Long Solana, Short Litecoin trade attractive if altcoin ETFs are approved: K33

- A long Solana, short Litecoin trading strategy could be attractive if altcoin ETFs gain SEC approval.

- Grayscale's SOL trust represents 0.1% of Solana's circulating supply and has never traded below its net asset value.

- The firm's LTC trust comprises 2.65% of Litecoin's circulating supply and has often traded at steep discounts to its underlying assets.

Solana (SOL) has lower chances of being affected by the potential supply pressure from Grayscale's influence compared to Litecoin (LTC) if the Securities and Exchange Commission (SEC) approves altcoin exchange-traded funds (ETFs).

Solana and Litecoin ETFs fuel deliberation ahead of SEC decision

Solana and Litecoin could see diverging investor sentiment if the SEC approves altcoin ETFs, noted Vetle Lunde, Head of Research at K33, in a Tuesday report.

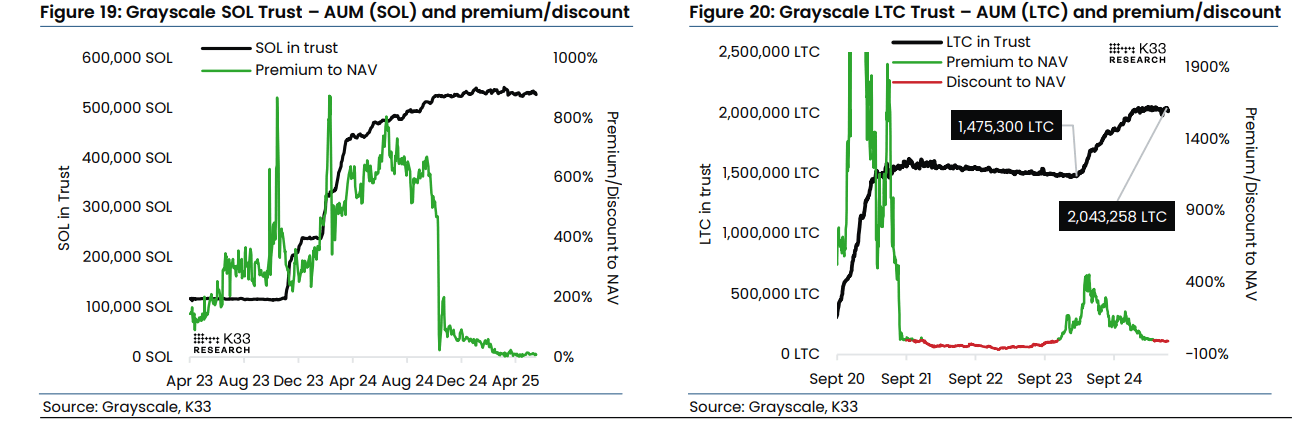

Lunde noted that a "long SOL, short LTC" trade may be attractive if altcoin ETFs are launched, citing the differences in the trading histories of Grayscale's Solana and Litecoin trusts.

The firm's Solana trust, which began trading in 2023, represents only 0.1% of the circulating SOL supply and has never traded below its net asset value (NAV). K33 noted that this removes the risk of excess supply hitting the market if Grayscale's SOL trust is converted into an ETF.

On the other hand, the Grayscale Litecoin trust, which went public earlier than its Solana counterpart, traded at steep discounts during the 2022 bear market and for most of 2025.

Lunde highlighted that Grayscale holds a large portion of LTC's circulating supply — 2.65%. Given its history of occasionally trading at discounts, the firm's Litecoin trust could experience significant outflows upon conversion to an ETF.

"We see a long SOL, short LTC trade as attractive after ETF launches, assuming they occur around the same time. Given LTC's history of sharp reactions to positive news, we'll likely wait a few days post-launch before acting."

Grayscale SOL & LTC Trusts. Source: K33 Research

Intense outflows from Grayscale Bitcoin and Ethereum trusts also pressured BTC and ETH ETFs during their respective launches last year. However, inflows into several other products were able to offset outflows from Grayscale to a large extent.

Unlike Bitcoin and Ethereum ETFs, Grayscale is one of the only three issuers, alongside Canary Capital and CoinShares, that have filed for an LTC ETF, "meaning fewer issuers are present to offset the potential outflows," the report states.

The prediction from K33 comes as the US Securities and Exchange Commission (SEC) approved generic listing standards for crypto ETFs. The regulator is also expected to make a decision on Litecoin and Solana ETF filings in early October, before deciding on other funds later in the month.

Solana and Litecoin trade around $210 and $107, down 2% and up 0.1%, respectively, over the past 24 hours.

Author

Michael Ebiekutan

FXStreet

With a deep passion for web3 technology, he's collaborated with industry-leading brands like Mara, ITAK, and FXStreet in delivering groundbreaking reports on web3's transformative potential across diverse sectors. In addi