Litecoin maintains a recovery path

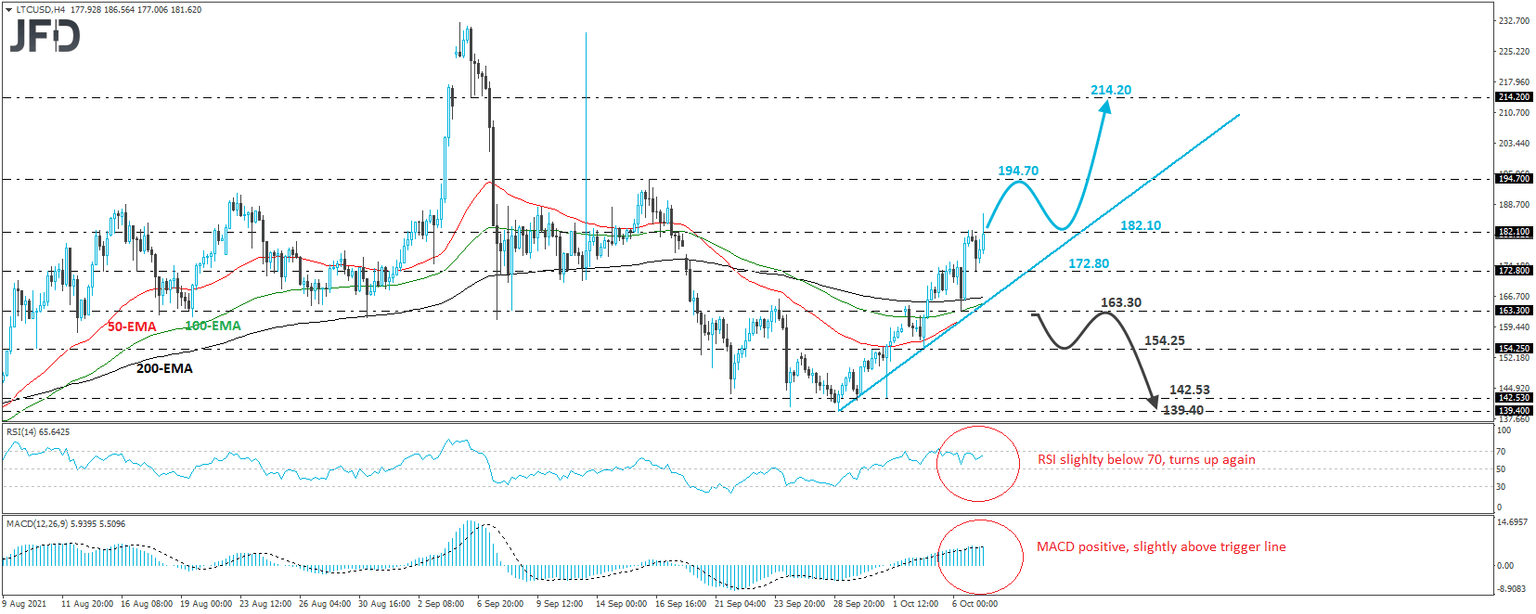

LTC/USD moved lower yesterday, after it hit resistance near 182.10. However, the crypto triggered some buy orders at around 172.80 and rebounded to trade temporarily above the 182.10 mark. Now, it is back below it though. Overall, the cryptocurrency continues to print higher highs and higher lows above the upside support line taken from the low of September 29th and thus, we will consider the short-term outlook to be positive.

Another attempt above 182.10 could encourage the buyers to push the action towards the peak of September 16th, at around 194.70. They may decide to take a break after testing that zone, thereby allowing a retreat. But as long as that retreat stays limited above the aforementioned upside line, we would see decent chances for another leg north. This time, the bulls may overcome the 194.70 barrier, a move that could carry larger extensions, perhaps towards the inside swing low of September 6th, at 214.20.

Looking at our short-term oscillators, we see that the RSI lies slightly below 70 and has just turned up again, while the MACD runs slightly above both its zero and trigger lines. Both indicators detect upside momentum and support the case for some further recovery in this cryptocurrency.

Now, in order to abandon the upside scenario and start examining whether the bears have gained the upper hand again, we would like to see a dip below 163.30. This may confirm the break below the pre-mentioned upside line and could initially aim for the low of October 4th, at 154.25. Another break, below 154.25 could see scope for extensions towards the 142.53 level, marked by the low of October 1st, or towards the 139.40 zone, marked by the low of September 29th.

Author

JFD Team

JFD