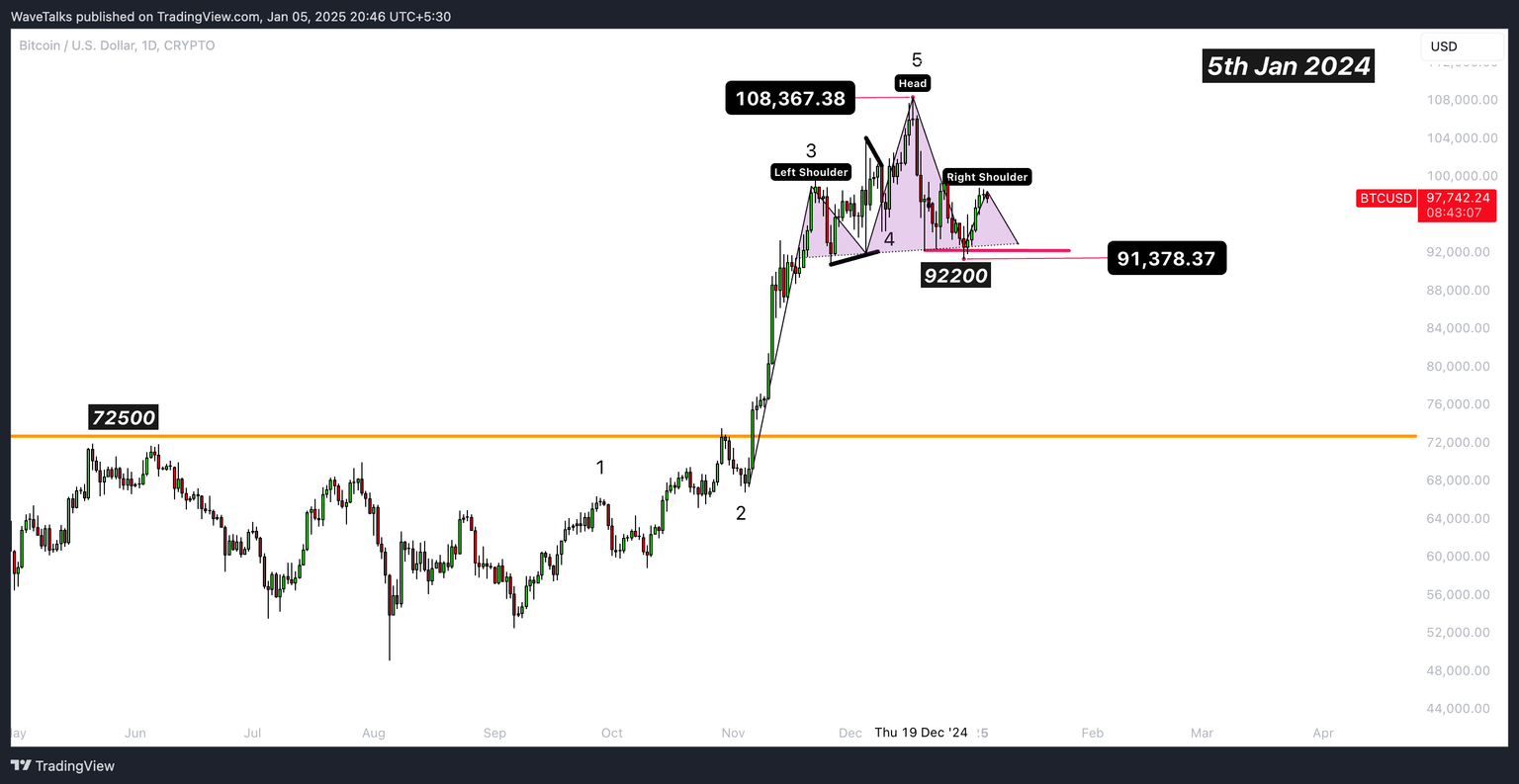

Is Bitcoin's next stop $75.000? Head and shoulders pattern signals danger ahead

Check our previous analysis: 'Did Bitcoin top out at $1,08,367? Critical levels to watch' to understand the larger picture and how the current scenario unfolds.

Overview

Bitcoin recently topped out at 108,367 and initially dropped to a low of 92,209, following which it entered a sideways consolidation between 99,872 and 92,200. The price briefly breached this range to make a short-term low of 91,378, then rebounded towards the 99,000 mark. Currently, Bitcoin appears to be unfolding Wave 2 as a complex correction, aligning with a classic Head & Shoulder (H&S) chart pattern.

Head and shoulder pattern analysis

-

Left shoulder: Formed near 99,662.

-

Head: At the peak of 108,367.

-

Right shoulder: Currently developing under 99,872.

The neckline for the pattern lies at approximately 92,200.

Bookish Target: Using the vertical distance from the head to the neckline (108,367 - 92,200 = 16,167), the projected downside target after breaking the neckline would be: 92,200 - 16,167 = 76,033 (approx. 75,000 zone).

Key levels to watch

-

Resistance zones:

-

99,000 - 100,000: Strong resistance zone.

-

Any failure to break above this will likely confirm bearish momentum.

-

-

Support levels:

-

91,378 (recent low): A decisive break below this will validate the pattern.

-

85,000 - 75,000: Next logical supports if the neckline at 92,200 is breached.

-

-

Line in the sand (stop losses):

-

For bearish positions, above 100,000 invalidates bearish setups.

-

For bullish positions, a close below 91,378 invalidates the upward momentum.

-

Trading strategies

Bearish strategy (H&S pattern confirmation):

-

Entry: Short below 91,378, targeting the neckline breach.

-

Stop loss: Above 99,872 (right shoulder high).

-

Targets:

-

85,000 (initial support zone).

-

75,000 (H&S target).

-

Bullish strategy (breakout above 100K):

-

Entry: Long above 100,000, targeting new highs.

-

Stop loss: Below 98,500.

-

Targets:

-

105,000 - 108,000 (previous highs).

-

Extension targets based on bullish momentum.

-

Neutral approach (range play):

-

Long position:

-

Buy near 92,200 - 91,378 (neckline support).

-

Target: 98,500 - 99,000 (range resistance).

-

Stop loss: Below 90,500.

-

-

Short position:

-

Sell near 99,000 - 100,000 (resistance zone).

-

Target: 92,200 - 91,378 (range support).

-

Stop Loss: Above 100,000.

-

Expected scenario

-

If Bitcoin decisively breaks below 91,378, it would signal the activation of the Head & Shoulder pattern with potential downside towards 85,000 - 75,000.

-

If bulls reclaim 100,000, it would invalidate the bearish setup and open the door for further upside to retest 108,367 and possibly beyond.

Caution: Any rejection between 99,000 - 100,000 could be an early signal of a downside move. Be vigilant at these resistance levels.

Conclusion: The market remains highly sensitive around the 99,000 - 100,000 resistance zone and 91,378 support. Adopting a disciplined approach with stop-loss levels is essential to navigate this volatile phase effectively.

Author

Abhishek H. Singh

WaveTalks

Abhishek is a seasoned financial analyst with over a decade of experience specializing in Elliott Wave Theory.