETC Labs using NiceHash to increase the network’s hashrate to make potential attacks prohibitively expensive. Although regulation may reduce the chances of future attacks, it appears to be more of a long-term plan.

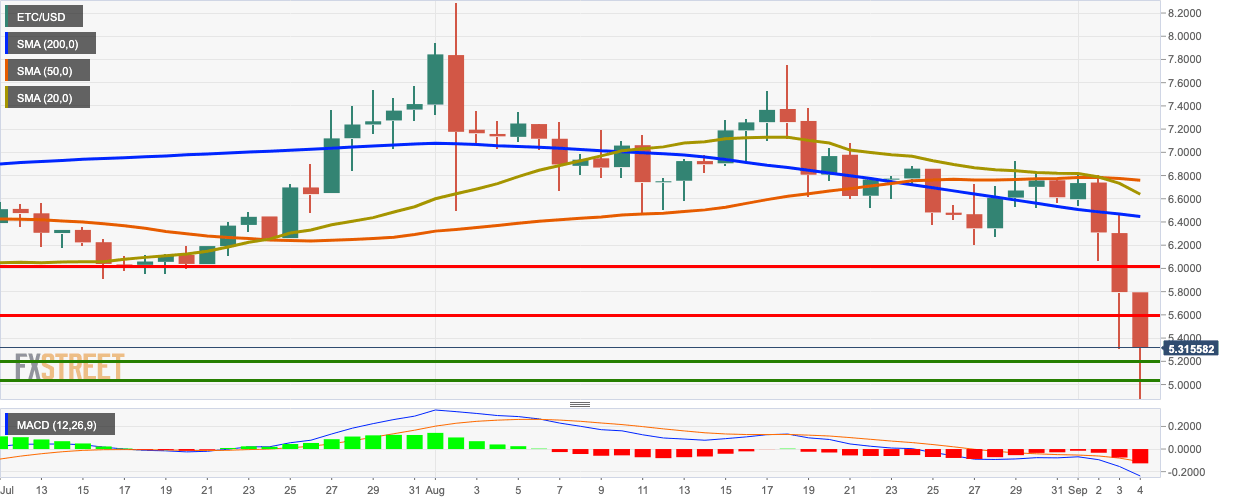

ETC/USD daily chart

ETC/USD failed to break at the SMA 20 and SMA 50 curves and had three consecutive bearish days. So far this Friday, the price has dropped from $5.795 to $5.309. The MACD shows increasing bearish momentum. ETC/USD has strong resistance levels $5.60, $6.02, $6.45 (SMA 200), $6.64 (SMA 20) and $6.75 (SMA 50). On the downside, we have two healthy support levels at $5.20 and $5.02.

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.