MATIC price could crash another 22% if this signal pops

- MATIC price has fallen off the cliff and crashed 17% this week, suggesting more could be on its way.

- A lower low below the May 9 swing low at $0.477 could see Polygon nosedive another 22%.

- A bullish engulfing candlestick validation above $0.686, although unlikely, will prevent the bearish thesis.

MATIC price has signaled a successful breach of its consolidation phase after the recent weekly candlestick close. A further crash could be in the works if bears push Polygon to produce a lower low.

MATIC price on edge

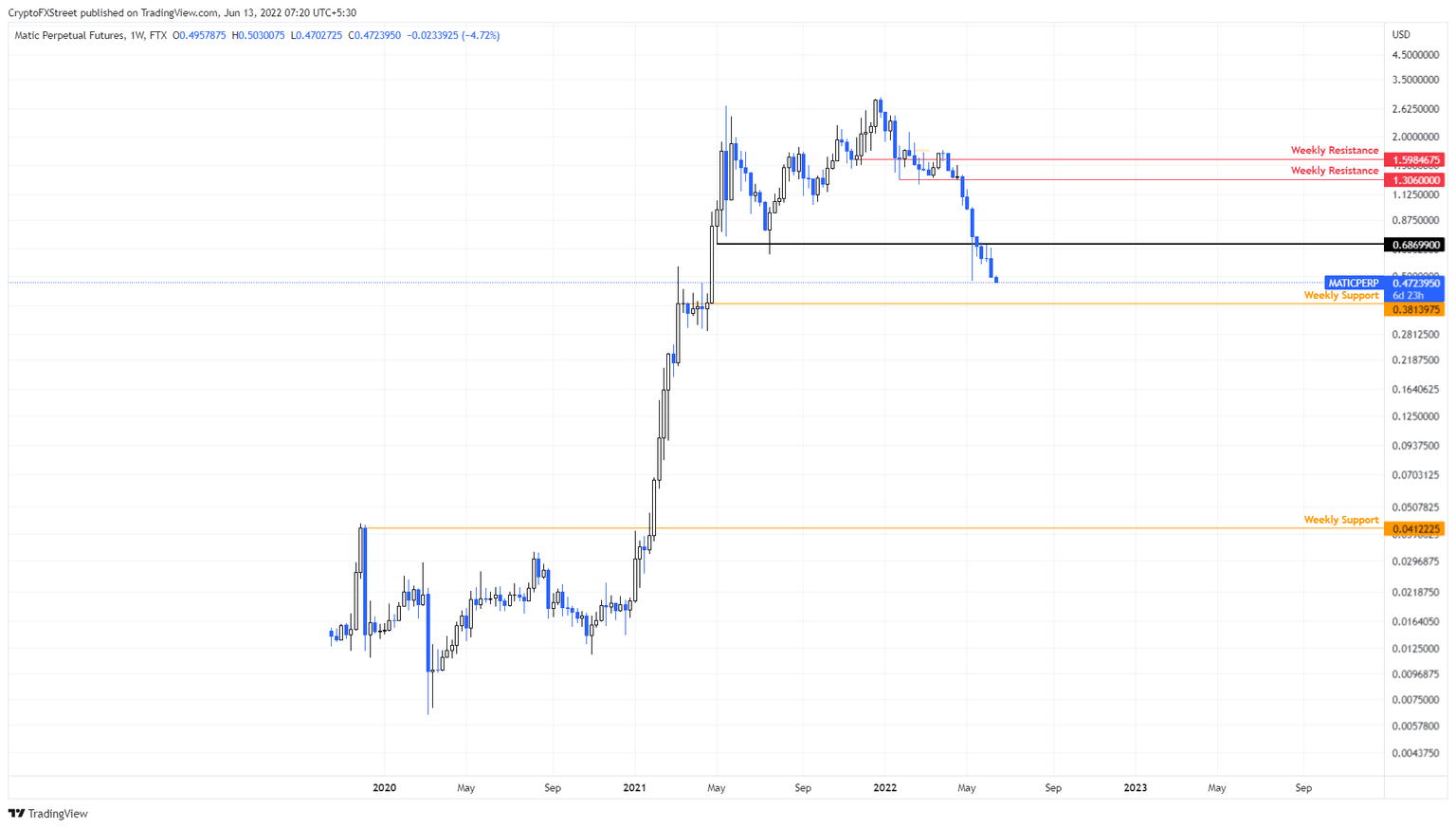

MATIC price set an all-time high at $2.69 in May 2021 and then set a new one at $2.92 in December 2021. Since then, the altcoin has been stuck in a range, extending from its all-time high and the $0.686 base.

However, in the third week of May, MATIC price breached the aforementioned barrier. Since then, two weekly candlesticks have elapsed which confirms a successful flip of the $0.686 support level into a resistance barrier.

Going forward, if MATIC price produces a lower low below the swing low at $0.477, it will create a new lower low and add to the bearish propaganda. In such a case, Polygon could crash another 22% to the weekly support level at $0.381. While there is a chance for a steeper correction, buyers are likely to step in here and cauterize the bleeding.

MATIC/USDT 1-week chart

On the other hand, if MATIC price produces a weekly bullish engulfing candlestick that closes above the $0.686 hurdle, the bearish thesis will face invalidation. This development will signal a resurgence of Polygon bulls.

In such a case, MATIC price needs to retest the same level to confirm a successful flip.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.