OP investors in profit relax as Optimism price exhibits recovery rally signal

- Optimism price is nearing the resistance at $1.338; 50-day EMA and price signals suggest a recovery is likely.

- At the moment, the active addresses mostly constitute investors who are suspended between losses and profits.

- Since long-term held OP has not moved for some time, the altcoin is mostly vulnerable to loss offsetting from short-term traders.

Optimism price bounced back over the past day after noting a two-month low. The altcoin is exhibiting bullish signals. However, its bullish bias might face some resistance if the short-term investors decide to exit to prevent any potential losses going forward.

Optimism price likely to rise soon

Optimism price, at the time of writing, is treading at $1.337, just below the resistance level of $1.338. This line has been tested multiple times in the past as a support floor. A breach and flip of the same level into support could initiate an upward momentum. This would also enable OP to reclaim the 50-, 100- and 200-day Exponential Moving Averages (EMA) into support, which would boost the altcoin to $1.663 and beyond.

The Relative Strength Index (RSI) and the Moving Average Convergence Divergence (MACD) both suggest a bullish outlook. The former should breach the neutral line at 50.0 as prices increase. Similarly, MACD is observing a potential bullish crossover. Furthermore, the fading red bars on its histogram suggest receding bearishness, and the emergence of green bars would hint at a bullish momentum.

OP/USD 1-day chart

Nevertheless, a failed breach cannot be considered an unlikely possibility. In the event that Optimism price pulls back from $1.338, it could fall back to test the three-month-old support at $1.069. Losing this level would invalidate the bullish thesis, bringing losses to investors.

OP price may fall due to short-term interests

Optimism price declining, and OP holders observing losses mostly move in tandem when there is a lack of outside influence. A recovery in price would lure investors to sell for profit, and selling would lead to a decline if it is substantial.

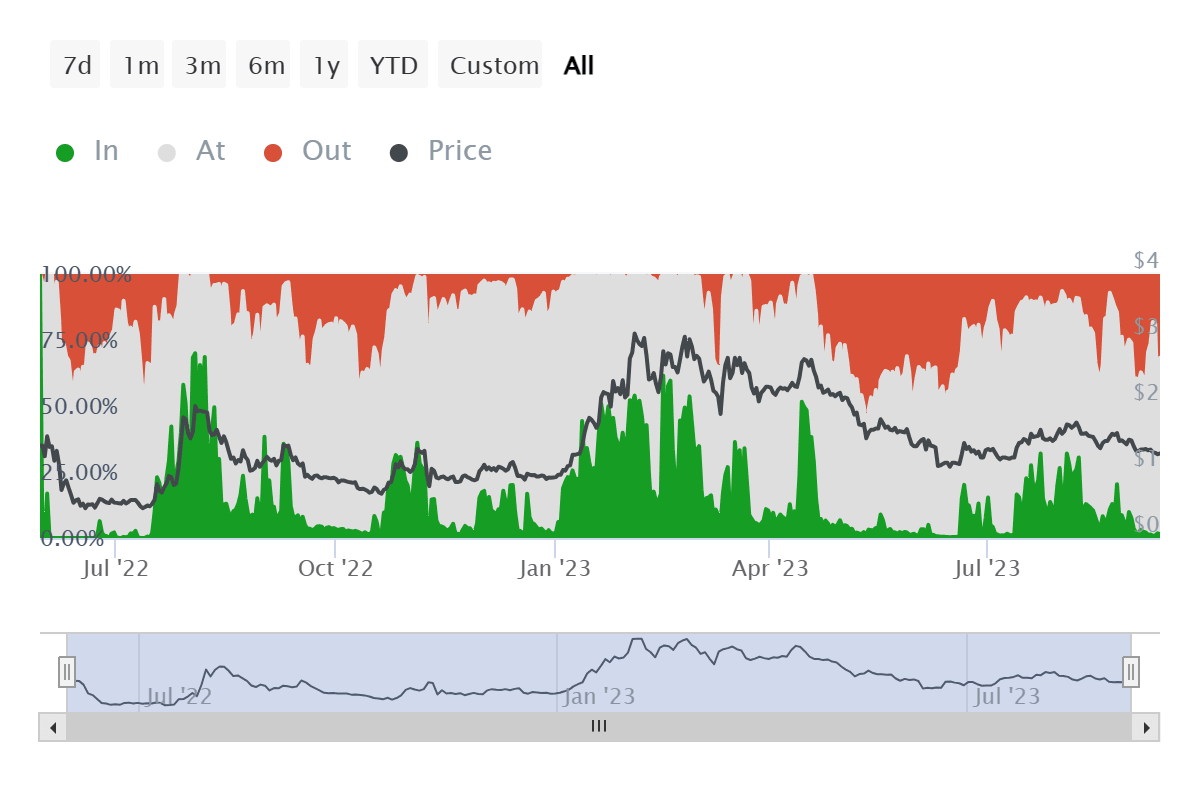

This is a threat to OP should it breach the resistance at $1.338. The reason behind this is the activity of the investors. At the moment, addresses in profits and losses only amount to 1.4% and 31.7% of the active addresses, respectively. The remaining 66.9% are the ones that are hanging betwixt as these holders bought their supply when OP was between $1.320 and $1.440.

Optimism active addresses by profitability

Thus, a recovery could trigger selling if investors decide to prevent potential future losses. Regardless, any selling that takes place would only be from short-term traders (holding OP for less than a month) since long-term held OP (for more than a year) has not been moved in almost a month.

Optimism age consumed

Going forward, investors looking to jump in on Optimism should note that the altcoin is vulnerable to short-term selling. This could lead to corrections even if OP was to observe any recovery.

Like this article? Help us with some feedback by answering this survey:

Author

Aaryamann Shrivastava

FXStreet

Aaryamann Shrivastava is a Cryptocurrency journalist and market analyst with over 1,000 articles under his name. Graduated with an Honours in Journalism, he has been part of the crypto industry for more than a year now.

%2520%5B05.25.57%2C%252013%2520Sep%2C%25202023%5D-638301630203193440.png&w=1536&q=95)