MATIC Price Prediction: Polygon bears target $0.95

- MATIC price bounced 17.5% on Wednesday but failed to close above resistance levels that would confirm a likely bullish reversal.

- Bears look poised to maintain control and resume selling pressure.

- Final support levels for MATIC ahead – their failure could trigger a flash crash below even $0.95

MATIC price action gave bulls a slight reprieve on Wednesday with an impressive double-digit percentage gain for the day. However, the daily close was below the Tenkan-Sen and acted as a warning that the rally on Wednesday was more likely a dead-cat bounce. In other words, the bearish trend is likely to continue.

MATIC price must hold $1.15 or face sub-$1 prices

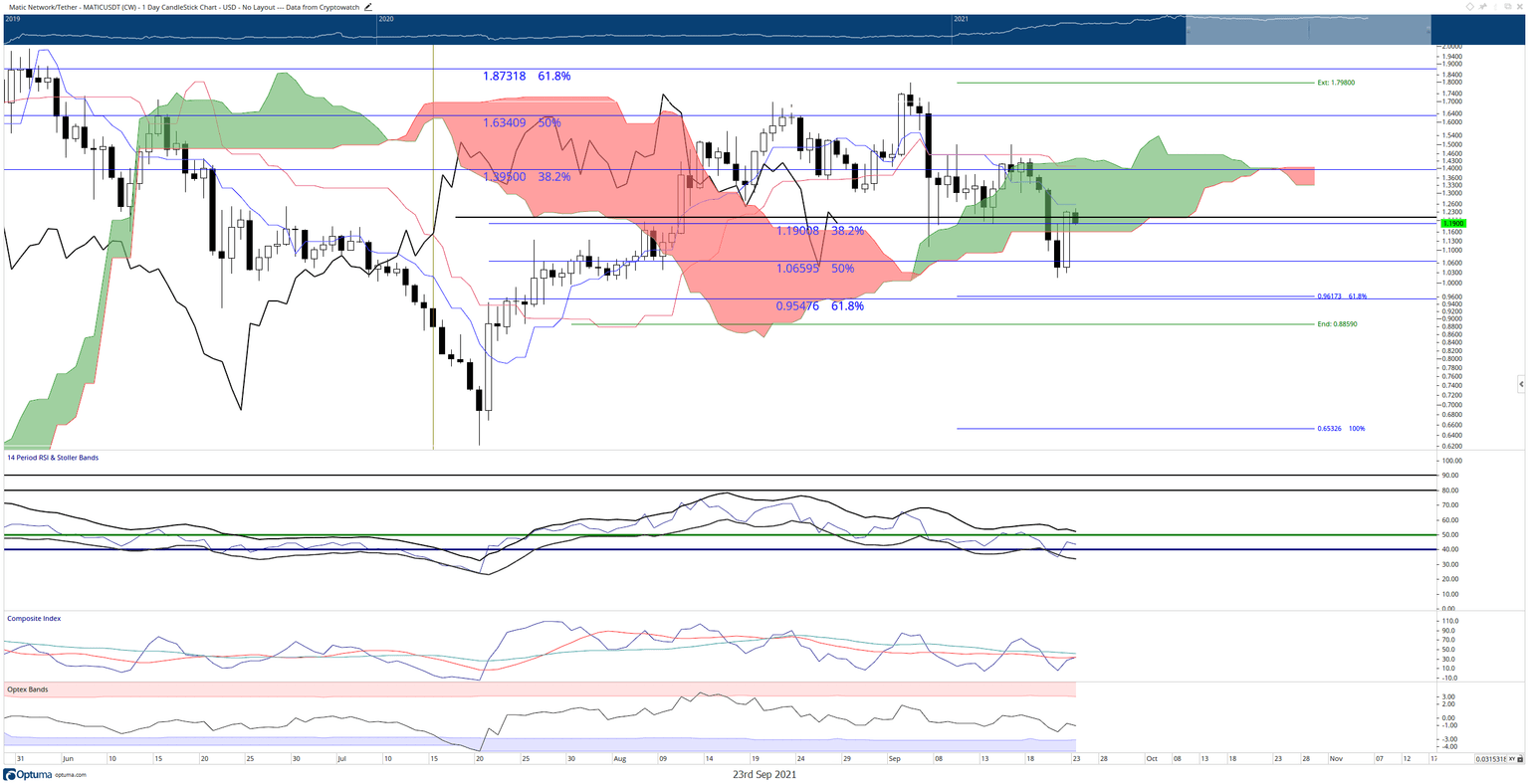

MATIC price faces near-term resistance against two intense resistance levels that share the $1.25 value area: the daily Tenkan-Sen and a high volume node in the volume profile. Bulls have one final support zone to prevent a push below the $1 level. The bottom of the Cloud (Senkou Span B) and the second-highest high volume node for 2021 exists at the $1.165 value area that must hold as support to prevent a significant fall.

The near-term target for bears is the 61.8% Fibonacci retracement and 61.8% Fibonacci extension at $0.95, but it may not hold as support. Instead, MATIC price could fall swiftly down to a high volume node, and the 100% Fibonacci expansion shares the $0.65 value area. The volume profile is thin between $0.95 and $0.65. Additionally, a MATIC price close at $0.95 would put the Chikou Span below the Cloud and create overwhelmingly bearish conditions within the Ichimoku Kinko Hyo system.

MATIC/USDT Daily Ichimoku Chart

If bulls wish to wrest control from the bears, they will need to close MATIC price above $1.2765 in the short-term and ultimately above $1.54 in the near term. If bulls were to close MATIC price anywhere above the Cloud ($1.465 or greater), then the threat of any near-term bearish momentum would likely be invalidated.

Like this article? Help us with some feedback by answering this survey:

Author

Jonathan Morgan

Independent Analyst

Jonathan has been working as an Independent future, forex, and cryptocurrency trader and analyst for 8 years. He also has been writing for the past 5 years.