Polkadot price goes nose down in the dirt

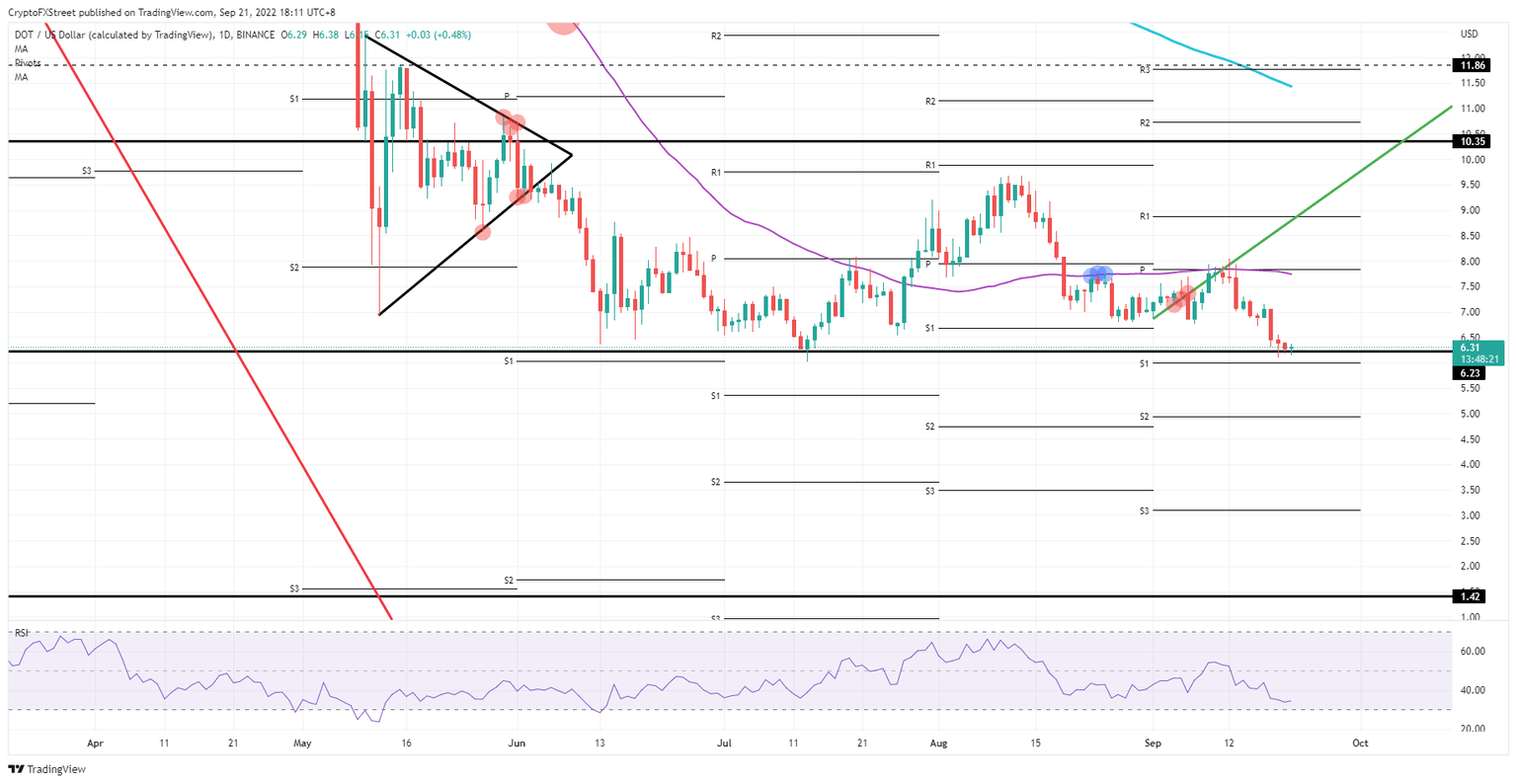

- Polkadot price hits the floor at $6.23 yet again.

- A squeeze and break to the downside are inevitable with still lower highs.

- After Putin’s sabre rattling and with the Fed set for another jumbo hike, it is time to look at $1.42.

Polkadot (DOT) price is on the cusp of breaking below $6.23 as pressure keeps building and the week reaches its boiling point. After the war comments from Putin this morning, and the Fed, BoE and other central banks ready to hike even more, further tightening and risk aversion are creeping into the already battered markets. Cryptocurrencies are taking a step back and there is a risk DOT price could soon collapse under bearish pressure, opening up room for a crash to $1.42 in the medium-term.

DOT price requires good news

Polkadot price action is seeing dark clouds forming above its price action as geopolitical forces and central banks are squeezing the market once again. Cryptocurrencies are overall on the back foot this morning after Putin called for mobilisation with a view to sending roughly 300,000 troops to Ukraine while calling out the West as a threat to Russia, and putting battlefield-use of nuclear weapons back on the table. Add to that the Fed rate hike meeting this afternoon, with possibly even a 100 bps hike, and there is simply no silver lining in sight for now.

DOT price is a perfect reflection of that sentiment with bulls having their faces pushed into the mud as lower highs are proof of bears overpowering them. Expect to see a break below $6.23 any time soon, and should there be a firm close below, expect to see more downside risk at hand. As to where this could eventually go, if current elements keep developing in a negative path, expect to see $1.42 by year-end.

DOT/USD Daily chart

Although several tail risks keep price action muted, there appears to be some small buying at $6.23 as the Relative Strength Index is showing a small knee jerk reaction today. Expect to see a possible uptick should the Fed come out less hawkish than usual this evening. Such an outcome would mean that DOT price has some room to go to $7.00.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.