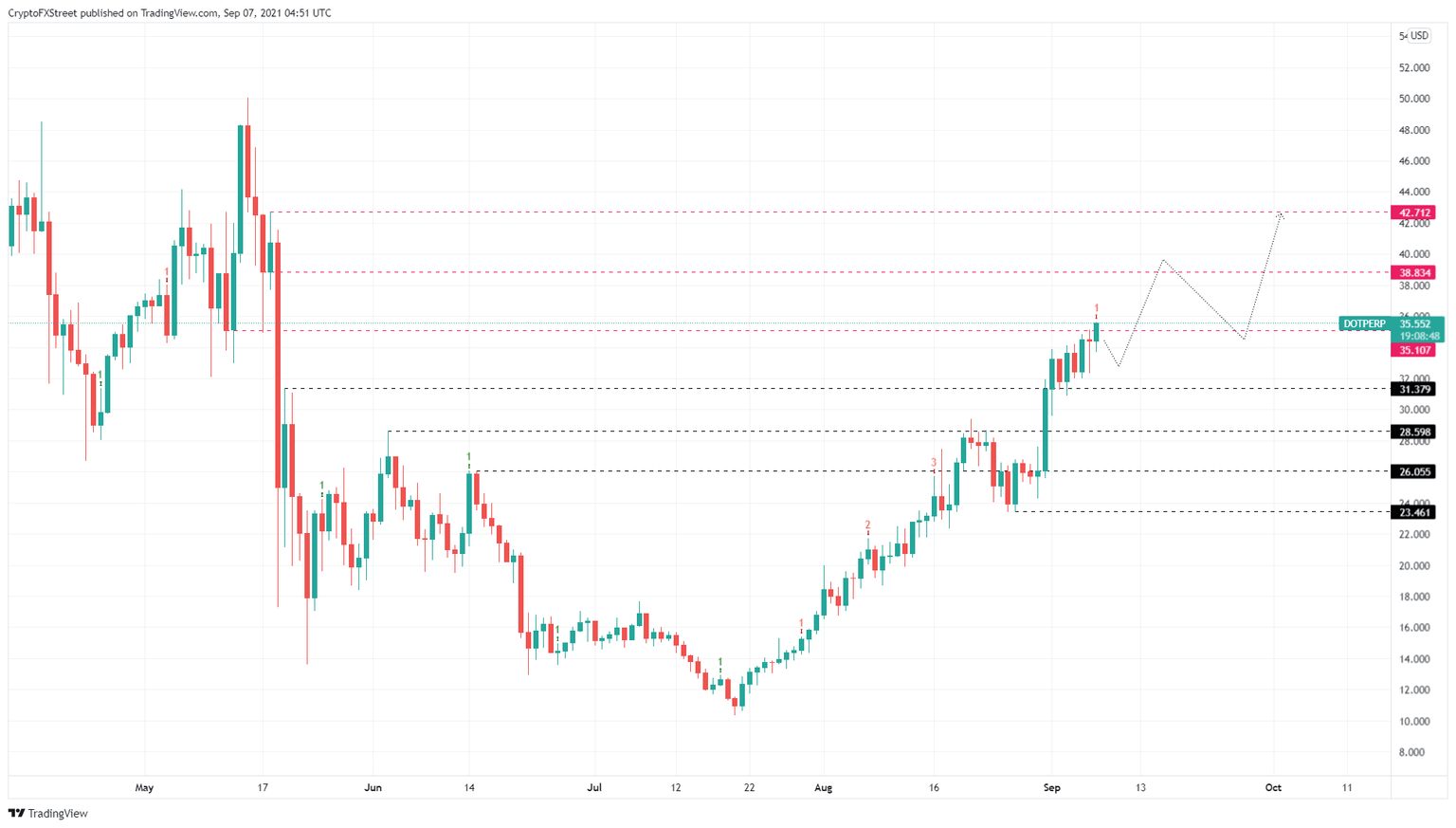

Polkadot Price Prediction: DOT upside limited to 23% as sell signals emerge

- Polkadot price is consolidating below the $35.11 resistance level.

- The MRI has flashed a sell signal, indicating a minor retracement might ensue.

- In a highly bullish case, a decisive close above $35.11 could propel DOT to $38.83 and $42.71.

Polkadot price is seeing a lack of buying pressure, which has led to a consolidation phase under a crucial resistance level. Moreover, a sell signal from the MRI indicator further limits any upside potential DOT has. Therefore, investors need to be careful around this altcoin.

Polkadot price at inflection point

Polkadot price rose 50% since August 27 but started consolidating since September 1. The coiling up could lead to a breakout in either direction, but upsetting the bullish expectation is the Momentum Reversal Indicator (MRI)’s sell signal in the form of a red ‘one’ candlestick on the daily chart. This technical formation forecasts a one-to-four candlestick correction.

Therefore, investors need to be careful of this consolidation resolving with a downward breakout.

However, if the buyers manage to overcome the bearish indications, market participants expect DOT to continue its ascent to $38.83 after an 11% ascent. If such a move occurs, the run-up might extend to $42.71, constituting a 23% climb from the current position.

Beyond this resistance barrier, Polkadot price will have a chance to retest the all-time high at $50.04.

DOT/USDT 1-day chart

The bullish outlook for Polkadot price hangs by a thread, despite climbing 50% over the past week. Even if DOT manages to breach through the immediate resistance, the upswing cannot be guaranteed.

On the other hand, if Polkadot price produces a lower low below $31.38, it will invalidate the bullish thesis. In some cases, this move could trigger a 16% downswing to $26.06.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.