Polkadot price presents buy opportunity with incoming drop to $22

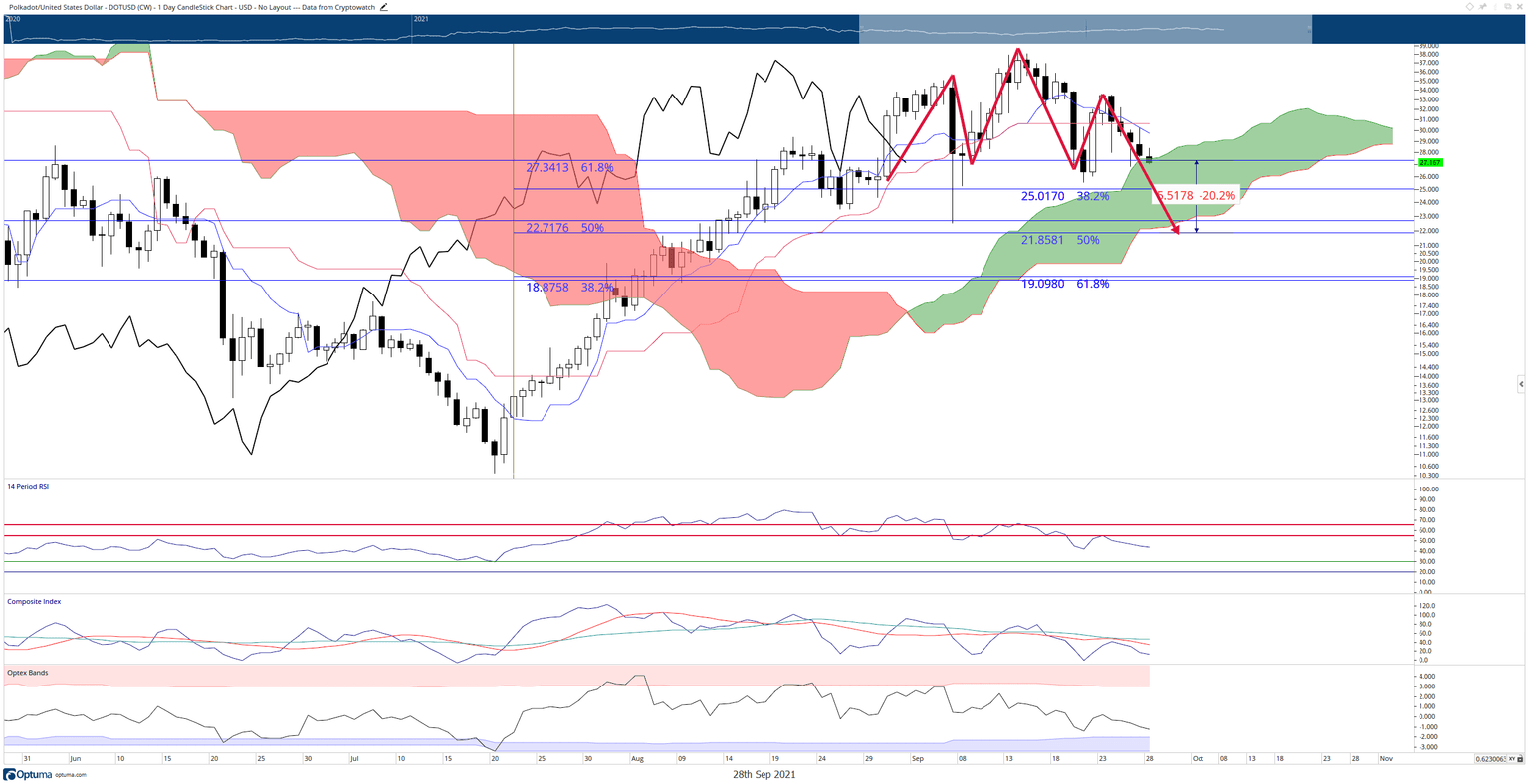

- Polkadot price approaching neckline break of a head-and-shoulders pattern.

- Chikou span below the candlesticks signals substantial and imminent price collapse soon.

- Oscillator levels support sustained selling pressure.

Polkadot price remains a laggard for how little it has moved from its recent swing highs compared to its peers. As a result, steep retracements towards the low $20 range are likely.

Polkadot price falls below 61.8% Fibonacci retracement and enters the Cloud

Polkadot price is currently under extremely bearish trading conditions within the Ichimoku Kinko Hyo system. Polkadot bulls failed to support Polkadot enough to maintain the Chikou Span above the candlesticks and instead have allowed the Chikou Span to drift well below the candlesticks.

The neckline of a head-and-shoulder pattern shares the same 27.34 value area as the 61.8% Fibonacci retracement level – a level that Polkadot price is currently trading below. The projected target zone for sellers is a zone that buyers may also find extremely attractive: $22. There is a collection of some massive support levels at the $22 value area.

There are two 50% Fibonacci retracement levels near the $22 level. The first 50% Fibonacci level is from the swing of May 15 to July 20th, while the second is from July 20th to September 14th. Between those 50% levels is the most substantial support/resistance within the Ichimoku system: Senkou Span B. Additionally, there is a high volume node at $22 as well.

DOT/USD Daily Ichimoku Chart

Buyers anticipating a discount should be aware that as bearish as Polkadot price current is, it is not hard for Polkadot to return to a bull market. If buyers can elevate the Chikou Span to above the candlesticks ($35), nearly all conditions with the Ichimoku system for a solid bullish breakout could be met. Evidence of invalidation of any move south would be consistent daily support against Senkou Span A.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.