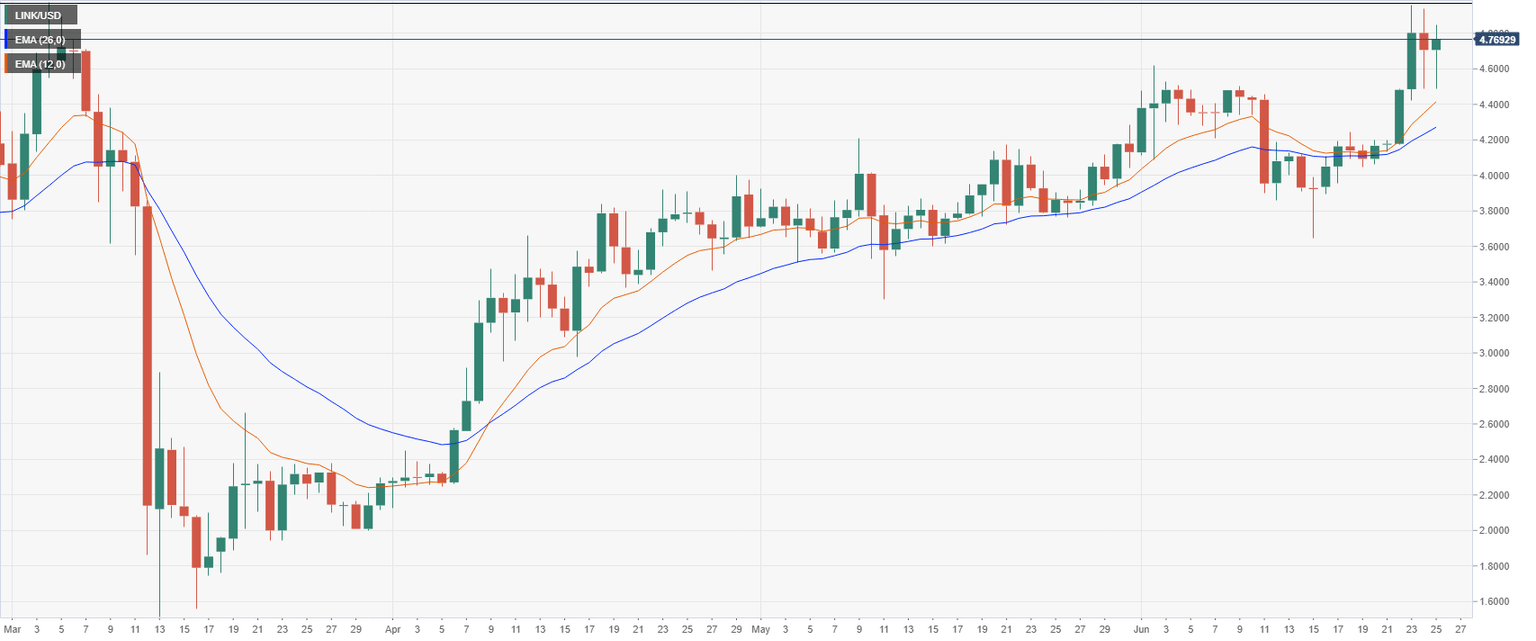

Link Technical Analysis: LINK/USD gearing up to crack $5 and establish a new 2020-high

- LINK/USD is currently trading at $4.77, really close to the 2020-high established on April 3.

- Link has formed two consecutive bullish reversal candlesticks on the daily chart.

LINK is changing hands at $4.76 at the time of writing after yet another bounce from $4.5. On June 24, LINK/USD dropped to $4.487 but recovered on the same day. Something similar happened on June 25 indicating that bulls have a lot of buying power and are willing to buy the dips.

LINK/USD daily chart

The daily chart is clearly in favor of the buyers and LINK continues trading way above the daily 12-EMA or the 26-EMA. After a brief pause around $4, LINK has continued with its long-term uptrend and it’s getting ready to crack $5 next. Bulls are only facing the $4.97, 2020-high, and $5 as resistance.

LINK/USD 4-hour chart

The 4-hour chart is still in an uptrend despite the last two volatile crashes. If LINK needs to consolidate further, bulls can use the 12-EMA at $4.68 for support. The most important level to hold is at $4.48 to keep the uptrend going.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.

-637286988739931709.png&w=1536&q=95)