Lido DAO price set to plummet 24% amid ETH staking ban rumors

- Lido Dao price has been showing whipsaw moves these past few days.

- LDO jumps wildly on rumours that the SEC might ban staking for retail customers, while LDO would not be in scope as it is decentralized.

- Unless LDO price action stabilizes, expect to see a sharp decline as investors will look for more technical cryptocurrencies to trade.

Lido Dao (LDO) price action is set to see interest from investors fading quite rapidly as the price action has been trading erratically and illogically these past few days. Those investors will probably take their money and run as volatility is getting too high, making it very difficult to maintain good trade management. With the current outside pressures and tailwinds, a decline of 24% would not be unlikely.

Lido Dao price had swings of 18% and 30% intraday

Lido Dao price is trading like it is on steroids. With firm intraday swings near 18% and one day even at 30% this week, traders are backing away from the alt-coin as it is almost impossible to get a sense of direction. To make matters worse, throughout the week price action has been closing each time nearly unchanged, making it a losing operation for any bull or bear trying to get involved.

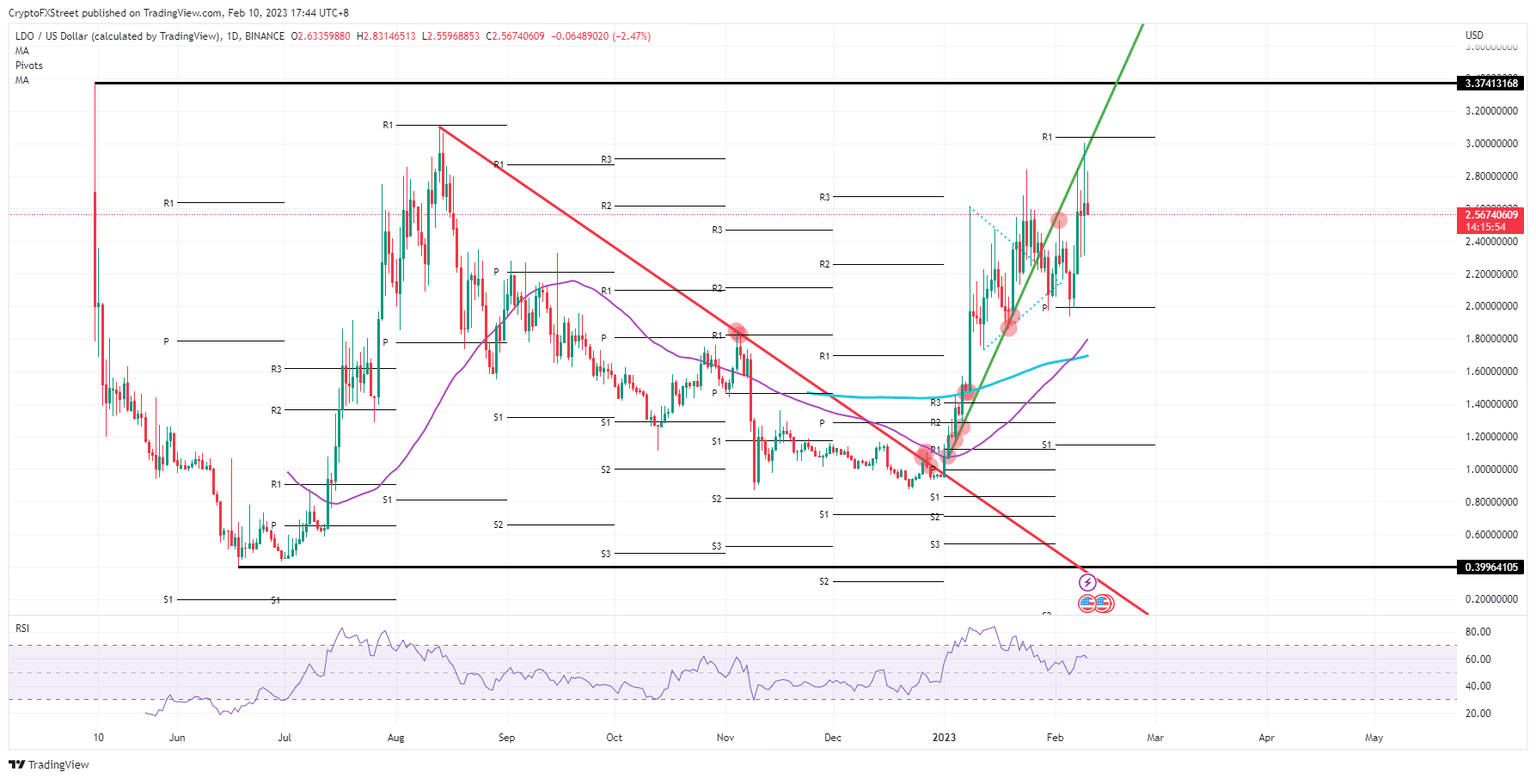

LDO needs to undergo some sort of treatment to get itself fixed and trade more logically and technically with respect to certain levels or pivots. The best proof that traders are exiting can be found in the Relative Strength Index (RSI), which is tanking. Ideally, LDO would need to fall back to a key support level. This could see traders start building a better sense of price action that would allow reentry. The best level for that is at $2, near the monthly pivot or 24% lower.

LDO/USD daily chart

If a breakout trade occurs, Lido Dao traders could still be part of the price action. That would be, for example, if price action jumps to the upside and breaks above the R1 resistance level near $3. Bulls would be able to add to their positions, and new bulls could get involved on that break and go for $3.37 as a profit target nearby.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.