Lido DAO price has dangerous exit-liquidity levels near $1.60

- Lido DAO price lost 50% of its market value in November.

- LDO price has unmitigated orderblocks near $1.60.

- Invalidation of the bullish thesis is a breach below $1.10.

Lido DAO price appears to be moving north while the rest of the market succumbs to Bitcoin’s lacklustre recovery. As the market may be setting up for another downswing, a risky countertrend opportunity is displayed within the LDO technicals. Traders should apply extreme caution if they intend to engage with the LDO token.

Lido DAO price shows a dangerous play

LDO price could set up a risky bet in the coming hours. Since November 6, the digital currency has declined by 50%. Post-decline, the bulls have shown retaliation efforts worth keeping an eye on. An additional countertrend move should not be ruled off the table.

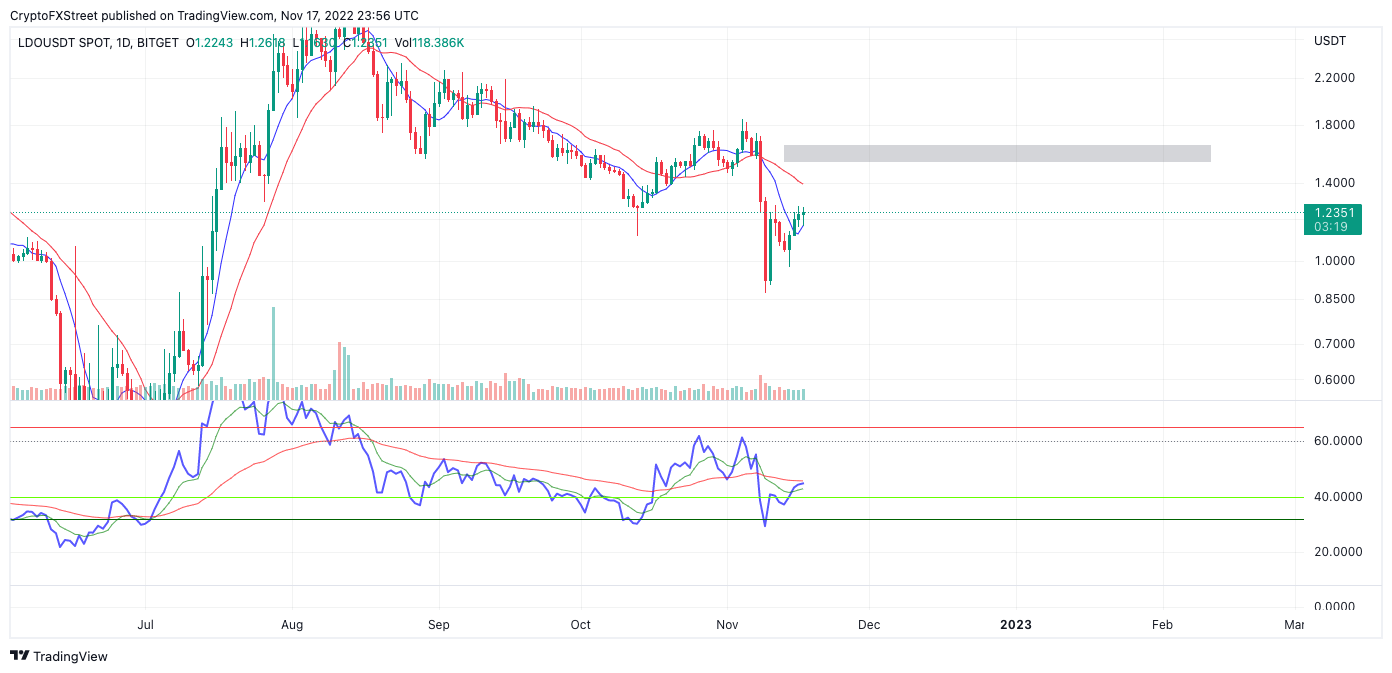

LDO price currently auctions at $1.23 as the bulls have managed to breach the 8-day exponential moving average (EMA). After two days of retests, the LDO price remains above the trend indicator, which compounds the idea that the bulls are poised to battle for last-minute gains. A daily order block has yet to be tagged at the $1.60 level. The bulls in the market may be aiming to mitigate the level for a quick 30% profit spike in the coming hours before an anticipated BTC crash occurs.

LDOUSDT 1-Day Chart

Still, traders looking to partake in the move must practice extraordinary precautions as Bitcoin’s pennant consolidation could resolve with a surging downtrend rally at any moment. The bullish invalidation is the 8-day EMA support at $1.10.

Should the bears tag the low, an additional dip toward the previous congestion zone at $0.61 could occur. Such a move would result in a 50% decline from the current market value.

Here's how Bitcoin's moves could affect LDO Classic price -FX Street Team

Author

Tony M.

FXStreet Contributor

Tony Montpeirous began investing in cryptocurrencies in 2017. His trading style incorporates Elliot Wave, Auction Market Theory, Fibonacci and price action as the cornerstone of his technical analysis.