JUST IN: Aave moves closer to decentralization via admin keys handover

- Aave just announced the handover of the protocol admin keys to the governance.

- This handover is a step towards the full decentralization of the project.

Aave, one of the largest DeFi projects and provider of decentralized lending and borrowing, announced on Wednesday the handover of the protocol admin keys to the governance. The Aave governance program went live on the Ethereum network in September 2020. The mainnet release allowed holders to vote for proposals. The AAVE token was previously known as LEND, and holders voted to migrate the LEND token to the AAVE token using a 100:1 ratio.

According to the official announcement, now that the governance is thoroughly tested, the team has decided to migrate the protocol ownership to the governance smart contracts.

In the coming weeks, we will also update more parameters of the governance system in order to further decentralize the proposal submission process.

AAVE is in a robust downtrend and shows no recovery signs

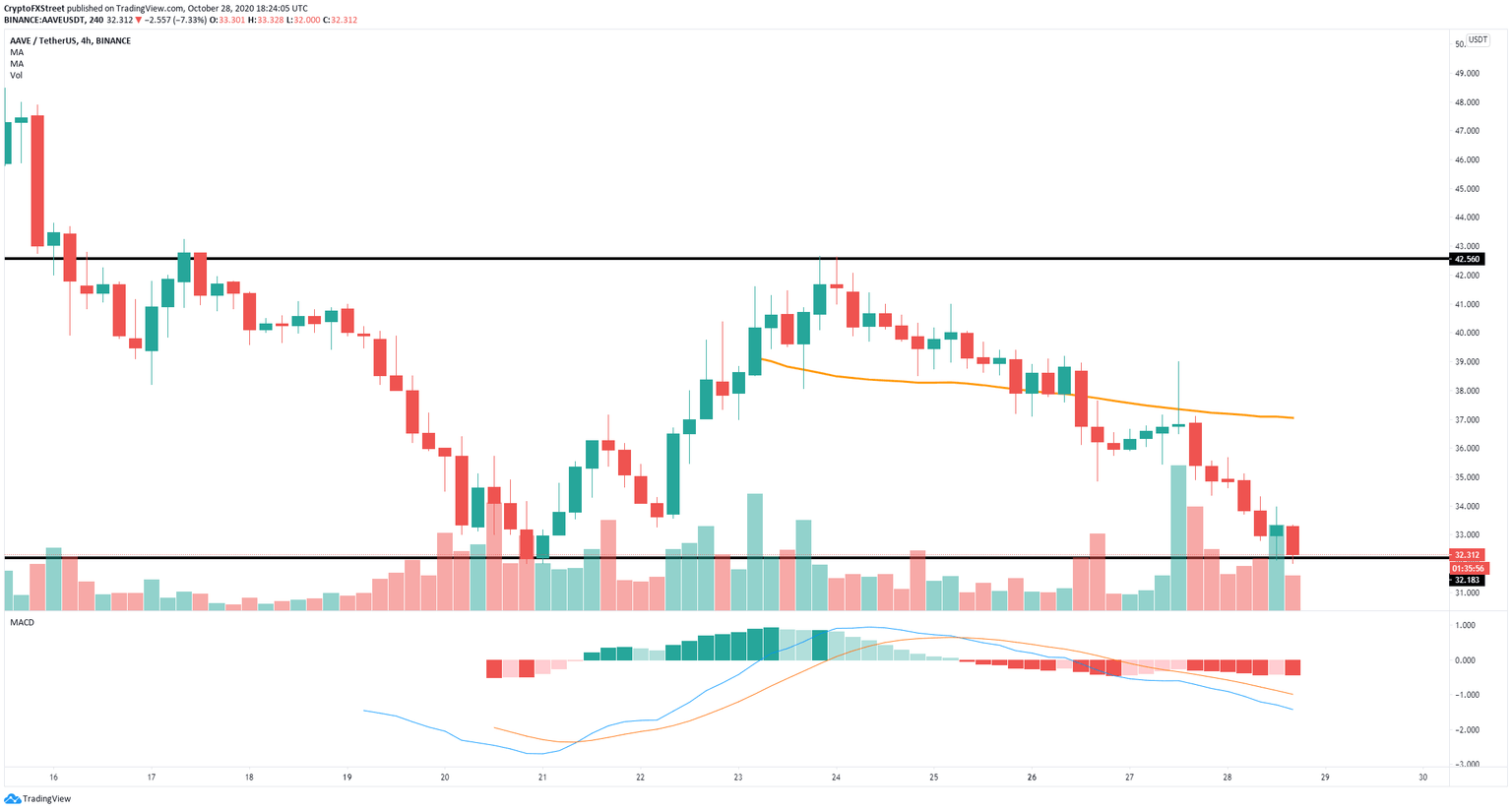

Despite the announcement by the team of AAVE, the price of the token remains low around $32.30, losing more than 7% of its value in the past 24 hours. The 4-hour chart shows only bearish signs.

AAVE/USDT 4-hour chart

The MACD has turned bearish on October 25 and continues gaining momentum. The most critical support level is established at $32.18. A breakout below this point can drive AAVE to a new low down to $30.

Can the bulls confirm a double bottom?

On the other hand, AAVE's price is currently at $32.30, right above the critical support level at $32.18. If the bulls can successfully defend this level, the odds of establishing a double bottom pattern will be magnified.

Successfully confirming the pattern would put a price target of $42.5 for AAVE bulls, the neckline of the figure.

Author

Lorenzo Stroe

Independent Analyst

Lorenzo is an experienced Technical Analyst and Content Writer who has been working in the cryptocurrency industry since 2012. He also has a passion for trading.