Litecoin Price Analysis: A bull pennant on hourly chart suggests further upside

- Litecoin extends Saturday’s rebound.

- $45.30 eyed amid a potential bull pennant formation.

- Golden cross pattern spotted on the hourly chart.

The sixth most widely traded cryptocurrency, Litecoin (LTC/USD), with a market capitalization of $2.85 billion, is one of the top performers amongst the top 10 favorite digital assets so far this Sunday. The coin has resumed the recent bullish momentum, reversing Friday’s temporary correction. At the press time, LTC/USD is consolidating the latest uptick to 44.31 highs, up nearly 2% to trade around 44.10.

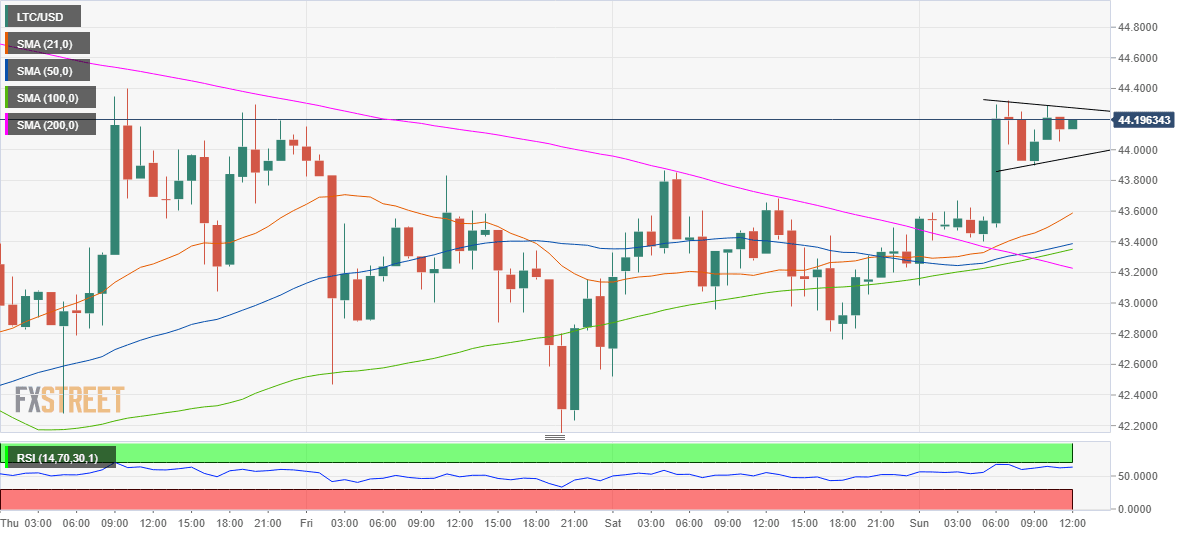

LTC/USD 1-hour chart

The price is trending higher but within a range inside a pennant formation, with the pole seen from 43.40 to 44.30.

A bullish breakout would imply a continuation of the recent upbeat momentum, with 45.30, the pattern target on the buyers’ radar.

The renewed upside in the spot gained traction after the 50-hourly Simple Moving Average (HMA) crossed the 200-HMA from below, charting a golden cross pattern.

Also, the hourly Relative Strength Index (RSI) is sitting comfortably above the midline, pointing towards more gains.

Should the bulls face rejection at the falling trendline resistance at 44.30, the coin could retrace towards the rising trendline support at 43.93.

A break below the latter would invalidate the formation, with the next support seen at the upward sloping 21-HMA of 43.53.

If the bears take out the 21-HMA support, the 43.00 round figure would come into play.

LTC/USD additional technical levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.