MATIC price confirms breakout, upswing to $4 likely

- MATIC price saw an impressive upswing that breached the $1.73 resistance barrier, triggering a bull rally.

- Theoretical projections have Polygon ready to rally 150% and hit a target of $4.33.

- A breakdown of the $1.47 support level will jeopardize the bullish thesis.

MATIC price is consolidating after a riveting upswing since October 12. The ascent is cooling off, hinting at a retest of a crucial support level. This could be the last time this Layer-2 token will retrace to the current levels as it is about to embark on a massive bull run.

MATIC price to enter tremendously optimistic phase

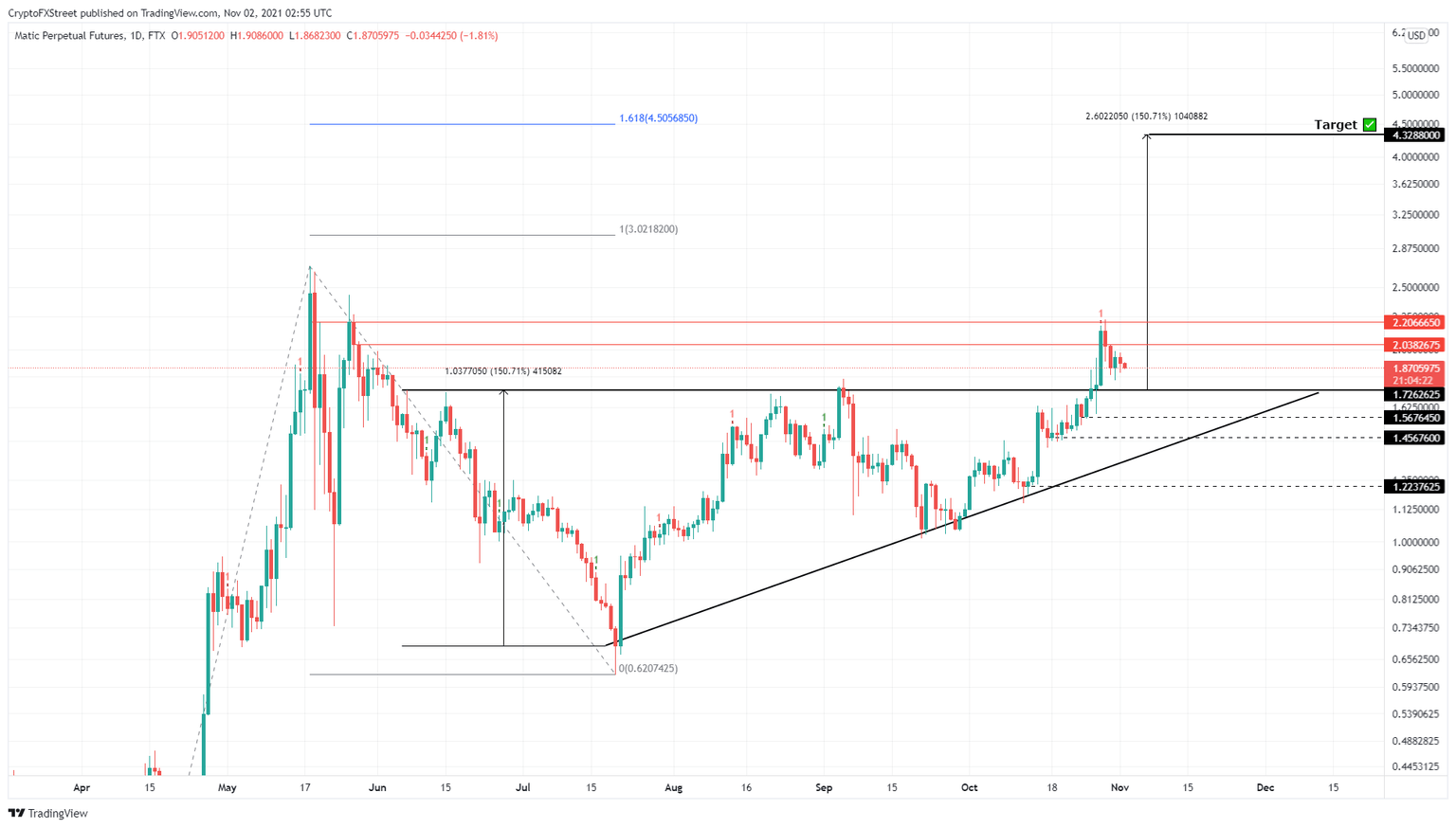

MATIC price set up roughly four equal highs around $1.73 and four higher lows since June 7. When these swing points are connected using trend lines, it reveals the formation of a five-month-long ascending triangle pattern.

This technical formation forecasts a 150% upswing determined by adding the distance between the first swing high and swing low to the breakout point at $1.73. The resulting target puts MATIC price at $4.33.

On October 26, MATIC price saw a massive burst in buying pressure leading to a 21% ascent that breached the ascending triangle’s base at $1.73. Since then, Polygon has retraced 16% to where it currently stands. This move will further strengthen the bullish thesis, and the resulting upswing is likely to produce a decisive daily close above $2.21, which will further confirm the start of a rally to $4.33.

MATIC/USDT 1-day chart

On the other hand, if MATIC price fails to hold up above $1.73, it will signal a weakness among the buyers and suggest that Polygon is likely to reenter the ascending triangle pattern. However, a breakdown of the $1.46 support floor will create a lower low and invalidate the bullish thesis. In this case, Polygon could retest the $1.22 support level.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.