MATIC price gives bulls another opportunity to undo recent losses

- MATIC price undoes its gains from last week and finds a footing around 100-day SMA at $1.99.

- Investors can expect a 17% uptrend that retests the 12-hour breaker, ranging from $2.43 to $2.63.

- If Polygon produces a 12-hour candlestick close below the $1.94 support level, it will invalidate the bullish thesis.

MATIC price has seen an increase in selling pressure that has undone most of its gains from the last week. The retracement has knocked Polygon down to a stable barrier that is likely to sustain the incoming bearish momentum, allowing bulls to make a comeback.

MATIC price takes another jab

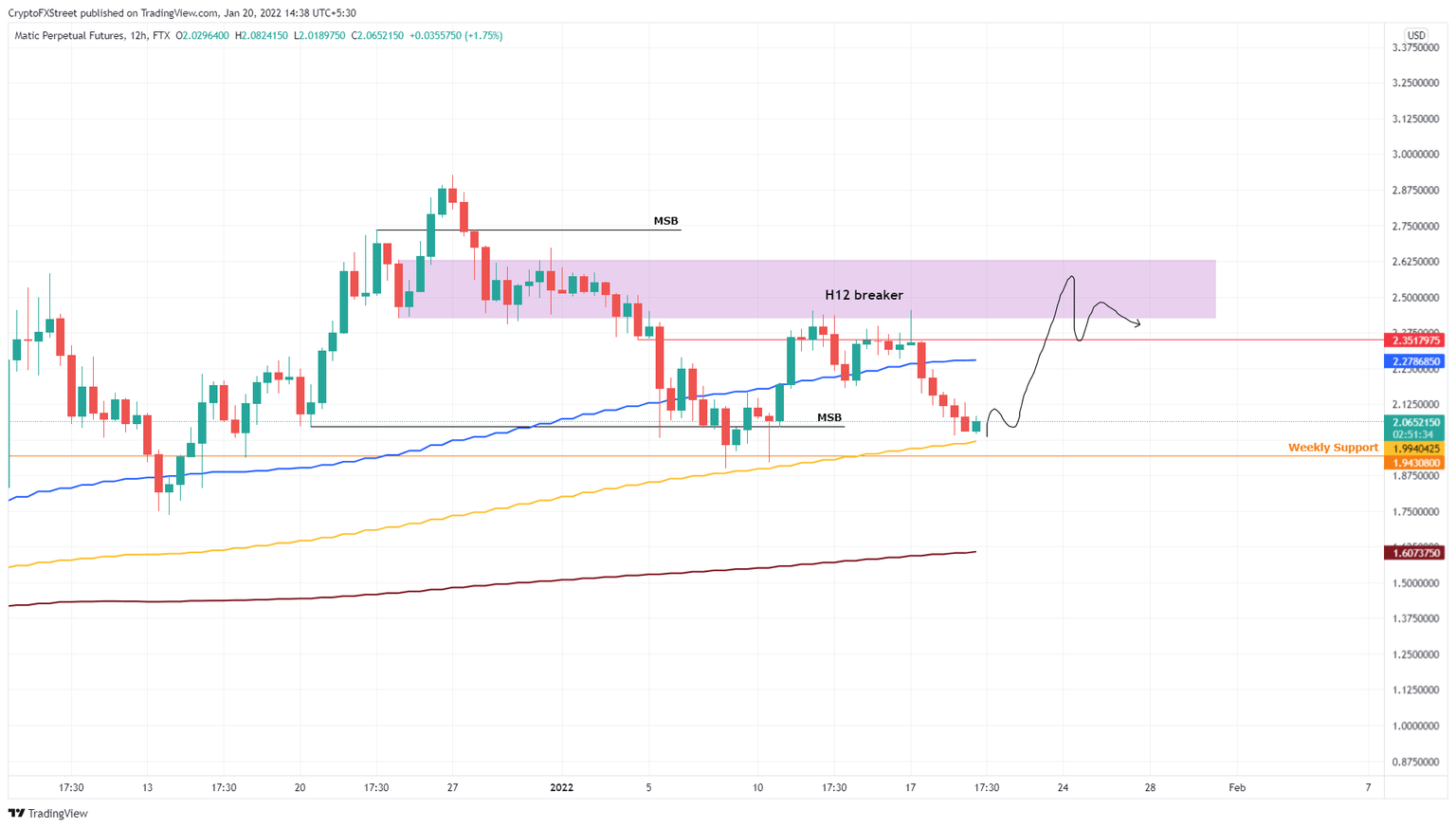

MATIC price bounced off the 100-day Simple Moving Average (SMA) twice on January 8 and 10, leading to a 27% upswing. This rally faced a massive blockade from a recently flipped supply zone, ranging from $2.43 to $2.63.

A rejection at the level mentioned above sent Polygon tumbling, causing it to hover around the 100-day SMA at $1.99, roughly coinciding with the weekly support level. A bounce off this support confluence could be the key to kick-starting an uptrend for MATIC price. It makes a good place, therefore, for market participants to open long positions.

Investors can expect Polygon bulls to generate a 15% ascent to retest the immediate hurdle at $2.35. If buyers manage to slice through the hurdle, there is a good chance MATIC price could retest the 12-hour supply at $2.43. This run-up would be where the Polygon upside will probably be capped; investors can book profits around $2.43, bringing the total gain to 17%.

MATIC/USDT 12-hour chart

While things are looking optimistic for MATIC price, a breakdown of the weekly support level at $1.94 will create a scenario favoring bears. If sellers produce a 12-hour candlestick close below this barrier, it will create a lower low, invalidating the bullish thesis.

This development could push MATIC price down to the 200-day SMA at $1.61.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.