NEAR holds steady following Bitwise NEAR ETF filing

- Bitwise filed an S-1 with the SEC to launch a Bitwise NEAR ETF.

- The filing is the first official expression of interest in a NEAR ETF from an asset manager.

- NEAR could face another rejection at a descending triangle's upper boundary.

NEAR held steady above the $2 mark on Tuesday despite Bitwise's NEAR exchange-traded fund (ETF) filing with the Securities & Exchange Commission (SEC). The filing follows NEAR witnessing a sustained rejection around the upper boundary of a descending triangle.

NEAR joins crypto ETF hopefuls following Bitwise filing with SEC

Asset manager Bitwise has submitted a registration with the SEC to launch a NEAR ETF, according to an S-1 filing on Tuesday. The ETF would provide investors with price exposure to NEAR, eliminating the need to hold the digital asset directly, similar to how Bitwise's spot Bitcoin ETF (BITB) offers exposure to BTC.

The filing — which is the first NEAR ETF interest from an asset manager — comes after Bitwise registered a NEAR Trust in the state of Delaware. A 19b-4 filing is expected to follow, which is a necessary step in the SEC's approval process.

Although Bitwise did not state the exchange on which the product will be listed, Coinbase Custody Trust Company will be responsible for safekeeping the trust’s NEAR tokens.

In addition to the NEAR ETF, Bitwise is seeking approval for several other crypto-focused products, including Solana, XRP, Dogecoin, and Aptos ETFs.

Investors showed little excitement following the filing, as NEAR is down over 3% on the day alongside a general decline in the Artificial intelligence sector. This extended the token's decline in the past week to over 12%.

NEAR faces rejection at key descending triangle's upper boundary

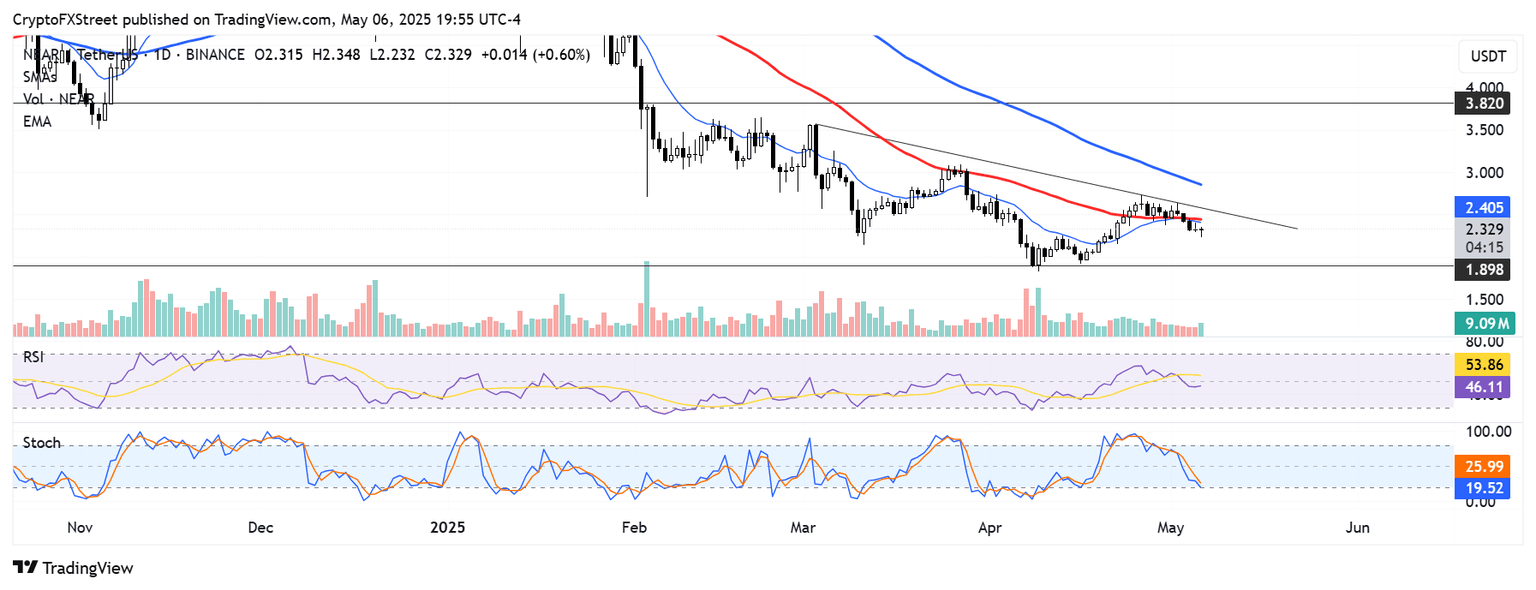

NEAR trades within a descending triangle pattern, with a key falling trendline extending from March 3. NEAR faces resistance at the upper boundary of the descending triangle — strengthened by the 50-day Simple Moving Average (SMA). A surge above this level could mark the beginning of a turnaround for the altcoin.

NEAR/USDT daily chart

On the downside, NEAR faces support at $1.898. The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) are below their neutral levels, with the latter nearing the oversold region.

Other top AI tokens are showing mixed performance, with Bittensor (TAO) down 0.2%, Render (RENDER) down 1% and Artificial Superintelligence (FET) up over 3%.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi