Polygon’s Sandeep Nailwal says “something big is coming” as MATIC price targets $0.70

- MATIC price shows bullish signs despite the presence of multiple hurdles in its path.

- Investors can expect Polygon to reach $0.68 in a highly bullish case, if it overcomes intermediate blockades.

- A four-hour candlestick close below $0.38 will invalidate the optimistic outlook and trigger further losses.

MATIC price has seen a resurgence of buying pressure that has caused it to rally over the last 24 hours. This development comes after Coca-Cola announced on July 3 the launch of its Polygon-based NFTs.

Polygon NFT scene to take off soon

Coca-Cola announced that it will be launching an NFT collection on the Polygon blockchain in collaboration with Rich Mnisi, who is an artist and an advocate of the LGBTQIA+ community.

Based on the website, these collectibles are made in celebration of the community and each piece, “aims to shine color-filled light on the community's members and spread a message of Love.”

Furthermore, the announcement reveals that all proceeds from the initial sale and re-sale of the NFTs in Coca-Cola’s Pride collection will be donated to charities serving the LGBTQIA+ community.

Another important update for the Polygon community is Meta’s announcement of the launch of NFTs on Ethereum and Polygon. The company’s Product Manager Navdeep Singh shared the initial announcement on Twitter.

We're launching NFTs on Facebook! Excited to share what I've been working on with the world. pic.twitter.com/TaV66zRanV

— Navdeep Singh (@navdeep_ua) June 29, 2022

Perhaps, the most significant development is the recent announcement from Polygon’s co-founders of where they’re taking the project next – the “mass adoption of Web3 on mobile.”

Mihailo Bjelic, co-founder of Polygon tweeted,

Mass adoption of Web3 will happen on mobile and @0xPolygon is preparing for it.

— Mihailo Bjelic (@MihailoBjelic) July 4, 2022

Our strategy is not to make our own devices. Instead, we will integrate with existing manufacturers.

Today, we are proud to announce the first major integration.

Onwards. https://t.co/sGCfTm6v7P

Sandeep Nailwal, co-founder of Polygon, also added that the company is working “on a different strategy by collaborating with existing Mobile heavyweights for global scale.”

“Something (Sth) big is coming.”

MATIC price ready to rumble

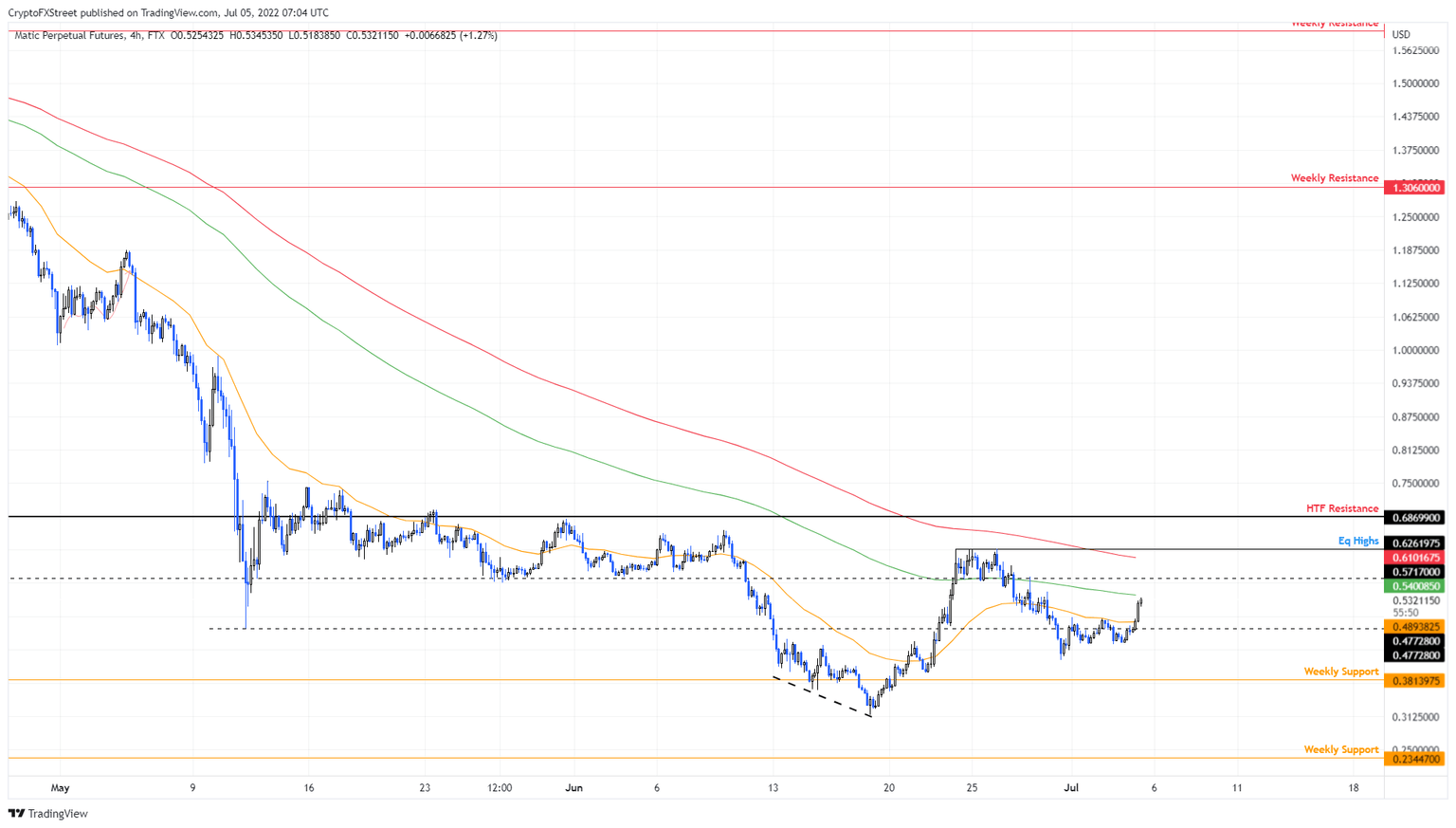

MATIC price has reclaimed two resistance levels and flipped them into support levels – $0.38 and $0.47. This development comes as Polygon currently trades above the 8-day Exponential Moving Average (EMA) at $0.48.

The recovery rally that began on June 18 is likely to witness more gains provided MATIC price overcomes the 34-day EMA at $0.540

This move will open the path for Polygon market makers to sweep above the equal highs at $0.57 and collect the buy-stop liquidity. A flip of the $0.57 hurdle will put MATIC buyers against the most significant resistance barrier at $0.68.

In some cases, MATIC price could extend beyond the aforementioned level and reach $0.70, where the upside is likely capped in the short-term for Polygon.

MATIC/USDT 4-hour chart

While things are looking up for MATIC price, the assumption of the recovery rally continuation depends on bulls overcoming multiple hurdles. Rejection at any of these barriers could knock Polygon lower.

If MATIC price produces a four-hour candlestick close below $0.38 will invalidate the optimistic outlook and trigger further losses to the $0.23 support barrier.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.