Litecoin price to provide buy opportunity before LTC shoots for $320

- Litecoin price looks ready to make a massive move as it flips the $232.94 resistance barrier to support.

- This move is likely to be accompanied by an explosive 40% ascent to $322.31.

- A daily close below $189.75 will invalidate the bullish thesis for LTC.

Litecoin price has been on a slow uptrend since September 29 but exploded on November 8. This volatile move has breached a crucial barrier and turned it to the bulls’ advantage, suggesting that an upswing is likely.

Litecoin price prepares for higher highs

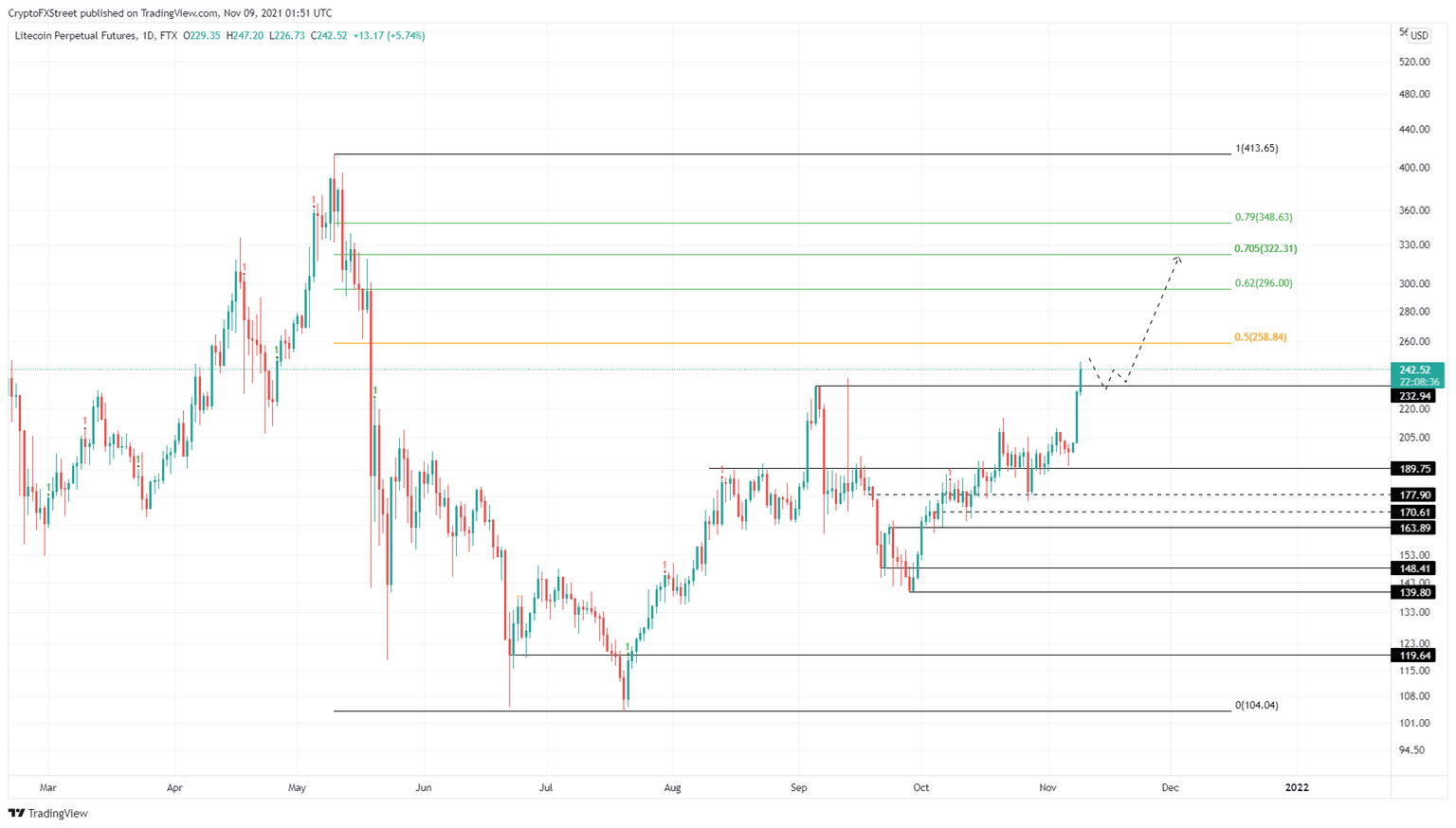

Litecoin price rose 77% since September 29 and has sliced through the $232.94 resistance barrier. While it has over this hurdle, it needs to bounce off to confirm a conversion into a support level. Therefore, a retest of $232.94 will be the buying opportunity for investors who missed the first spike in price.

The bounce from this barrier will likely push Litecoin price to shatter the 50% Fibonacci extension level at $258.84, serving as a secondary confirmation of the bull rally. LTC will continue this ascent if the bullish momentum continues to pour in, allowing it to retest the 70.5% Fibonacci retracement level at $322.31.

While a further ascent of LTC market value is possible, Litecoin price needs to produce a daily close above $348.63. Assuming it does, the buyers will likely push the altcoin to retest the range high at $413.65. This move, however, would constitute a 77% gain from $232.94.

LTC/USDT 1-day chart

Regardless of the bullish outlook, Litecoin price needs to produce a daily close above $258.84 and hold the $232.94 support level. Failing to do so will likely result in a downtrend to $189.75. While LTC might bounce off this barrier to restart an uptrend, a daily close below it would produce a lower low, invalidating the bullish thesis.

In such a case, Litecoin price would revisit the proximity support floors at $117.90 or $170.61.

Author

Akash Girimath

FXStreet

Akash Girimath is a Mechanical Engineer interested in the chaos of the financial markets. Trying to make sense of this convoluted yet fascinating space, he switched his engineering job to become a crypto reporter and analyst.