Litecoin Price Analysis: LTC vulnerable to massive sell-off if $100 gives way

- Litecoin retreated from the recent high amid healthy correction.

- The price may extend the decline if $100 is broken.

Litecoin (LTC) topped at $124.7 on December 19 ad started the correction. At the time of writing, the token is changing hands at $102, down about 20% from the recent high. The global see-off on the cryptocurrency market increased the bearish pressure on LTC; however, it looks pretty healthy relative to other major digital assets.

Currently, Litecoin sits in 6th place in the global cryptocurrency market rating with a current market capitalization of $6.8 billion. Notably, LTC's average daily trading volumes hit $12 billion, twice as much as its market value.

Litecoin's correction is not over yet

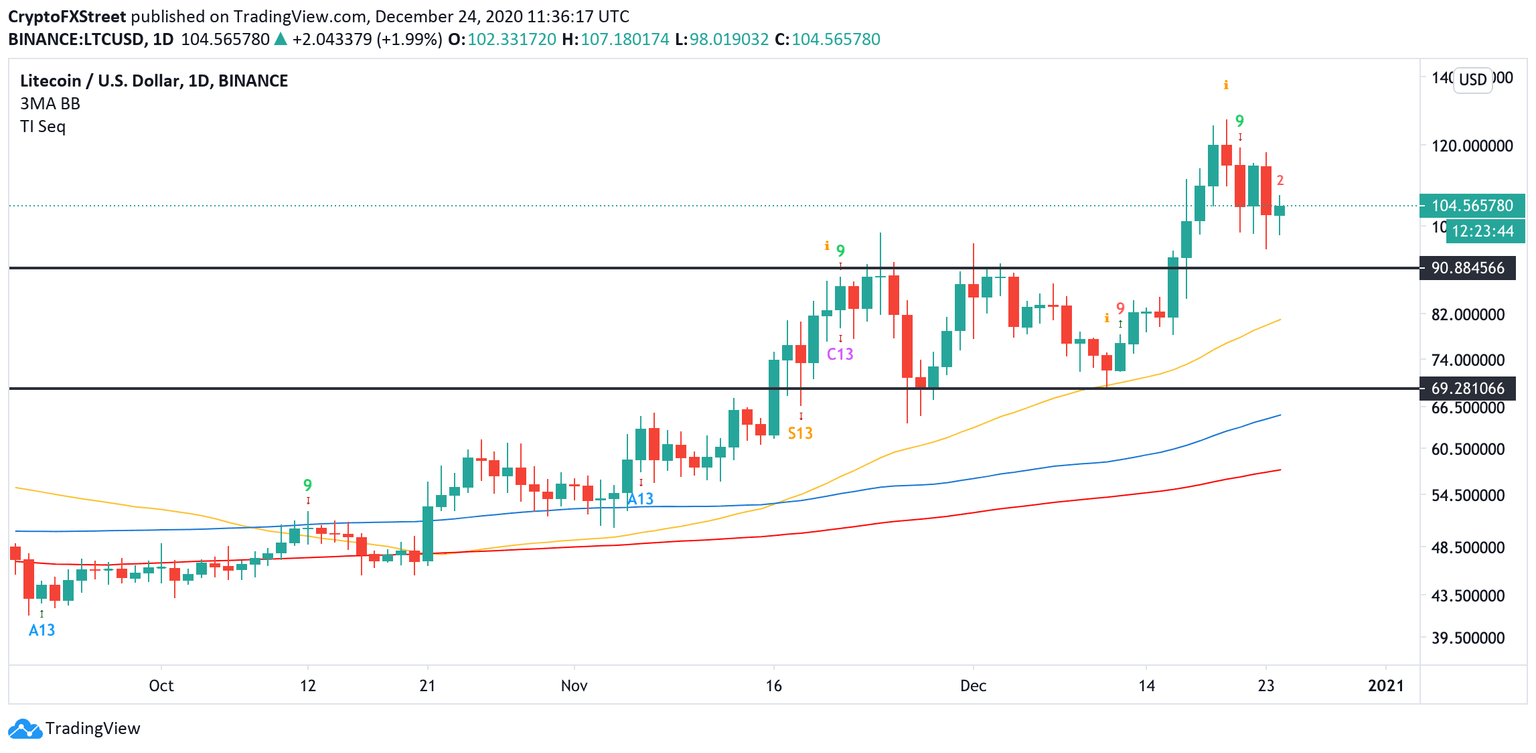

As FXStreet previously reported, LTC was ripe for the healthy correction after a strong bullish momentum that took the price from $70 to $124 in less than two weeks. A sell signal presented by TD Sequential indicator on December 21 was confirmed by the sell-off.

LTC, daily chart

However, the price seems to have found support on approach to $100. This psychological barrier may serve as a local bottom, but once it is cleared, the correction may be extended to $90. This former resistance may be verified as a support and serve as a jumping-off ground for a new bullish move. If $90 gives way, daily EMA50 at $80 will come into focus.

LTC, In/Out of the Money Around Price (IOMAP)

On the upside, LTC needs to clear a strong barrier located on the approach to $110. In/Out of the Money Around Price (IOMAP) data shows that over 53,000 addresses purchased 4.2 million LTC from $105 to $108. If this area is cleared, the buying pressure will increase. The price may quickly reach the next target of $117, followed by the recent high of $124.

Author

Tanya Abrosimova

Independent Analyst

%252024-637444070614430264.png&w=1536&q=95)