Lido Dao Price Forecast: Things just got grim after the US upbeat jobs report, with 27% losses forecasted

- Lido Dao has received a firm rejection and sees bears roaring back.

- LDO in the ropes after a very strong US job report lashes out at the goldilocks' hopes.

- Seeing the upward revisions from the previous numbers, the Fed is proven to be right and hopes for a rate cut this year are fading.

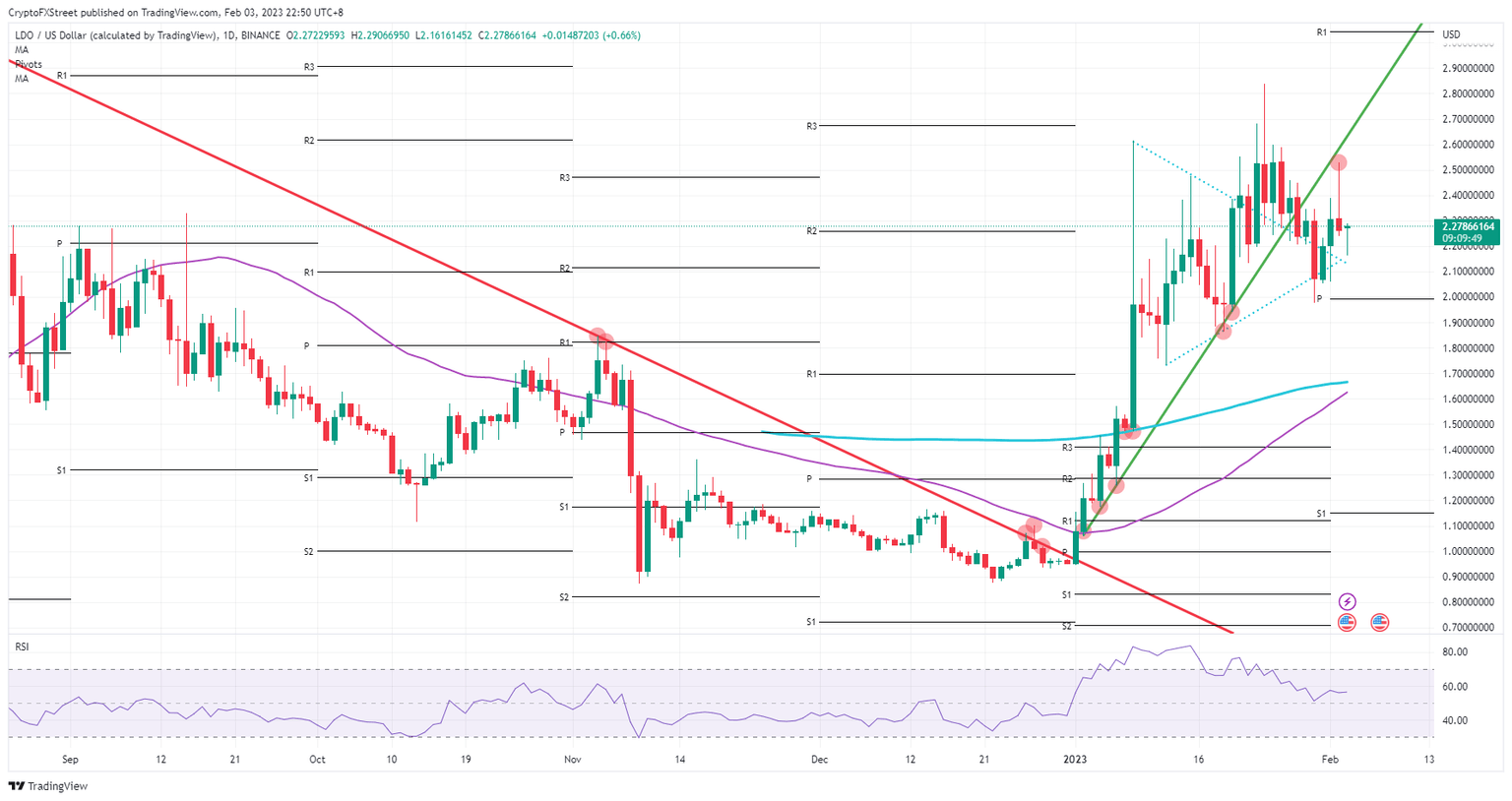

Lido Dao (LDO) traders received a very cold shower after the US jobs report on Friday. Although already on Thursday, LDO received a firm rejection after spiking higher, bears seem to be taking over the steering wheel as the Relative Strength Index points to more downside. The risk is that a Federal Reserve (Fed) rate cut for later this year gets priced out, which would mean bad news for risk assets like cryptocurrencies, with a drop towards $1.7 in the projections for LDO.

Lido Dao price sees bulls scared of things to come

Lido Dao can say goodbye to its upside price target of $3 for now as cold water has been poured on this rally after the US jobs report threw a spanner in the works. With a very upbeat number overstepping the biggest number in the economic survey, together with firm upward revision on all fronts, the Fed seems to be this time undershooting the situation. With tiring wages and more people employed at higher wages, this inflation spiral is not ending anytime soon.

LDO gets a gut punch to move to the downside and will see more downside as the hopes for a rate cut later this year are seeing very few changes. This repricing of that trade idea comes with a selloff in equities and cryptocurrencies. With only the monthly pivot at $2, the road is open for a 27% drop towards $1.7 to get caught by both the 55-day and the 200-day Simple Moving Average.

LDO/USD daily chart

Markets could be seen brushing off this strong number starting next week as the dust settles over the weekend on all the central banks and the US jobs number. Expect a hesitant start with support at $2 ready to provide a trigger for a bounce higher. On the upside, $3 might be farfetched, but $2.8 should be up for a test.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.