Monero Price Prediction: XMR targeting $100 after seemingly forming a double top

- XMR is trading at $131.54 after hitting a robust resistance level at $139.

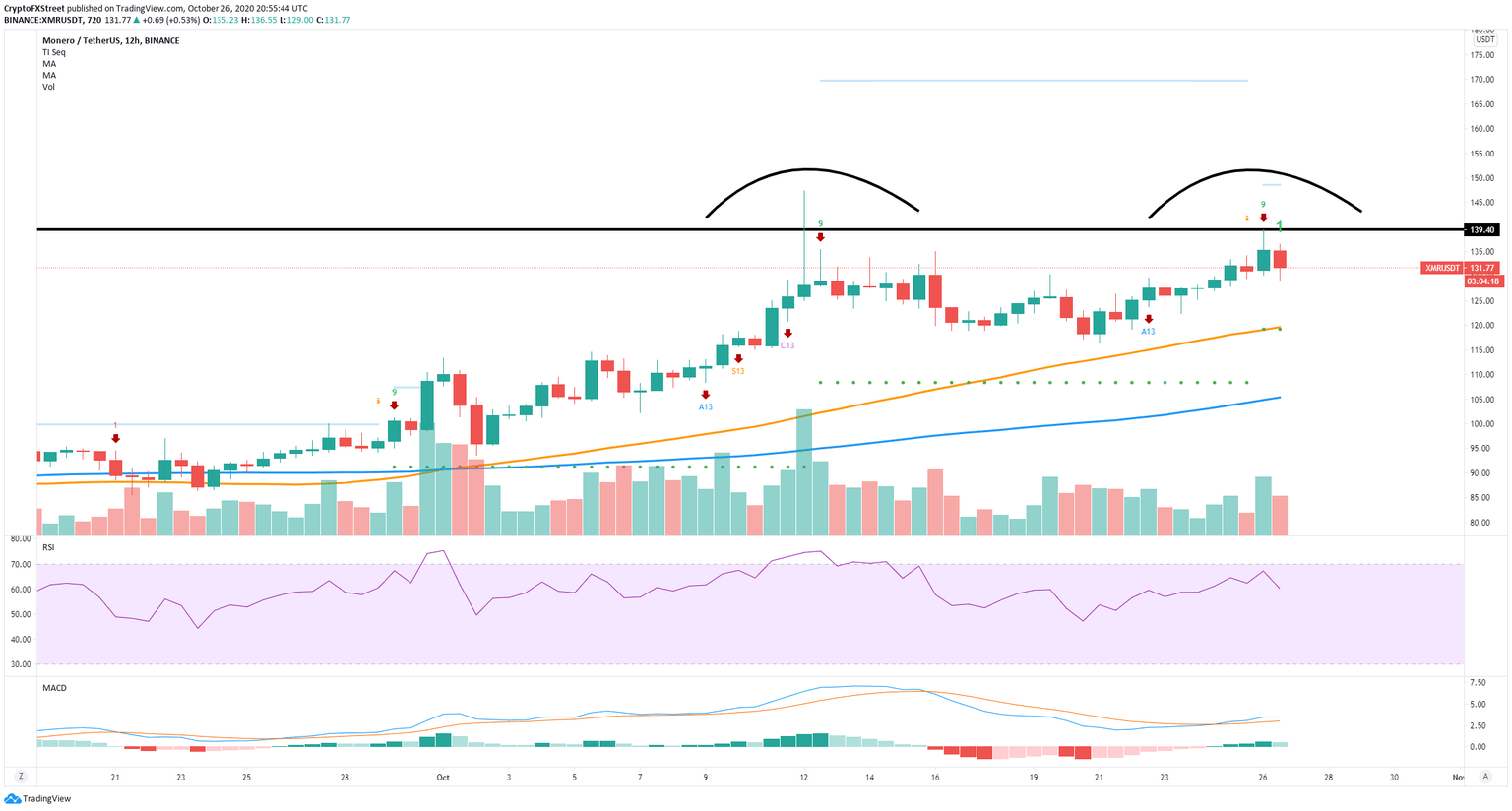

- On the 12-hour chart, the price seems to have established a double top.

XMR is up by 13% in the past five days and has confirmed uptrends on the daily chart and the 12-hour chart. Monero is currently ranked 14th by market capitalization, with $2.32 billion.

Monero facing a potential rejection towards $100

On the 12-hour chart, the price of XMR got rejected at $139, forming what seems to be a double top currently. On top of that, the TD sequential indicator presented a sell signal, which also happened on October 12, the other head of the double top.

XMR/USDT 12-hour chart

Validation and continuation of this sell signal can easily drive the price of XMR down to the 50-SMA at $120 and as low as $100. The MACD is slowly turning bearish, and selling pressure is mounting on XMR.

XMR bulls still holding short-term time frames

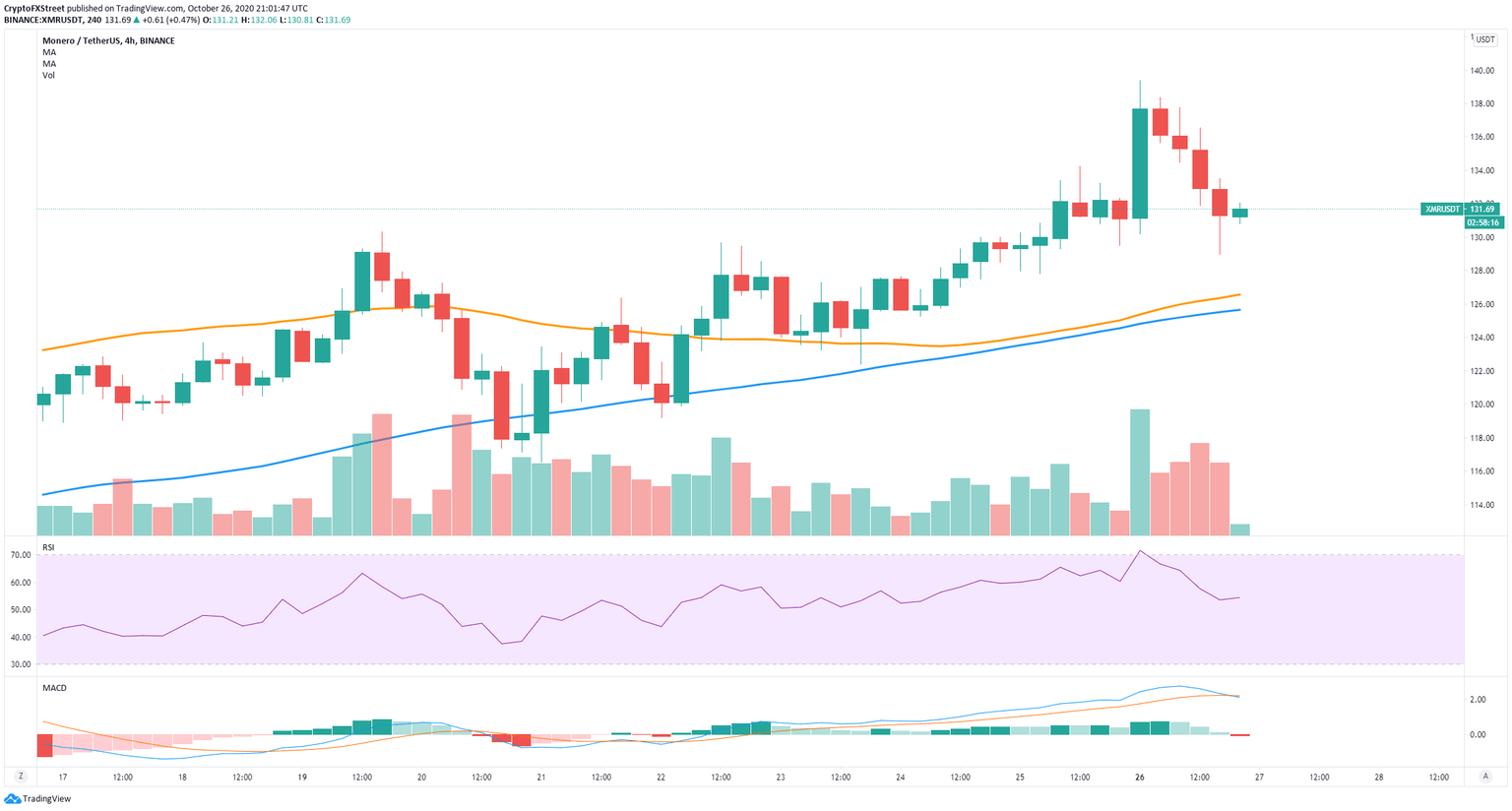

The 4-hour chart is still in favor of the bulls as the uptrend continues intact. The 50-SMA and the 100-SMA are acting as healthy support levels at around $125. The RSI was overextended for a brief period of time but has cooled off significantly.

XMR/USDT 4-hour chart

The most critical resistance level is $139, where the double top seems to be formed. A breakout above this point would be crucial and likely to push the price of XMR towards $300 as there is very little resistance to the upside.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.