Missed ApeCoin rally to $19? This upcoming dip is your last chance to buy APE before new highs

- ApeCoin price seems to be slowing down after creating a new all-time high at $19.62.

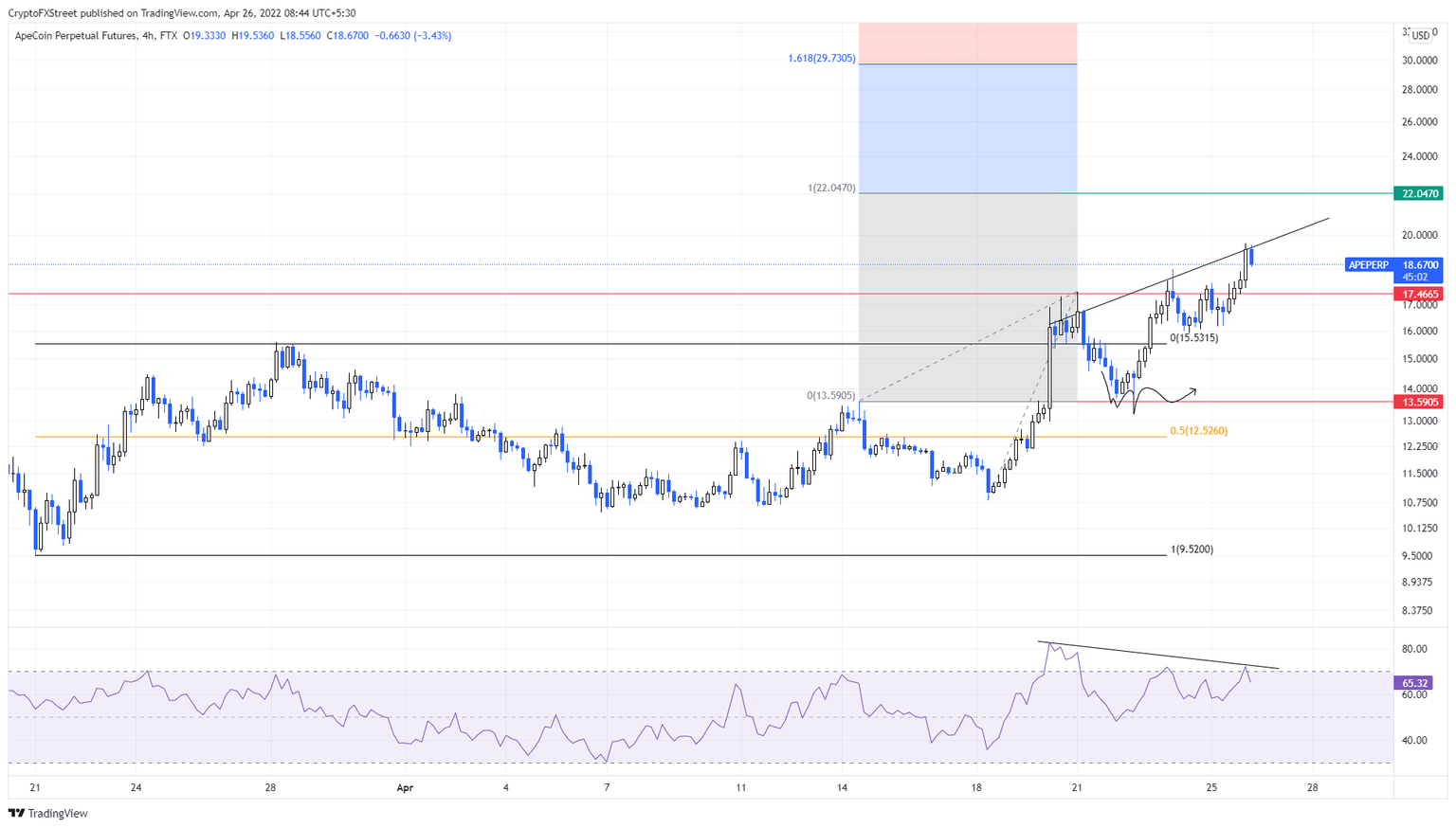

- Technicals suggest a divergence, hinting at a minor retracement before a full-blown rally to a new high at $22.04.

- A daily candlestick close below $15.61 will invalidate the bullish thesis for APE.

ApeCoin price is coiling up, suggesting the possibility of a minor correction before any uptrend. This downswing will provide sidelined buyers an opportunity to accumulate before a massive rally.

ApeCoin price prepares for next leg higher

ApeCoin price has been producing higher highs since April 10, and the recent uptick also set a new all-time high at $19.62. The last three swings are interesting since a trend line can be drawn connecting these points to show a steady uptrend. However, the Relative Strength Index (RSI) has produced three consecutive lower lows, indicating a bearish divergence.

This technical formation suggests that the momentum is waning while ApeCoin price rises. Often, this setup leads to a minor retracement in the market value of APE.

For ApeCoin price, the correction will likely slow down around the previous all-time high at $17.46. However, clearing this barrier will allow APE to tag the $15.61 level, which was the upper limit of the trading range.

In total, this pullback would constitute a 15% move and is likely where sidelined investors can enter the market. The resulting upswing should make a run at the 100% retracement level at $22.04, where ApeCoin price could form a new all-time high.

If this scenario plays out, the buyers at $15.61 would stand to make 40% once ApeCoin price reaches $22.04.

APE/USDT 4-hour chart

While technicals are forecasting a minor downtrend, the 24-hour active addresses suggest a different outlook following an uptick from 4,132 to 5,639 over the last 24 hours. This 36% upswing indicates that investors are actively looking to get in on the ApeCoin price action at the current levels.

Interestingly, this index opposes the bearish divergence seen against the RSI. Therefore, investors looking to short the incoming retracement need to be careful as there could be a short squeeze.

APE 24-hour active addresses

On the other hand, if ApeCoin price produces a four-hour candlestick close below $15.61, it will invalidate the bullish thesis and open up the possibility of further descent to $12.56.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.

%20%5B09.14.46%2C%2026%20Apr%2C%202022%5D-637865464020773230.png&w=1536&q=95)