OKEx Technical Weekly: Positive bias with increased institution longs

The cryptocurrency market has a muted start on Monday after bitcoin prices briefly touched 9300 levels over the weekend. Markets’ bias was mostly on the positive side, fresh data shows that institutions’ bitcoin long positions have increased to the highest since early August, indicating that long funds could be setting up for the upcoming Bitcoin halving, which is half a year away from now.

In our previous publication <Bitcoin and Altcoin Post-Rally Trade>, OKEx Perspectives has examined the CME bitcoin futures chart, and believe that the late October rally gap is likely to be filled. Meanwhile, the bullishness in the equities markets could continue to be an underlying support for the cryptocurrency space.

Additionally, we’ve seen bitcoin price volatility has been lowered after the rally last week. OKEx Quant notes that investors can use Value at Risk (VaR) method to manage portfolio risk due to market volatility.

News-wise, we expect that any major development from China’s state blockchain and DECP could continue to drive the market. OKEx has studied about how China’s DECP project could accelerate the race of digitizing currency globally and higher adoption in blockchain technology.

Price Analysis - BTCUSD

BTCUSD has been consolidating at above 9200 levels, the widening of the Bollinger bands suggests that price volatility has been decreasing, therefore the pair is likely to continue its consolidation before developing the next move.

The Ultimate Oscillator has generated higher lows, this could indicate that buying momentum has been building up despite the limited price actions.

The July-October downward trend line (blue line) has initially turned into a support for the pair, and the line is something trader to watch closely. Also, the 200-day moving average (green line) should be good support.

OKEx’s BTC Long/Short Ratio has retreated some recent highs (figure 2), this could provide some positive environment for building up long positions.

CME’s Bitcoin Futures CoTshows that institutional asset managers’ long position has been ina one-month high, reaching around 1300 BTC worth of contracts, while the overall number of positions also slightly increased.

Source: FX Street

Source: OKEx

Source: CME

ETHUSDT

ETHUSD trade about 1% lower on Monday Asia session. The pair has failed to claim the 200 level after multiple attempts and the 250-day moving average makes a significate resistance.

The pair has could be in the process of forming a symmetrical triangle pattern, if that’s the case, the pair could continue its range trading between 160 to 190 for an extended period.

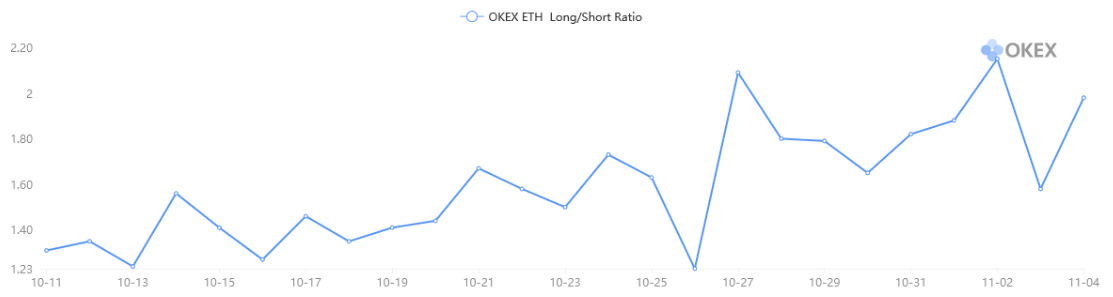

However, the Ultimate Oscillator has produced some lower highs recently, suggesting there could be a bias on the downside, which also supported by the high ETH Long/Short Ratio (figure 5).

On the fundamental front, the Ethereum Istanbul upgrade is set to happen on the first week of December (possibly on December 4), it’s interesting to see how ETH traders will set up for this.

Source: FX Street

Source: OKEx

ATOMUSDT

Cosmos was one of the altcoin gainers in the Monday session, it traded about 1% higher against USDT at the time of writing.

Indicators have shown mixed sentiment as the pair is set to retest the September high of 3.56, and the Ultimate Oscillatorhas been in-line with the price trend, however, trade volume has shown a divergence.

Traders can use the 50 MA asa short-term reference level, which is at around 3.21.OKExTechnicals believes that if the 4-hour 50 MA is compromised, further downside risks could exist.

Source: OKEx; Tradingview

LINKUSDT

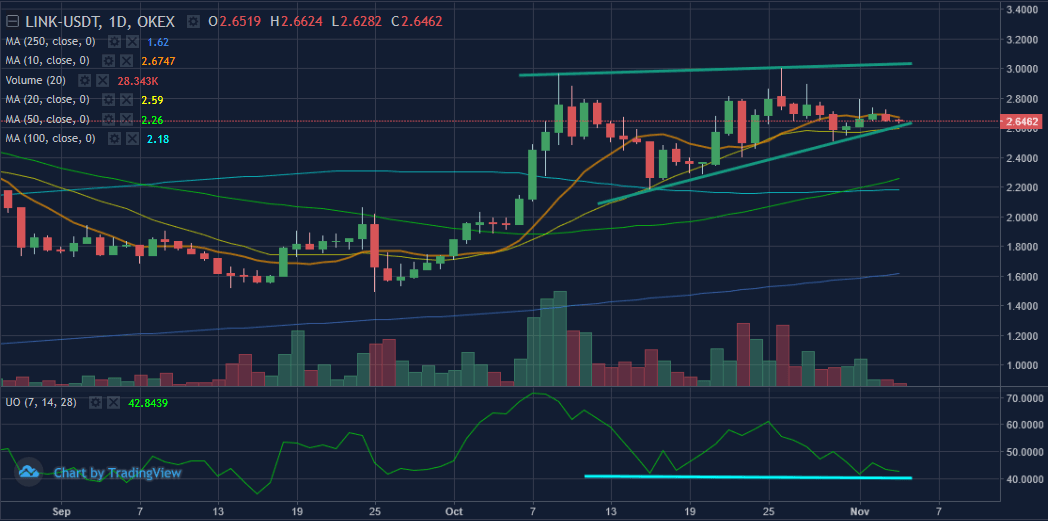

Chainlink could set for a rebound against the USDT as the pair reached the lower end of the recent triangle pattern.

We’ve seen the Ultimate Oscillator rebound when it drops to near 40. Again, the indicator reading has been approaching 40 recently.

The 20-day moving average area seems like decent support, which is near 2.59, and the upper reference would be near 3.

Source: OKEx; Tradingview

Author

Cyrus Ip

OKEx

Cyrus Ip has the privilege to work with OKEx as a Research Analyst, where he found some of the brightest talents in the crypto space.