Litecoin price seeks new all-time high, but LTC shows bearish divergence

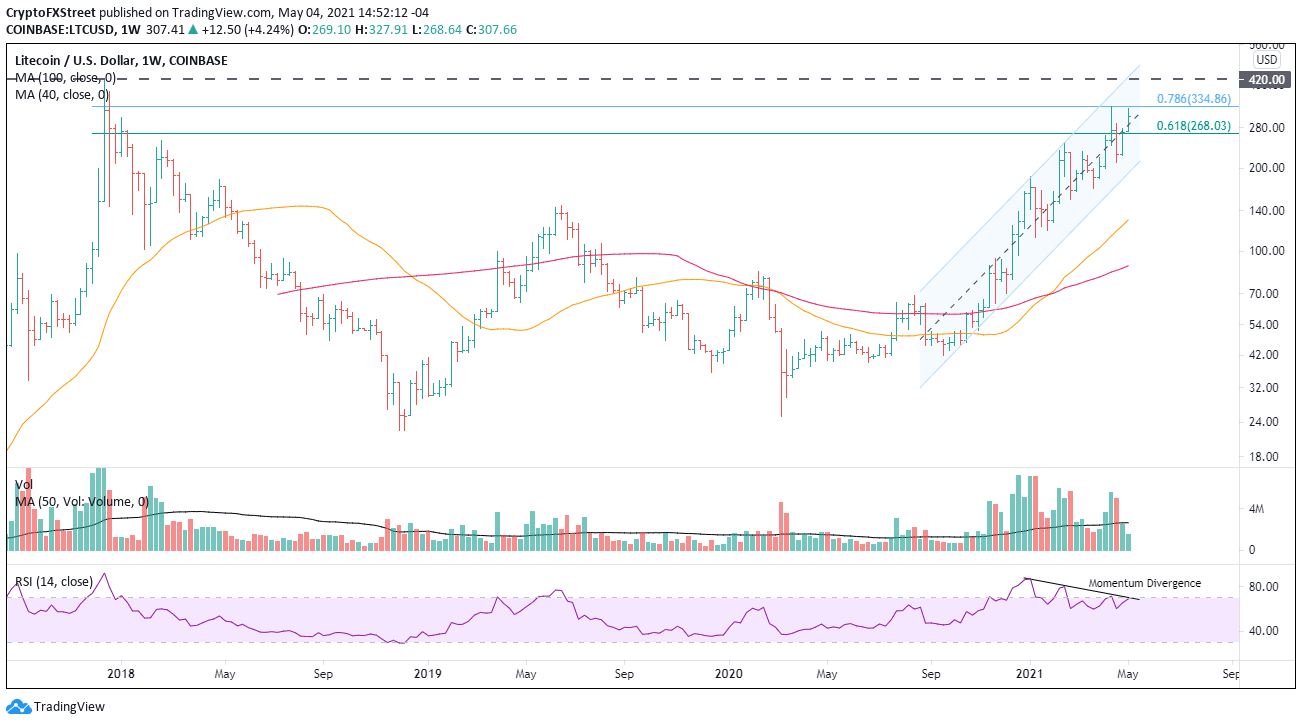

- Litecoin price stalls again at the 78.6% Fibonacci retracement of the 2017-2018 bear market.

- Ascending Channel governing Litecoin price action since the fall of 2020.

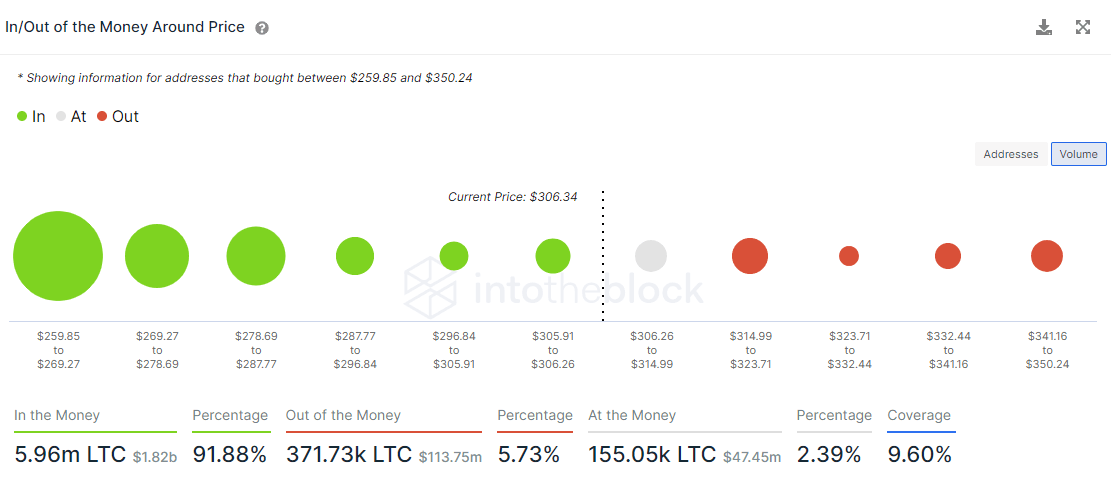

- IOMAP data displays minimal resistance until $350.00.

Litecoin price failure today at the critical Fibonacci level is the second time since mid-April and lowers the odds that LTC can overcome the resistance and launch a substantive test of the all-time high at $420.00.

Litecoin price in need of a dominant catalyst

The IntoTheBlock In/Out of the Money Around Price (IOMAP) data shows almost no resistance from the current Litecoin price until $350.24, which is slightly beyond the 78.6% retracement level mentioned above.

Likewise, Litecoin shows limited support until a cluster between $259.85 to $269.27. A total of 103.49k addresses bought 3.39 million LTC at an average price of $265.07, which is slightly below the 61.8% retracement of the 2017-2018 bear market at $268.03.

LTC IOMAP data

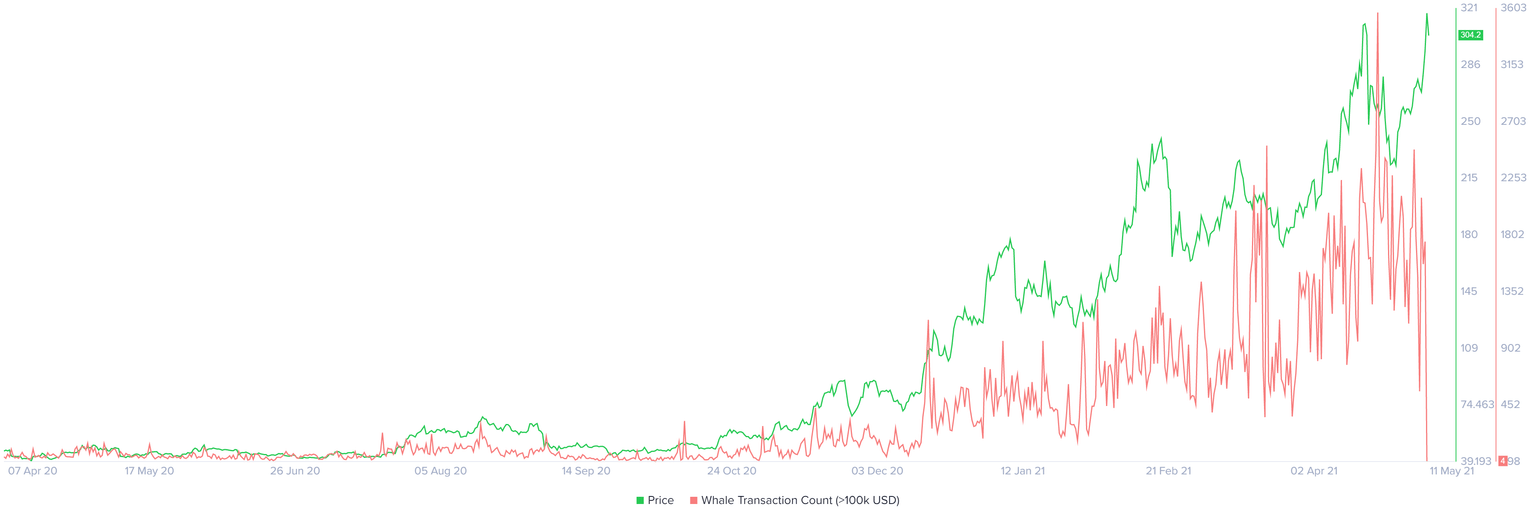

On the other hand, the whale transaction count has fallen from the peak of 2.501 to 4 as of yesterday. The reading is similar to what preceded the long rally that began in October 2020.

The minimum level of whales (transaction count > 100k USD) points to a new source of buying power moving forward if Litecoin price can get off the mat.

LTC Whale Transaction Count (>100K USD)

The on-chain metrics offer a positive outlook for Litecoin price, but the resilience of the 78.6% retracement at $334.86 is a significant obstacle to overcome before the all-time high at $420.00.

A failure to hold the 61.8% retracement at $268.03 will assure a test of the 10-week SMA at $ 231.47 and potentially project a decline to the channel’s lower trend line at $189.65.

Adding to the bearish outlook is the negative momentum divergence between the weekly RSI and price since the mid-February high. If a new rally high is printed, it needs to be confirmed by the momentum index.

LTC/USD weekly chart

Only a weekly close above 78.6% retracement level will encourage a re-evaluation of the bearish outlook and boost the probability of a successful breakout into new highs in the coming days or weeks.

Author

Sheldon McIntyre, CMT

Independent Analyst

Sheldon has 24 years of investment experience holding various positions in companies based in the United States and Chile. His core competencies include BRIC and G-10 equity markets, swing and position trading and technical analysis.