Lido Dao Price Forecast: Watch out for a massive bull trap that could be vital for 2023

- Lido Dao price action is playing a dangerous game after a failed breakout higher.

- LDO is at risk of being sucked into a bull trap.

- Seeing the timing of this trap ahead of a heavy month of February, the current mood could dampen and turn into another sell-off.

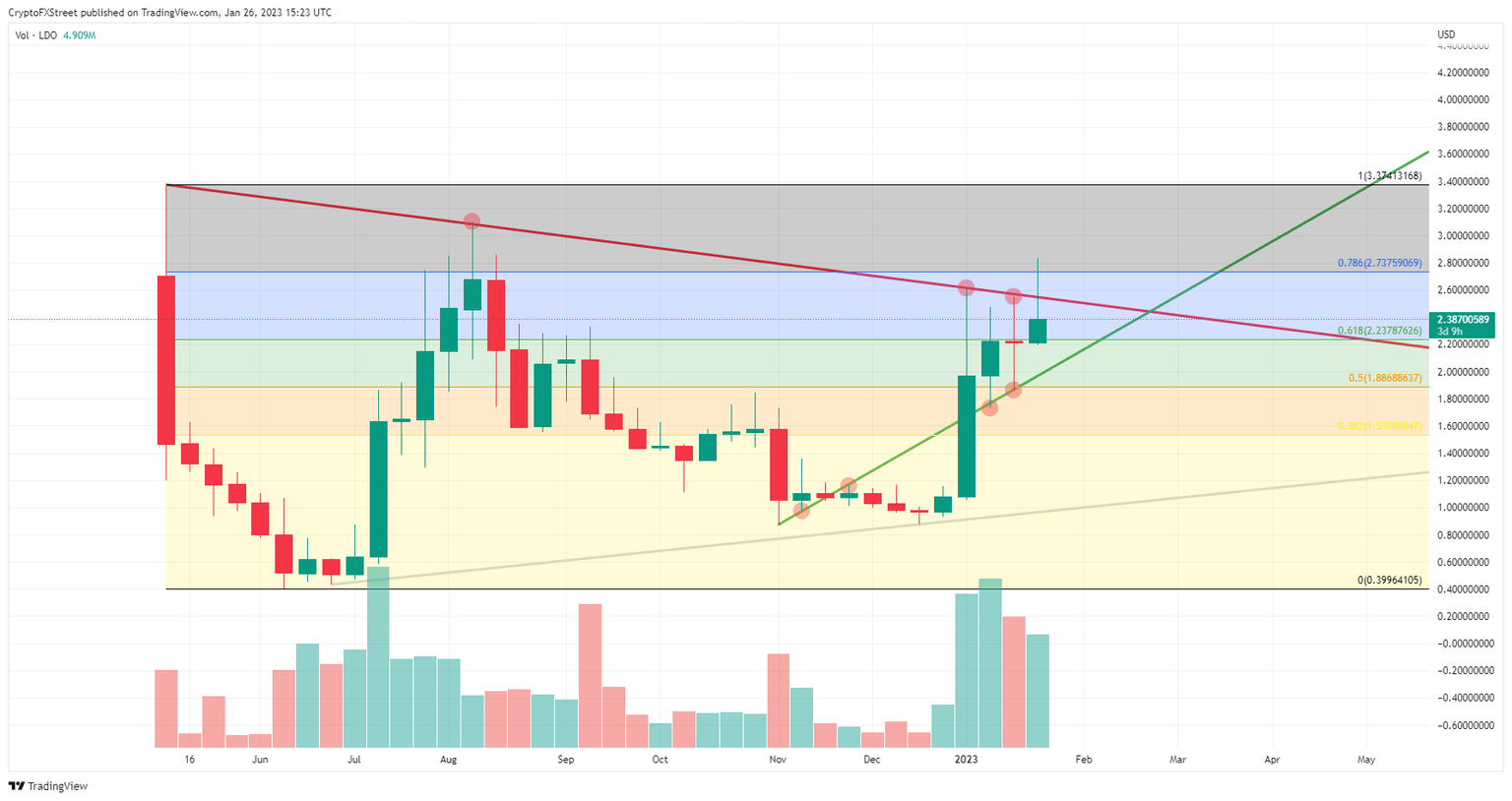

Lido Dao (LDO) price has had a strong bullish print this week as price action moved above the 78.6% Fibonacci level at $0.786. Meanwhile, price action has been fading and is even starting to trade quite far off the break at the red descending trend line. This so close to the weekly close and with several central banks lined up to come out with their first monetary assessment of the situation for 2023 creates the risk of a bull trap that could have far-reaching consequences.

Lido Dao price could be in for an underestimated risk in February

Lido Dao is still young in its assistance since the price action saw the light of day back in May of 2022. After having experienced the crypto winter as a novice to the other cryptocurrencies, LDO has substantially gained back control of the upper echelon in its price level with an almost full swing back up toward its opening price. LDO broke above it briefly this week and then retreated below it as bulls seem doubtful about whether to stay in or take a profit.

The timing of all this, and the current positioning just below the red descending trend line, does not come as a surprise, seeing that the violence in Ukraine is predicted to enter a more acute phase after tank deliveries from Germany and the US were approved and several central banks are set to make their first appearance for 2023. Expect more downside to come as those same central banks have already issued warnings throughout January that markets have advanced too quickly and too high. Expect a drop back to $2 with the risk of the green ascending trend line coming under pressure. A break would see a move toward $1.60 in the possible sell-off that follows by April.

LDO/USD weekly chart

As bulls have already pierced through that red descending trend line, many stops from bears will have been taken out. They will not enter again quickly due to LDO's steep recovery. Expect in the coming weeks to see a surge in LDO price again with an ultimate level at $3.40 by the end of February.

Author

Filip Lagaart

FXStreet

Filip Lagaart is a former sales/trader with over 15 years of financial markets expertise under its belt.