Newly found malware uses Dogecoin blockchain to breach cloud servers

- Researchers at Intezar have detected a malware (Doki) that relies on Dogecoin to attack cloud servers.

- The malware uses the blockchain to generate C2 domain addresses and breach cloud servers.

- There has been no adverse effect on DOGE/USD’s price.

A new study by Intezar has revealed that hackers are relying on the Dogecoin (DOGE) blockchain to expand a malware dubbed “Doki.” The researchers at Intezar noted that Doki is an undetected backdoor that exploits the Dogecoin blockchain “in a unique way” to generate C2 domain addresses and breach cloud servers. It is deployed through a botnet called Ngrok.

The malware then uses these domain addresses to search for additional vulnerable cloud servers within the victim’s network. An excerpt from the research paper reads:

The attacker controls which address the malware will contact by transferring a specific amount of Dogecoin from his or her wallet. Since only the attacker has control over the wallet, only he can control when and how much Dogecoin to transfer and switch the domain accordingly.

According to Intezar, using Dogecoin to deploy malware that’s not related to cryptocurrencies may be “quite resilient” to security protocols and law enforcement. This is why Doki has managed to go unnoticed for more than six months despite having been uploaded to the VirusTotal database back in January.

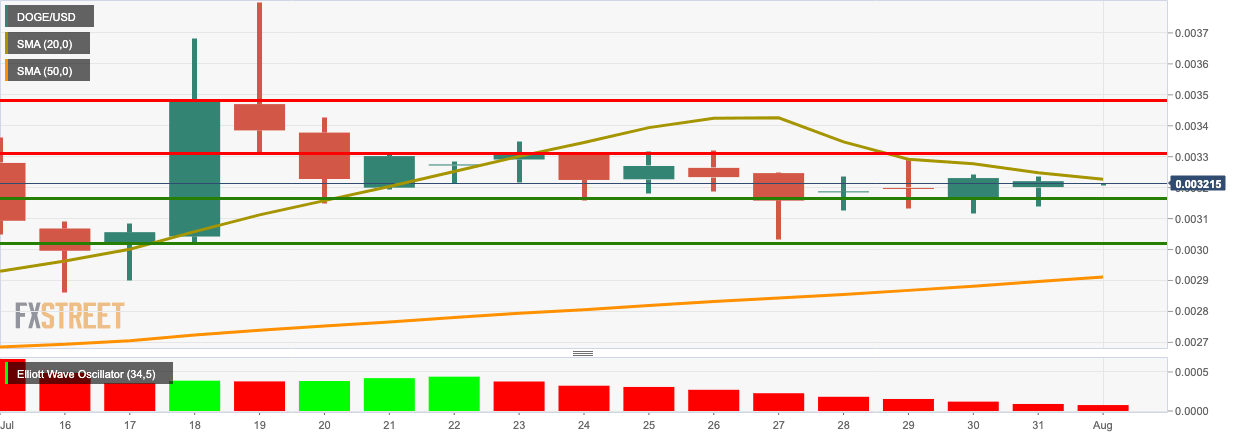

DOGE/USD daily chart

DOGE/USD is on course of having three straight bullish and has encountered resistance at the SMA 20 curve. Currently, it’s priced at $0.003215. The Elliott Oscillator has had ten consecutive red sessions. The price shows three strong resistance levels at $0.003225 (SMA 20), $0.003312 and $0.003477. On the downside, we have three healthy support levels at $0.003163, $0.003024 and $0.002914 (SMA 50).

Author

Rajarshi Mitra

Independent Analyst

Rajarshi entered the blockchain space in 2016. He is a blockchain researcher who has worked for Blockgeeks and has done research work for several ICOs. He gets regularly invited to give talks on the blockchain technology and cryptocurrencies.