MATIC price hints at 11% move after Polygon bulls seize control

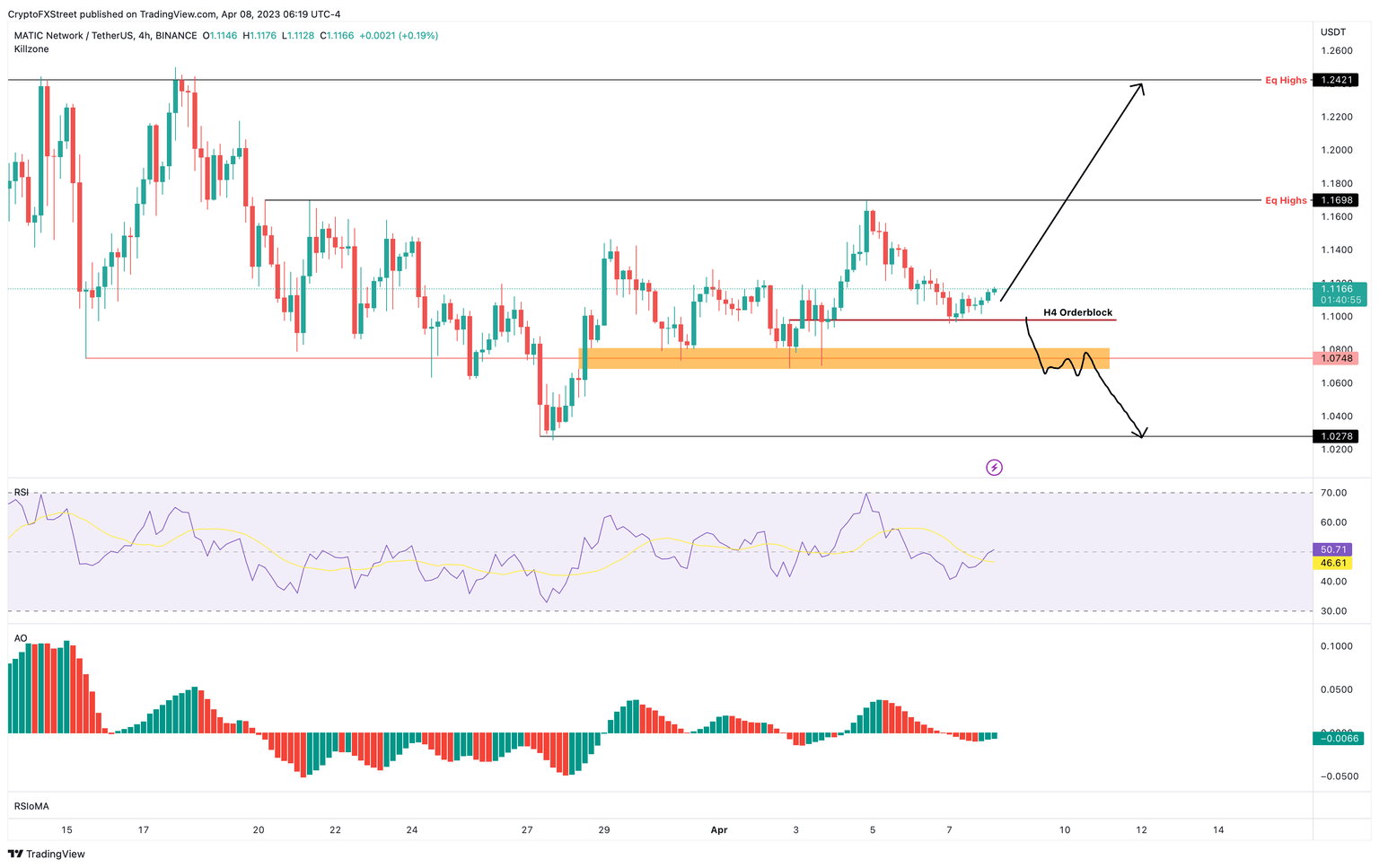

- MATIC price prepares for an uptrend as it bounces off the four-hour orderblock at $1.09.

- Investors can expect a swift 11% move which will collect the buy-stops resting above $1.16 and $1.24 equal highs.

- A daily candlestick close below $1.07 will invalidate the bullish thesis for Polygon.

MATIC price shows signs of reversal as it bounces off a critical demand area. This level has caused sidelined buyers to step up, resulting in a minor uptick. If this trend continues into next week, investors can expect Polygon to move north.

Read More: What Polygon's zkEVM mainnet launch means for MATIC holders

MATIC price shows signs of an uptrend

MATIC price retraced 6% after setting up a local top at $1.15 on April 4 and tagged the four-hour orderblock’s upper limit at $1.09. This move absorbed the selling pressure and induced a spike in buying pressure that has resulted in a nearly 2.0% move that could be the start of a reversal.

The Relative Strength Index (RSI) for MATIC price is attempting to flip above the midpoint and the Awesome Oscillator (AO) is approaching the zero line, indicating a slow uptick in bullish momentum. Depending on how the week starts, MATIC price could notice a continuation of this move.

The first target is the buy stops resting above the $1.16 level. A successful liquidity hunt here without a noticeable reduction in the bullish momentum could see Polygon bulls attempt to sweep the $1.24 level for buy stops.

In total, this MATIC price move would constitute an 11.0% gain for traders.

MATIC/USDT 4-hour chart

Regardless of the surge in bullish momentum after a bounce off the orderblock, things could get dicey for MATIC price if the larger crypto market has a bearish tone. A daily candlestick close below the $1.07 level will invalidate the bullish thesis for Polygon and potentially trigger a 4.3% downswing to $1.02.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.