MATIC Price Prediction: Polygon steadies for a 70% rally

- MATIC price tests 50-day simple moving average (SMA) as pullback proceeds in an orderly tone.

- Volume levels during the pullback do not reveal a mass exodus from the digital asset.

- OKEx, a leading crypto exchange and derivatives trading platform, partners with Polygon.

MATIC price is resisting the notable Bitcoin price strength today. Instead, Polygon is flat at the time of writing, showing a lack of faith in the rally of the bellwether cryptocurrency. As long as support at the 50-day SMA remains active, MATIC price should be positioned to resume the advance from the May 23 low.

OKEx leverages Polygon scaling solution to deliver a better client experience

OKEx, the world-leading cryptocurrency spot and derivatives exchange, announced the integration of Polygon to allow more Ethereum-compatible applications to be built and connected. The outcome of the integration will be a quicker and more cost-efficient user experience when transferring funds from exchanges to the Polygon PoS network.

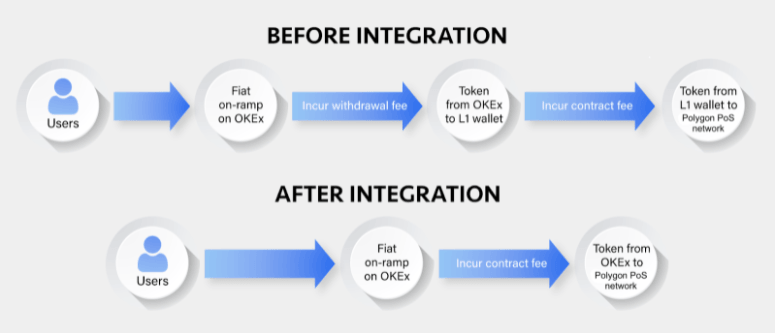

In the old process, users needed to withdraw funds from OKEx to a Layer-1 wallet, then connect the wallet to the Polygon PoS network, while being charged an exchange withdrawal fee and wallet contract fee. With the new integration, OKEx users can now transfer funds directly to the Polygon PoS network, with the withdrawal fee waived by OKEx.

OKEx - Polygon Integration Flow Chart

Users will be able to withdraw up to 23 digital assets with the integration, and in total, they will save nearly 25% in transaction fees with faster transactions.

OKEx CEO Jay Hao views the integration as another example of the exchange being a “trading partner that strives to make the crypto journey as easy and as cost-efficient as possible.”

Polygon highlighted the fact that the integration “will make it easier and more seamless for new users getting into the Polygon and Ethereum ecosystem.”

The demand for Layer-2 solutions on Ethereum has skyrocketed this year due to punishing network congestion and unbearable gas costs. As a result, transaction settlement times spiked, making microtransactions almost impossible on the Ethereum ecosystem. In response, Polygon has engineered a scaling solution that solves those issues, making it a perfect partner for OKEx.

MATIC price lounges, waiting for a new catalyst to revive the opportunity

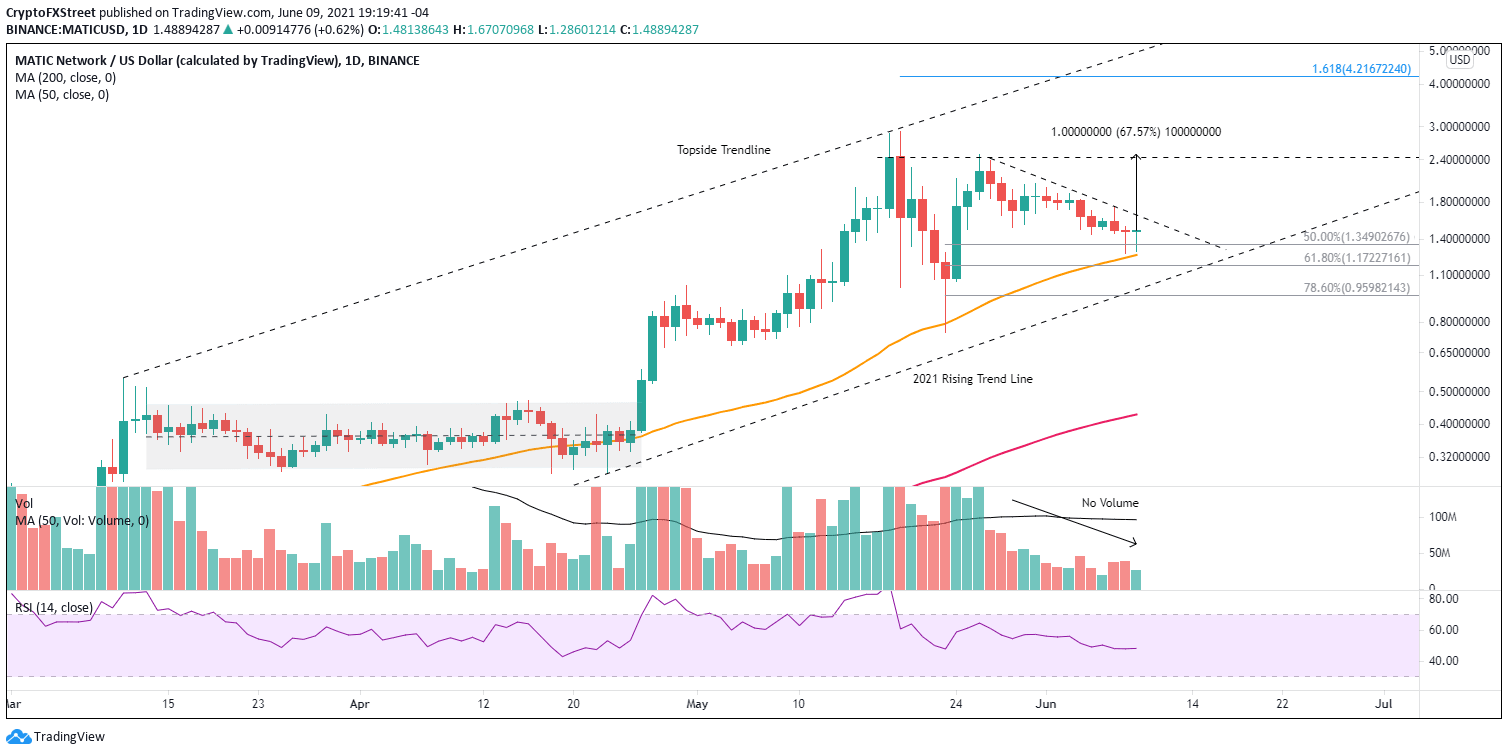

MATIC price strength was a positive highlight during the May correction, despite the initial plunge of 75%. Polygon recorded an impressive rebound of 230% from the May 23 correction low. For a time, the digital asset was proceeding with a cup-with-handle base, but the opportunity vanished when the general negative sway in the cryptocurrency market took control.

Since May 27, MATIC price has trended lower on meager volume, coming near the 50-day average, including yesterday’s intra-day sweep lower. Polygon now trades above the 50-day SMA, potentially forming the second consecutive doji on the daily chart. The dojis can represent indecision on the side of both buyers and sellers, suggesting that everyone is equally matched. Others interpret the dojis as an indicator of a reversal in the trend.

In isolation, dojis are market neutral, but on a consecutive basis and along a tactically important level like the 50-day SMA, investors should entertain the potential for a trend change. To confirm a change in trend, MATIC price needs to close above the May 7 high at $1.74. Once accomplished, Polygon is unrestricted to revisit the May 26 high at $2.48 that corresponds closely to the highest daily close on May 18 at $2.44.

More advanced targets include the all-time high of $2.89, the 161.8% Fibonacci extension of the May correction at $4.21 and finally, the topside trendline extending from March 11 at $4.94, achieving a 230% return from the current price.

A higher probability scenario is a test of the May 26 high at $2.48 before another pullback or pause, earning Polygon investors a 70% return for their commitment.

MATIC/USD daily chart

Polygon is gifted by a surplus of support levels just below the current price, including the 50% retracement of the rebound from the May 23 low, the 50-day SMA, the 61.8% retracement, the rising trend line and the 78.6% retracement.

If MATIC price prints a daily close below the 50-day SMA at $1.26, the improving outlook will be shelved in favor of more caution. However, as long as the 2021 rising trend line around $1.03 is not disbanded, it is unnecessary to entertain more expansive losses for the Indian blockchain scalability platform.

Polygon is receiving an increase in attention for its answer to some of the challenges confronted by the Ethereum blockchain, such as heavy fees, poor user experience and low transactions per minute. It is involved with the timeliest areas of cryptocurrencies, including DeFi, DApps, DAO’s and NFT’s.

The recognition is deserving, but after the historic climb in 2021, investors would be well-served to question if the potential has been fully priced into the digital asset. For now, stick to the levels for positioning decisions and stay abreast of the entire Polygon story as it unfolds.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.