Polkadot price snuffs out bullish spark as community celebrates first parachain migration

- Polkadot price loses momentum at $6.50 after sprouting from support at $6.10.

- KILT Protocol parachain successfully makes the first migration from a test environment to Polkadot.

- DOT price is on the cusp of validating a heads-and-shoulders pattern for an extended southbound move.

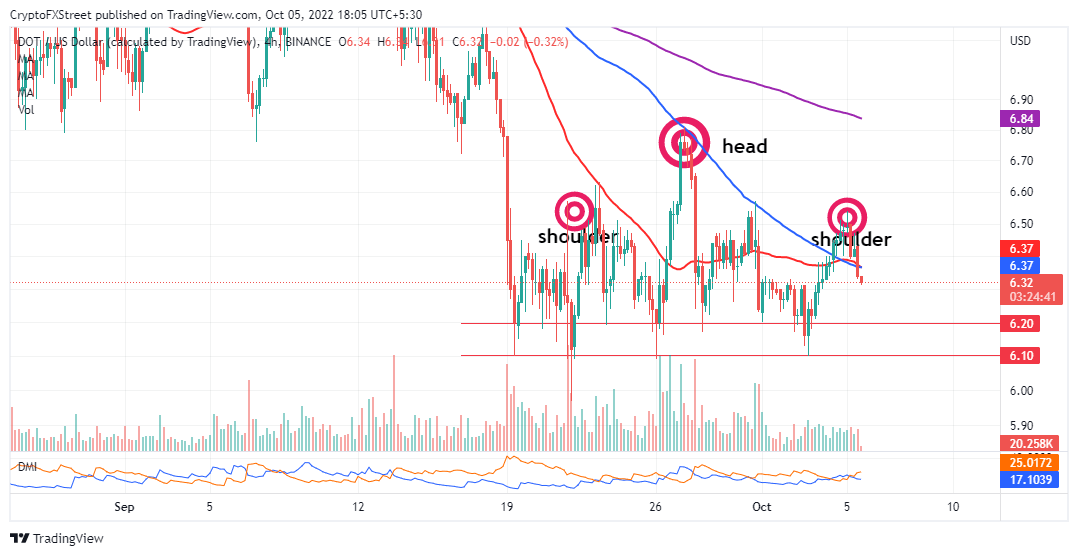

Polkadot price is doddering at $6.33 moments after snapping out of a northbound move from its support at $6.10. An intense seller concentration zone at $6.50 prevented bulls from achieving their potential, with upside targets at $6.80, $7.20 and $8.00 untested. Buyers will have an uphill battle defending DOT’s primary support area at $6.10 if an H&S (heads-and-shoulders) pattern gets validated on the four-hour chart.

Polkadot announces first parachain migration

Polkadot has achieved a historical Web3 milestone after migrating the KILT Protocol, which is blockchain protocol used for creating, issuing and verifying digital identities. KILT was migrated from Polkadot’s test and development environment, the Kusama Network, to its relay chain, the backbone of the Polkadot ecosystem. The development team said via a blog post published on October 4 that “the migration also represents the first instance of a parachain taking the upgrade path from Kusama to Polkadot.”

The historical development will precede other Web3 projects looking for an avenue to stress-test their technology in real-time. Polkadot’s idea is to alleviate risks associated with software upgrades, especially from one blockchain network to another.

“Happy to see KILT Protocol showing, for the first time, the live transition of an entire parachain ecosystem from one Relay Chain’s security umbrella to another. This is another demonstration of the power and flexibility of the Relay Chain model for decentralized application platforms,” says Dr. Gavin Wood, founder of Polkadot, expressing his satisfaction with the migration.

The founder of KILT Protocol, Ingo Rübe, added that this is a huge step toward decentralization. Rübe believes that the migration process was made possible by Polkadot’s technology and flexibility.

Polkadot price gives up on relief rally

Polkadot price reacted positively to the migration of the KILT Protocol from Kusuma but immediately started wiping out the accrued gains. Support expected at $6.38 – formed by the 50-day Simple Moving Average (SMA) red, and the 100-day SMA (blue) failed to stop DOT’s retracement, which could revisit the buyer congestion at $6.10.

DOT/USD four-hour chart

An heads-and-shoulders (H&S) pattern is also nearing maturity on the same four-hour chart. However, short sellers should consider waiting till Polkadot price slides below the $6.10 neckline at the H&S’s lows to confirm a breakout. Possible take-profit targets to the downside are the demand areas at $6.10, $5.80 and $5.40.

Odds will continue favoring bears, as shown by the DMI (Direction Movement Index). Nevertheless, the ongoing downward movement could be stopped if bulls move to reclaim the broken support at $6.38 while not losing focus on higher price levels at $6.80, $7.20 and $8.00.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren