Long-term holders remain confident about Bitcoin price rally as institutional investors buy $590 million worth of BTC

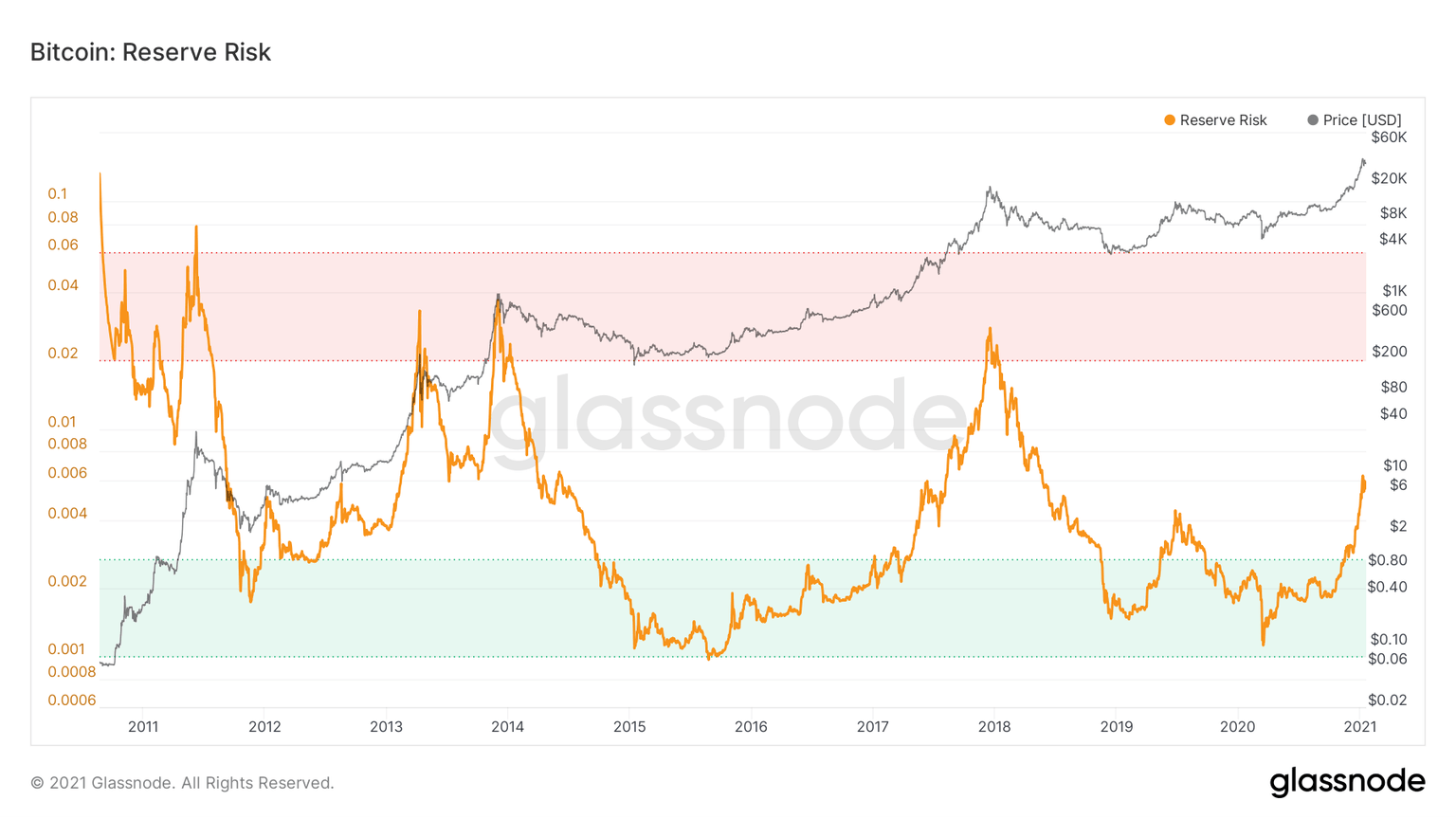

- The Reserve Risk indicator suggests that long term investors are confident that Bitcoin will rally again.

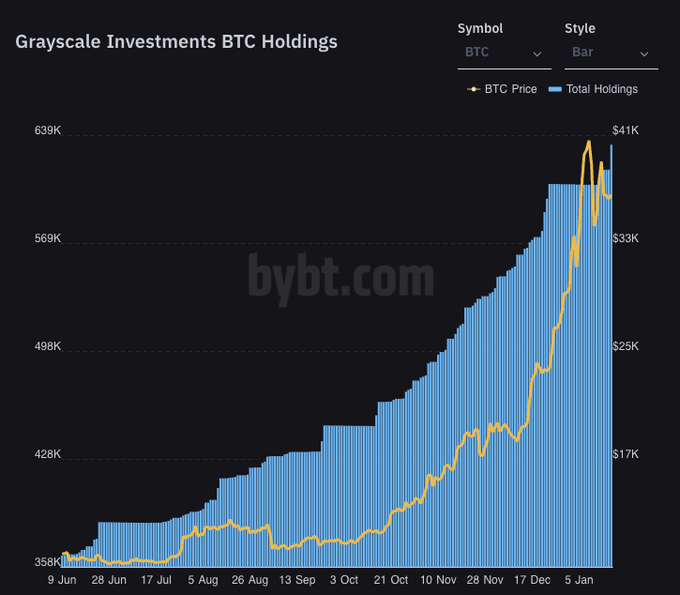

- Grayscale continues with the buying spree, filling its bags with 16,244 more BTC.

- Bitcoin’s NPL indicator by Santiment is flattening out, offering opportunities for new entries.

Bitcoin has delayed the expected breakout to $40,000, leading to uncertainty and even talks of a possible retreat under $30,000. However, the Reserve Risk indicator from Glassnode suggests that long-term investors are staying put. Meanwhile, the pioneer cryptocurrency is dancing above $36,500 amid the push for another leg up.

Bitcoin price is likely to resume the rally as investor confidence soars

The Reserve Risk indicator is arrived at by diving price by the HODL bank. In other words, the indicator helps to gauge the confidence of long-term holders in relation to the prevailing price of Bitcoin.

According to Glassnode, “when confidence is high, and the price is low, there is an attractive risk/reward to invest (Reserve Risk is low).” On the other hand, when the investors’ confidence is low, and the price is high, it means that the “risk/reward is unattractive.”

The chart below shows that Reserve Risk is relatively low. Therefore long-term investors in BTC are still confident that the price is a long way to the local high. The chart can also be interpreted to show that BTC trading at $36,000 is still affordable, and another rally is possible soon.

Bitcoin Reserve Risk chart

Grayscale continues to fill its bags, purchases 16,244 BTC

The largest Bitcoin Trust run by Grayscale Investments is reported to have purchased a whopping $590 million worth of Bitcoin. This amount equals 18x of the total daily BTC mined. At the moment, the digital asset manager boasts of approximately $22.9 billion worth of BTC.

Long-term holders of Bitcoin continue to confirm the confidence they have in the largest digital asset. The bullish outlook seems to have been validated by Grayscale’s additional purchase. Analysts in the market have recently said that HODLers hold BTC’s key to $40,000, particularly Grayscale.

Grayscale Investments BTC holdings

Simultaneously, Bitcoin’s Network Realized Profit/Loss by Santiment appears to be flattening out and creating viable entry opportunities for investors. It is worth mentioning that the NPL is used to calculate the general daily return on investment (ROI) for all transactions on the network.

The ROI is arrived at by taking the price at which the coins last moved in relation to the price the coin changes addresses again. Therefore, a significant spike in the NPL shows that holders are selling their coins at a profit. Simultaneously, a dip suggests that investors are incurring losses, and the likelihood of panic selling coming into the picture. The flattening out of the NPL hints at increasing confidence and growing bullish speculation.

Bitcoin NPL chart

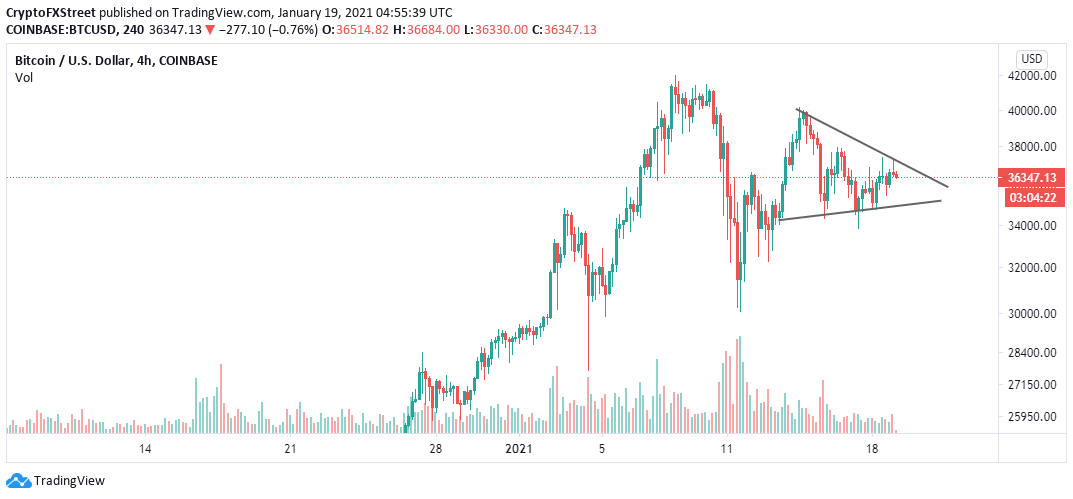

On the 4-hour chart, Bitcoin appears to be forming a pennant pattern with an upward target at $50,000. This pattern is mostly regarded as a continuation pattern, representing a period of consolidation after an uptrend. In this case, the asset in question is likely to make another significant leg up.

BTC/USD 4-hour chart

It is also essential to keep in mind that the longer Bitcoin takes to rise above $40,000, the stronger the bearish front becomes. Besides, buyers are likely to get exhausted as their efforts continually go unrewarded. The pennant pattern can also result in a breakdown that could see Bitcoin retest price levels under $30,000 and toward $20,000.

Author

John Isige

FXStreet

John Isige is a seasoned cryptocurrency journalist and markets analyst committed to delivering high-quality, actionable insights tailored to traders, investors, and crypto enthusiasts. He enjoys deep dives into emerging Web3 tren