Is optimism among Bitcoin traders a signal of a bigger BTC breakout to come?

- Bitcoin’s rebound above $21,000 in January has resulted in euphoria, market participants are optimistic for the second time after July.

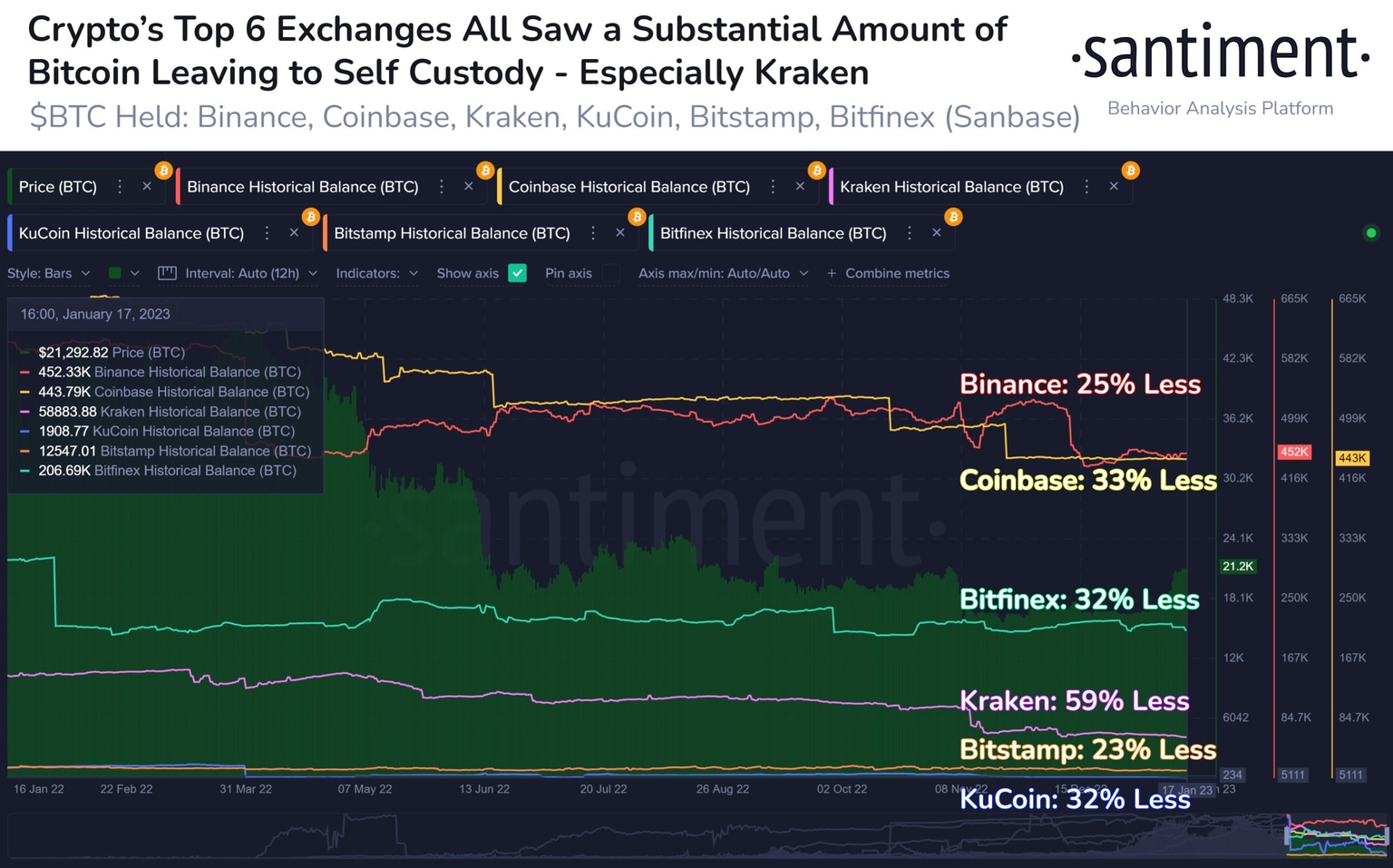

- The overall supply of BTC on exchanges has dropped from 11.85% to 6.65% Year-on-Year, signaling a rise in self-custody and a decline in selling pressure.

- Experts believe Bitcoin’s rally is a signal of a bigger bullish breakout in 2023.

Bitcoin price climbed above the key $21,000 level on January 18, after the release of lower-than-expected US inflation data in the form of the Producer Price Index (PPI), fueled a bullish narrative for risk assets, including cryptocurrencies, among investors. Based on data from crypto aggregator Santiment, the level of euphoria among traders is now the second-highest since July 2022, when the inflation outlook had also moderated and the US Federal Reserve was hinting at reducing the pace of interest rate hikes .

BTC holders believe the recent Bitcoin price rally is a sign of an imminent bullish breakout in the asset in 2023.

Also read: Bitcoin recovery fuels NFT growth, digital collectibles garner big interest as BTC crosses $21,550

Bitcoin optimism among traders climbs, is BTC price ready for a breakout?

Euphoria among BTC traders

Another sign investors are more bullish on the leading crypto is that the overall supply of Bitcoin on exchanges has dropped, suggesting selling pressure on the asset will ease.

Crypto exchange balances of Bitcoin declined

The Year-on-Year BTC supply has dropped from 11.85% to 6.65% signaling a rise in self-custody. This suggests investors are hoarding the asset ‘off exchange’ for the long-term and has further fueled a bullish narrative for Bitcoin.

Experts believe Bitcoin is preparing for a bullish breakout in 2023

Bitcoin market participants believe the asset’s recent gains, yielding 30% to holders in the two-week period between January 3 and 17, is a precursor of a bullish breakout in 2023.

Author

Ekta Mourya

FXStreet

Ekta Mourya has extensive experience in fundamental and on-chain analysis, particularly focused on impact of macroeconomics and central bank policies on cryptocurrencies.