Monero Price Analysis: XMR/USD downward momentum could gain traction to $100

- Monero bulls are working around the clock to defend the 50-day SMA to avert potential losses to $100.

- XMR/USD faces intense resistance on the immediate upside, including the descending channel’s upper boundary.

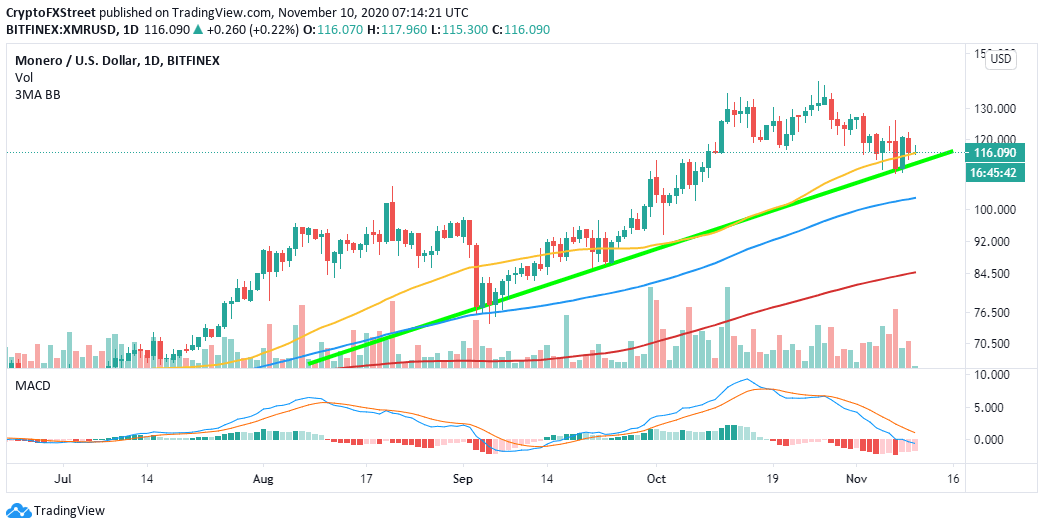

Monero’s upward momentum hit pause at $140 in October, cutting the bulls’ mission to elevate the crypto above $200. The struggle to defend the fundamental support level has also been real for the bullish camp as bears swung aggressively into action. At the time of writing, XMR is doddering at $115 after failing to hold above $120. If the technical outlook remains the same, Monero could dive further down to the next key support target.

Monero on the verge of a breakdown to $100

At the moment, XMR is holding firmly to short-term support provided by the 50-day SMA. It is uncertain that the price will keep this support long, especially with the Moving Average Convergence Divergence diving into the negative region. Similarly, the bearish divergence from MACD reinforced the intensifying selling pressure in the market.

In the event the Monero slides under the 50-day SMA, price action may gain momentum toward the next crucial support at the 100 SMA, highlighted at $100. The low trading volume has limited price movement, but the situation could change in the near term.

XMR/USD daily chart

The 4-hour chart shows XMR trading under the moving averages; 50 SMA, 100 SMA and 200 SMA emphasizing the growing selling pressure in the market. Besides, the cryptoasset is still confined in a descending parallel channel. If the short-term support at $115 fails to hold, the price might revisit lower levels at $ 110. A break under the channel is likely to complete the bearish leg to $100.

XMR/USD 4-hour chart

It is worth mentioning that if Monero closes the day above the 50 SMA in the daily range, the bearish scenario will be invalidated, giving way for a reversal above $120. Moreover, gaining ground past the 50 SMA in the 4-hour range will add credibility to the new bullish outlook and encourage buyers to join the market.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren

%20(4)-637405911260958171.png&w=1536&q=95)