Number of staked ETH passes 16M

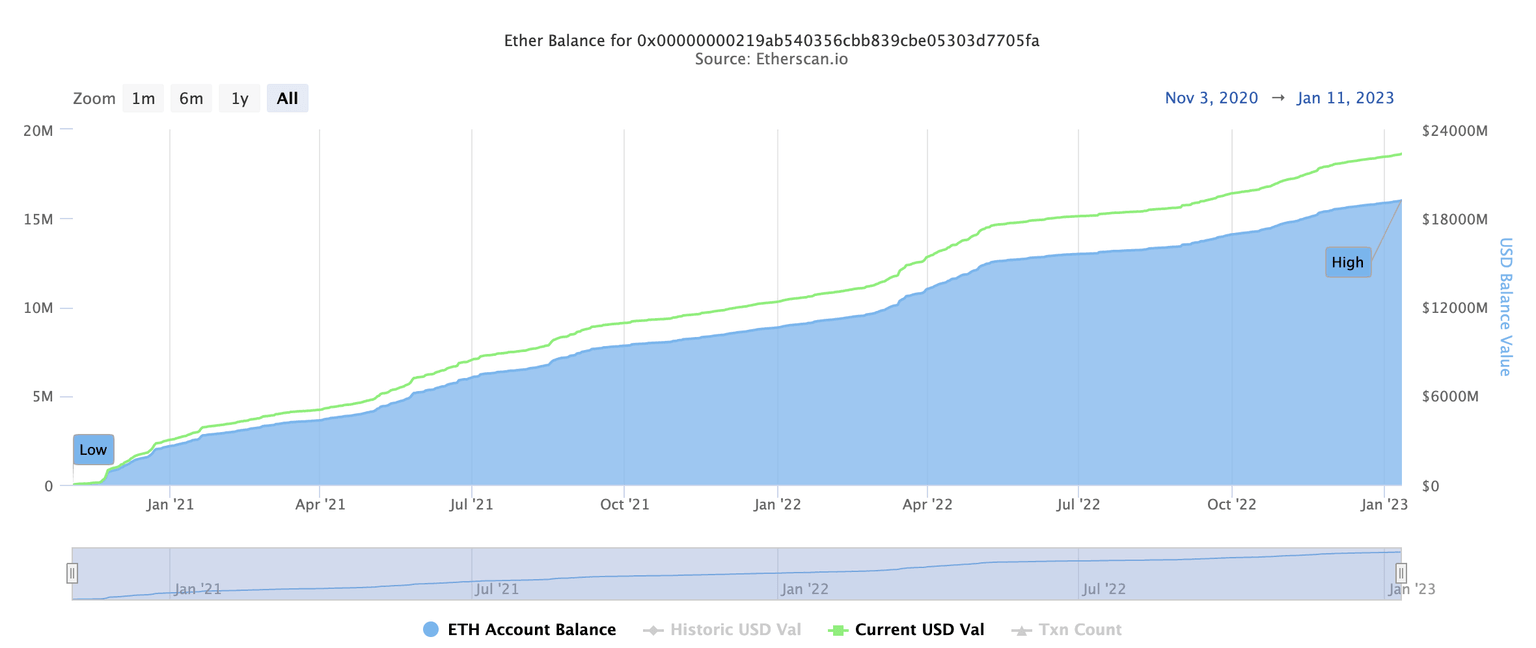

Almost four months after Ethereum’s successful shift to a proof-of-stake network, the second-biggest blockchain by market cap has passed another major milestone. More than 16 million ether (ETH) have been deposited into Ethereum’s Beacon Chain staking contract, data from Etherscan shows.

The 16 million ETH figure constitutes more than 13.28% of the total ether supply and represents nearly $22.38 billion at current prices. It comes nearly two years after Ethereum’s staking contract went live in 2020, when the network’s proof-of-stake Beacon Chain was first introduced.

Validators – people that help run the Ethereum network – “stake” ETH for a chance to write and authenticate transactions to the blockchain’s ledger. The staked funds get locked up with the network and accrue interest, but they will be impossible to withdraw until the network’s Shanghai upgrade, which is not expected until around March 2023.

While the growing number of staked ETH can be interpreted as a promising sign for Ethereum security and adoption, it will no doubt ramp up pressure on the network’s core developers to expedite work to enable withdrawals.

Ether balance in Ethereum's Beacon Chain staking contact (Etherscan)

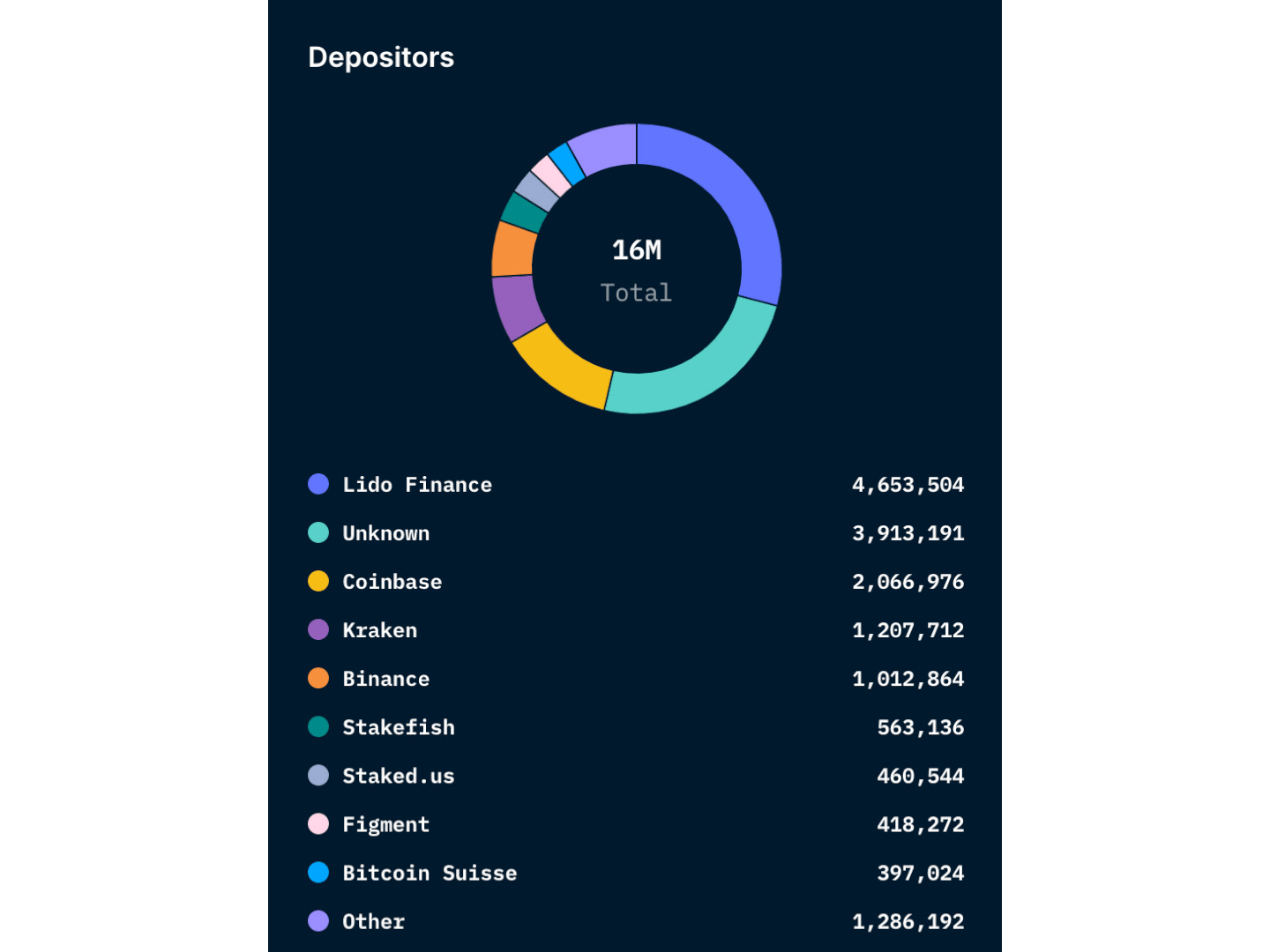

Data from Nansen indicates that the number of unique staking depositors stands at roughly 92,500, and data sourced from BeaconScan shows that the number of active validators is about 498,000.

A larger amount of staked ETH should theoretically make it more difficult for an individual actor to sabotage the Ethereum chain. However, the bulk of Ethereum’s stake currently belongs to a handful of large actors – fueling concern that control over the chain is becoming too centralized.

Top depositors in Ethereum’s Beacon Chain staking contract (Nansen)

Out of the 16 million ETH staked, roughly 4.65 million have been staked through Lido – a kind of community-driven validator collective. Lido, Coinbase, Kraken and Binance, the four largest Ethereum validators, command a 55.88% share of all staked ETH, according to Nansen.

The number of staked ETH has climbed about 16.68% since the Merge in September 2022, when Ethereum abandoned its old proof-of-work consensus mechanism. The Merge fully transitioned the Ethereum blockchain to a proof-of-stake (PoS) consensus mechanism, which abandoned proof-of-work’s energy-intensive crypto mining process in favor of today’s staking system.

Author

CoinDesk Analysis Team

CoinDesk

CoinDesk is the media platform for the next generation of investors exploring how cryptocurrencies and digital assets are contributing to the evolution of the global financial system.