Is the ongoing cryptocurrency market correction coming to an end?

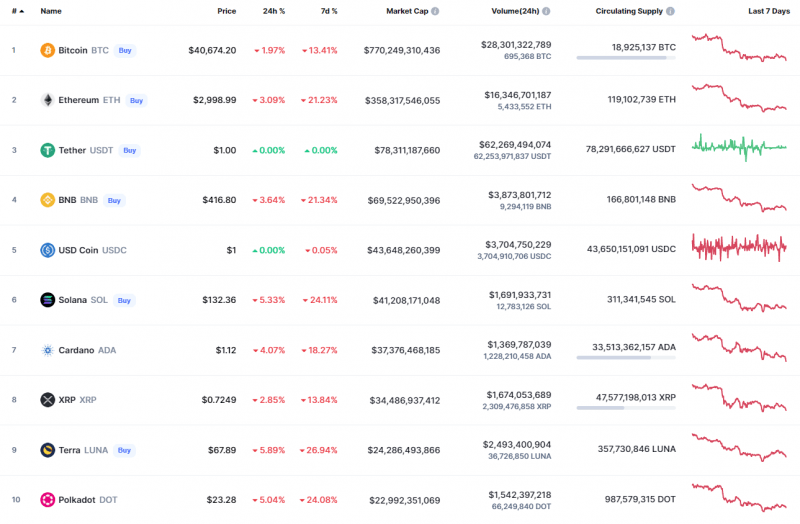

The new week has started with a renewed market correction, with all top 10 coins being in the red zone.

Top coins by CoinMarketCap

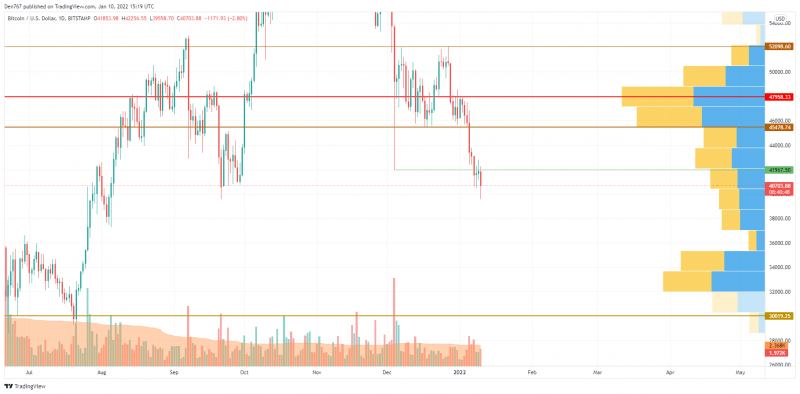

BTC/USD

The price of Bitcoin (BTC) has gone down by almost 2% since yesterday.

BTC/USD chart by TradingView

The main crypto has fixed below the support green line at $41,967, which means that bears are in control of the situation at the moment. The sellers' power is also confirmed by the increased trading volume.

If this pressure continues and BTC drops below the vital mark of $40,000, there is a change seeing the price around $35,000 shortly.

Bitcoin is trading at $40,745 at press time.

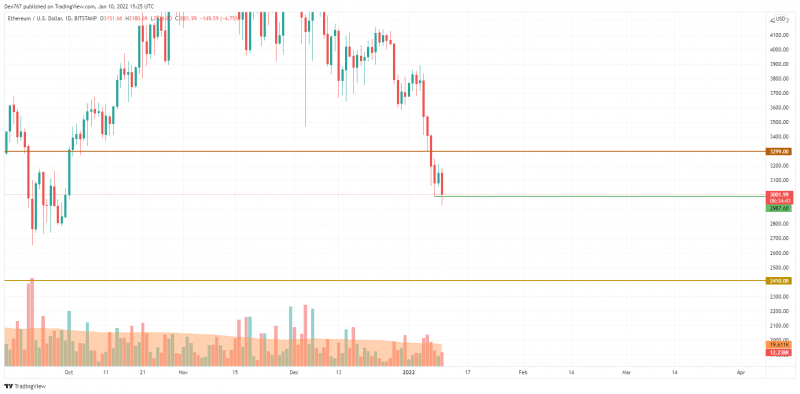

ETH/USD

Ethereum (ETH) is the biggest laggard from the list, falling by 2.92%.

ETH/USD chart by TradingView

Despite the drop, Ethereum (ETH) made a false breakout of the support level at $2,897. Until the rate is located above it, bulls have a chance to seize the iniative and try to restore the bullish trend.

However, if the daily candle fixes below the psychological mark of $3,000, there might be a sharp drop to $2,410 within the next weeks.

Ethereum is trading at $3,008 at press time.

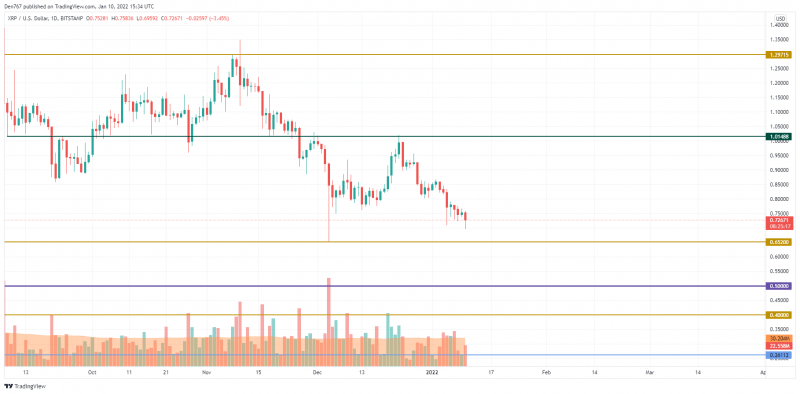

XRP/USD

XRP has also followed the decline of BTC and ETH, losing 2.61% of its price share over the last 24 hours.

XRP/USD chart by TradingView

That said, sideways trading remains a more likely scenario for the upcoming days as the price is located in the wide range between the support at $0.652 and the resistance at $1.01.Currently, the price is closer to the support, and if the level is broken, the decline may lead XRP to $0.50 soon.

XRP is trading at $0.7278 at press time.

Read full original article on U.Today

Author

Denys Serhiichuk

U.Today

With more than 5 years of trading, Denys has a deep knowledge of both technical and fundamental market analysis.