Polkadot price could turn bullish this week as DOT gains favor among futures traders

- Huobi Exchange has revealed that it has been experiencing healthy demand in the futures market for Polkadot.

- The exchange’s sentiments could indicate a potential pivot for a northbound move in the altcoin.

- DOT could have a bullish week amid multiple positive indicators.

Polkadot price (DOT) could have a bullish week, a thought extrapolated from a recent tweet by Huobi exchange about experiencing healthy demand in the futures market for Polkadot. Notably, the futures segment of the cryptocurrency market often moves simultaneously with the spot market. Moreover, in certain occurrences, it significantly influences general pricing. Judging from this, it is possible that Polkadot’s ticker, DOT, could record a demand uptick this week, hence increasing prices.

Polkadot changes the bearish tide in the futures market

The futures market began the week on the wrong foot as the largest cryptocurrency exchange by trading volume, Binance, experienced downtime in its futures segment early morning on April 10. Nevertheless, industry peer Huobi Exchange revealed that it has been witnessing a healthy demand in the futures market for Polkadot.

#Huobi Top Trader Long Positions:

— Huobi Futures (@HuobiFutures_) April 10, 2023

$HT 71%

$DOT 70%

#Bitcoin 64%

$ARB 62%

$ETH 55%

What's your next long?

Based on the Twitter post, DOT is now second in Huobi’s top trader position. This came after the altcoin outperformed Bitcoin (BTC) and Ethereum (ETH) on metrics of futures demand. The ranking is achieved after factoring in the ratio of longs to shots that each asset holder executed.

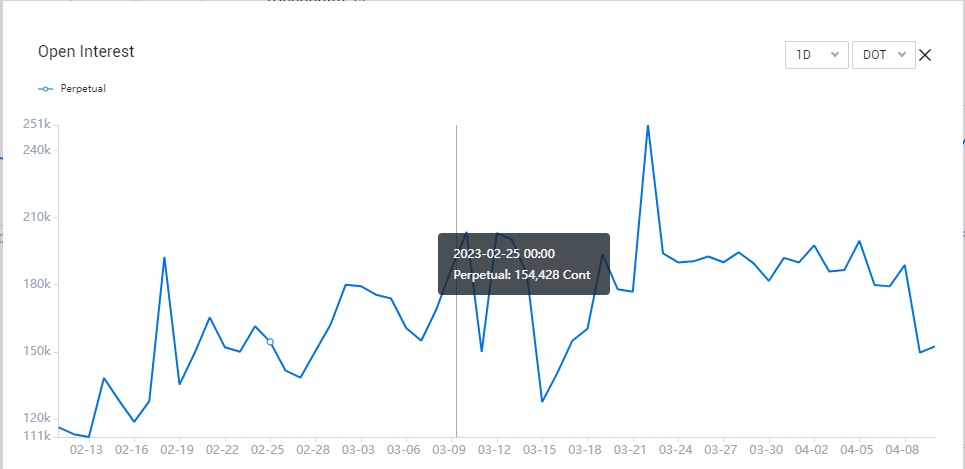

The surge could hint at a possible demand pivot, given that Polkadot’s open interest in the Huobi exchange has been on a downtrend since March 22. This surge showed signs of providing a pivot over the last 24 hours after Polkadot price retested the March 11 lows.

Polkadot price finds support at $6.10

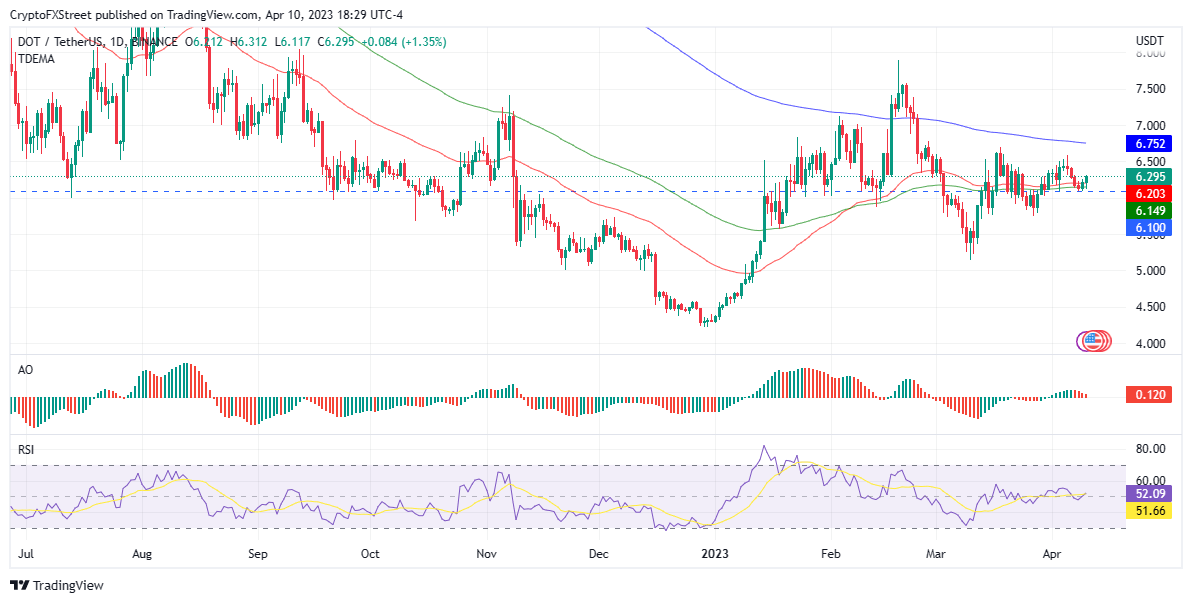

Polkadot price, at the time of writing, is at $6.29 after gaining almost 1% in the last 24 hours. The altcoin was rejected from the $6.45 resistance and found some bullish relief after the support at $6.10 held.

DOT/USDT 1-day chart

Given Polkadot’s ranking in the derivatives market on metrics of long positions vs. shorts, it is deducible that bullish demand could grow as the week progresses.

In the same way, the Polkadot price action showed that the sell wall could hint at a possible bullish pivot as demand slowly but effectively outweighs selling pressure.

If Polkadot price successfully secures enough volume, investors can expect at least a 6% upside this week.

Polkadot volume and network development

On matters of volume, Polkadot’s on-chain volume has been plummeting for three consecutive weeks and is currently standing near the monthly lows. Nevertheless, things could change soon as the consensus sentiment changes the tide.

The sentiment metric is up significantly over the past 10 days, indicating more investors expecting a bullish turn of events. Nevertheless, while the sentiment could lead to bullish volumes, the volume metric remains at its lowest since the last month.

On the upside, Polkadot has maintained healthy development activity since mid-March. Notably, the network has been performing well among other leading blockchains, boasting the highest development activity for a while now.

This network development could also be a confidence pump among DOT community members and investors.

Author

Lockridge Okoth

FXStreet

Lockridge is a believer in the transformative power of crypto and the blockchain industry.

%2520%5B01.34.49%2C%252011%2520Apr%2C%25202023%5D-638167673459941672.png&w=1536&q=95)

%2520%5B01.46.55%2C%252011%2520Apr%2C%25202023%5D-638167675210578452.png&w=1536&q=95)