Key Bitcoin options 'fear' indicator reflects traders' regulatory concerns

On Tuesday, SEC Chair Gary Gensler re-confirmed his plan to crack down on cryptocurrencies, and traders’ regulatory concerns are confirmed by this key Bitcoin futures and options indicator.

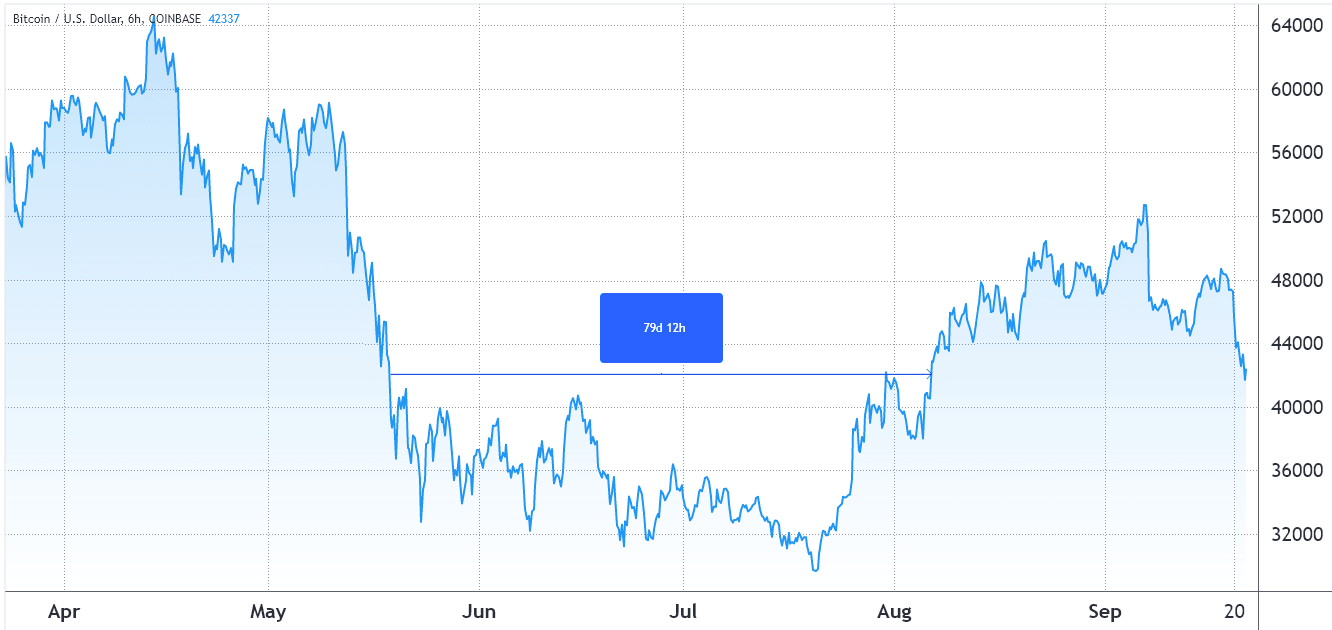

After 46 consecutive days of trading above $42,000, Bitcoin (BTC) price started to show weakness on Sept. 21. Over the last three days, the 13% accumulated loss was enough to erase the hard-earned gains added since Aug. 6. Historicals also show that the previous bearish cycle took 79 days to regain the all-important $42,000 level.

Traders' attention turned to the start of the U.S. Federal Reserve's monetary meeting, where the financial authority is expected to indicate whether it will curtail the $120 billion monthly asset repurchase stimulus program. Curiously, as all this takes place, China's equity markets, as measured by the iShares MSCI China ETF ($MCHI), rebounded 1% on Sept. 21.

Is China really the root of the recent correction?

The apparent disconnection between Bitcoin's performance and the global markets' slight recovery caused investors to question whether cryptocurrency regulation is playing a role in the current bearish scenario.

Today U.S. Securities and Commission (SEC) Chair Gary Gensler spoke to the Washington Post, and during the interview, he called stablecoins instruments for use at the "casino gaming tables."

Groan. The US regulatory clampdown on crypto which has been brewing the past six months just looks like it’s going to get uglier & uglier with each passing week. Not even sure what impact it’s going to have on the markets, but there sure isn’t much to be optimistic about rn.

— Grant Gulovsen, Esq. (@gulovsen) September 19, 2021

As noted by the attorney Grant Gulovsen, the looming shadow of regulation is expected to have a short-term bearish impact, and investors in any market hate uncertainties regarding what products and services will be allowed.

Bitcoin price in USD at Coinbase. Source: TradingView

Notice how the $42,000 level was crucial in determining the end of the mini-bear cycle that was supposedly initiated by Elon Musk's remarks on Bitcoin mining energy use on May 12.

To effectively measure how professional traders are pricing the risk of the further price collapse, investors should monitor the 25% delta skew, which compares similar call (buy) and put (sell) options side-by-side. It will turn positive when the protective put options premium is higher than similar risk call options.

A skew indicator oscillating between -7% and +7% is usually deemed neutral. On the other hand, the metric shifts above this range whenever the downside protection is more costly, typically a "fear" indicator.

Deribit Bitcoin options 25% delta skew. Source: Laevitas

As shown above, Bitcoin options traders have been neutral since July 25, when the indicator dropped below the 7% threshold. However, the recent price action caused shorter-term options traders to enter "fear" mode after the metric reached 9%.

Options markets confirm investors' lack of conviction

To exclude externalities specific to this options instrument, one should also analyze the perpetual futures markets.

Unlike regular monthly contracts, perpetual futures prices are very similar to those at regular spot exchanges. This feature makes retail traders' lives a lot easier because they no longer need to calculate the futures premium or manually roll over positions near expiry.

The funding rate was introduced to balance the exchange's exposure and it is charged from longs (buyers) when they are demanding more leverage. However, when the situation is reversed and shorts (sellers) are over-leveraged, the funding rate goes negative, so they become the ones paying the fee.

Bitcoin 8-hour USDT/USD margin futures funding rate. Source: Bybt

The chart above shows that Bitcoin's funding rate has constantly shifted to the negative side, despite not being sustainable or relevant. For example, a 0.05% rate charged every 8 hours is equivalent to 1% per week, which shouldn't force any derivatives trader to close their position.

Therefore, options markets data validates the "fear" indicator coming from the positive 25% delta options skew. There is a lack of conviction from buyers using derivatives markets, which is likely related to the recent negative regulatory concerns. The latest victim to regulatory pressure came from Coinbase exchange's decision to avert plans for offering a crypto lending program.

Author

Cointelegraph Team

Cointelegraph

We are privileged enough to work with the best and brightest in Bitcoin.